- Essential Bookkeeping Habits For Audit Ready Books in Canada

- Payroll Manual

Canadian Payroll Manual

Getting It Right For Small Business

Applies To Contract Of Service Relationships | Employer - Employee Status

By L.Kenway BComm CPB Retired

Originally published on Bookkeeping-Essentials.com in 2010 | Substantially revised February 19, 2025 | Updated February 25, 2025

WHAT'S IN THIS ARTICLE

Introduction | Purpose Of This Manual | How To Use This Manual | Quick Start Guide | Where Would You Like To Start? | Table Of Contents | The Bottom Line

NEXT SECTION >> Part 1 - Setting Up and Processing Payroll in Canada

JUMP TO >> Table of Contents

Canadian payroll tax obligations are complex

Canadian payroll tax obligations are complexPayroll For A Small Business Owner With Less Than 10 Employees In Canada

Welcome To Your Small Business Payroll Manual!

Innovation, Science and Economic Development Canada says, "Micro-businesses (1−4 employees) make up 55.3% of Canadian businesses. By adding those businesses with 5−9 employees, this number increases to 73.8%. In other words, almost three out of four Canadian businesses have 1−9 employees."*

I know firsthand how overwhelming payroll can be for small business owners. You're probably thinking, "All I really want is to make sure my employees are paid properly and keep the CRA happy. Nothing fancy - I just want to do it right!". I'm not a payroll expert, but I did learn a few things about basic Canadian payroll through experience before I retired.

I have tried to break everything down into what I think are simple, manageable steps. So grab your favorite beverage (mine right now is just plain Santevia filtered water), find a quiet place to concentrate without distractions, and let's tackle this together. By the time you finish this manual, you'll have a plan for handling your small business payroll all through the year including year-end tax slips.

As you work through the manual, remember to take notes to tweak it to your business so you aren't always recreating the wheel every time you do a payroll run!

*Source: Key Small Business Statistics 2023

Canadian Payroll Manual

Purpose Of This Manual

This Canadian Payroll Manual focuses specifically on small businesses who manage payroll for less than 10 employees, making complex payroll concepts manageable for micro-business owners. My aim is to provide practical answers to four questions:

- What do you need to do?

- When do you need to do it?

- How do you do it correctly?

- Where do you find help if you need it?

In doing so, I am trying to emphasize the unique challenges and subtleties faced by small businesses like yours.

How To Use This Manual

The Canadian Payroll Manual is organized into five main sections, each tailored for micro-business owners:

- Hiring and Paying Your First Employee - Start here if you're new to payroll. This section covers everything from worker classification to selecting the right payroll software.

- Running Payroll (The Regular Cycle) - I'll cover the payroll cycle basics, its rhythm as well as examine taxable benefits, auto allowances and how to pay employees in cash.

- Staying Compliant and Keeping the CRA Happy- Essential information for when you're dealing with regular payroll remittances to CRA, your annual tax filing obligations, record keeping requirements as well as some best practices tips and avoiding common mistakes.

- Working With Non-Employees - There's a different process for independent contractors and incorporated employees. There is still stuff you need to do to stay onside with the CRA!

- Reminders About Your Legal Obligations - Four things you need to keep on top of.

The Quick Start Guide below gets you going immediately. The detailed sections that follow provide a more in-depth perspective for when you need it. I've linked each section to various reference pages for when you need more details.

The time to have a map is before you enter the woods.

Brendon Burchard

Quick Start Guide

A reminder that the Canadian Payroll Manual's Quick Start Guide is designed specifically for small business owners managing payroll for 1-9 employees.

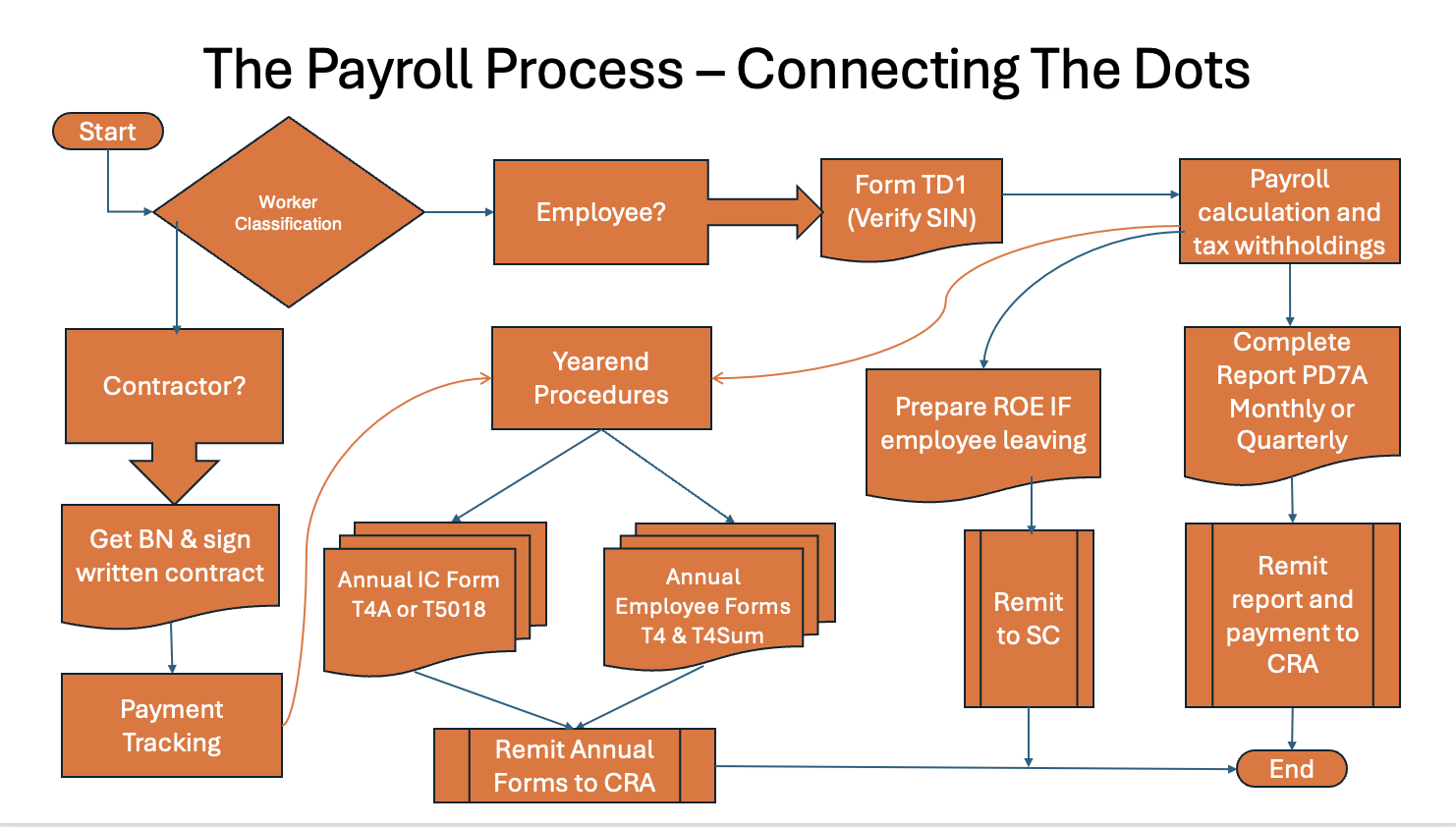

For those times when you need information fast, this section of the Canadian Payroll Manual provides useful quick-reference tools, one of which is a flowchart. Refer back to it if you get lost about where you are in the process.

You'll find the Payroll Process Overview Flowchart below shows you the connections between the different forms and procedures, from hiring new employees to issuing T4s and completing year-end payroll tasks. This flowchart helps you see the forest for the trees.

A simplified flowchart showing an overview of the payroll process.

A simplified flowchart showing an overview of the payroll process.See how the dots connect between the different forms and procedures.

Need to handle something specific right now? Here are some common tasks and where to find them:

Classifying workers correctly → Worker Classification

Register with CRA → Open a payroll account (It's the same process as registering for GST/HST)

Setting up a new employee → TD1 Forms and SIN Verification

Processing payroll → Steps for Hiring and Paying Your First Employee

Filing year-end tax forms → T4 and T4A Slips

Important Contact Information

CRA Business Enquiries: 1-800-959-5525

CRA Business Enquiries: 1-800-959-7775 (FR)

Service Canada (ROE help): 1-800-367-5693

[Your Province's] Workers' Compensation: [Insert number]

[Your Province's] Employment Standards: [Insert number]

Additional Reputable Resources

- Payroll

canada.ca/en/revenue-agency/services/tax/businesses/topics/payroll.html - Publication T4001 Employers’ Guide – Payroll Deductions and Remittances

canada.ca/en/revenue-agency/services/forms-publications/publications/t4001/employers-guide-payroll-deductions-remittances.html - Publication T4032 Payroll Deductions Tables Guide

canada.ca/en/revenue-agency/services/tax/businesses/topics/payroll/t4032-payroll-deductions-tables.html - Payroll Deductions Online Calculator

canada.ca/en/revenue-agency/services/e-services/digital-services-businesses/payroll-deductions-online-calculator.html - How to Complete the Record of Employment Form

publications.gc.ca/collections/collection_2012/servicecanada/SG5-12-1-2011-eng.pdf - Video How To Use The Payroll Deductions Tables

canada.ca/en/revenue-agency/services/tax/businesses/topics/payroll/t4032-payroll-deductions-tables.html - Filing Information Returns Electronically (tax slips and summaries)

canada.ca/en/revenue-agency/services/e-services/filing-information-returns-electronically-t4-t5-other-types-returns-overview.html - First Reference has free guides covering Canadian statutory holiday pay and vacation pay rules, essential HR policies, AI in the workplace, and more. First Reference helps Canadian businesses with HR compliance and policy management.

firstreference.com/resources/guides/

Canadian Payroll Manual

Where Would You Like To Start?

Let's get those payroll ducks in a row! Whether you're just starting out or looking to improve your process, this manual will help you develop a payroll routine and answer many of your questions along the way. You've got 5 choices. Which one do you want?

Canadian Payroll Manual

Table of Contents

PART 1 - Setting Up and Processing Payroll In Canada

1.0 Introduction

- We Are Here (A Look At The Flowchart For Where We Are In The Whole )

- Key Terms

1.1 Getting Started with Your First Employee

A. Introductory Information (content directly on this page)

B. Specific Topics (links to separate pages)

- Is Your Worker an Employee or Contractor?

- Canadian Employment and Labour Standards (Find Minimum Wage Information Here)

- Step-By-Step Setup and Hiring Instructions

- Getting It in Writing: Employee Agreements

- 2024 Province of Employment Rules for Remote Workers

1.2 Running Your Regular Payroll

A. Introductory Information (content directly on this page)

- Payroll Cycle Basics

- Your Payroll Rhythm

- Payroll Processing Methods (Manual vs Software)

- Payment Options (Direct Deposit vs Cheque)

- A Short Word About Data Security

- Setting Yourself Up for Success

- Your Pay Run Checklist

- Top 5 Common Payroll Calculation Mistakes

- Building Good Habits

B. Specific Topics (links to separate pages)

- When to Tax Employee Perks and Benefits

- Vehicle Allowances & Reimbursements

- Paying Casual Labour in Cash The Right Way

PART 2 - Payroll Compliance and Reporting In Canada

2.0 Introduction

- We Are Here (A Look At The Flowchart For Where We Are In The Whole )

- Key Terms

2.1 Keeping CRA Happy: Reports and Deadlines

A. Introductory Information (content directly on this page)

- Annual Filing Process Flowchart

- Year-End Task List

- Best Practices

- A Word About Minimum Wage

- CRA Hot Buttons To Avoid When Managing Payroll

- CRA Record Keeping Requirements

B. Specific Topics (links to separate pages)

2.2 Working with Non-Employees

A. Introductory Information (content directly on this page)

- Hiring and Managing Independent Contractors

- Required Forms and Documentation (T4A, Contracts)

- GST/HST Implications

- A Special Category: The Incorporated Employee

B. Specific Topics (links to separate pages)

- Why Worker Classification Matters

- Before You Hire A Subcontractor

- Do You Need A Written Agreement?

- Subcontractor Reporting Requirements

- T4A Information Slips

- T5018 or T4A? Which Slip Do You Use?

2.3. Reminders About Your Legal Obligations

Note: Tax rates and regulations change frequently. Always verify current rates and requirements with the appropriate government agency.

Remember: The Specific Topics sections are supporting articles that look at individual issues more deeply, while the main manual focuses on the broader payroll process and requirements.

Need help right now? Start with Part 1 if you're new to payroll, or make a selection from 'Where Would You Like To Start?'

The Bottom Line

Let's be honest - payroll probably isn't why you started your business. But as a small business owner in Canada, it's one of your most important responsibilities. Your employees count on their paycheques being accurate and on time, and the CRA expects you to handle all the related deductions and remittances correctly.

Don't worry - this manual breaks down Canadian payroll into manageable steps specifically for small business owners like you.

We'll skip the complex scenarios that rarely come up in businesses with less than 10 employees and focus on what you really need to know. Think of this as a conversation with a person who understands your challenges.

Ready to get started? Let's walk through this together, step by step.

JUMP TO >> Part 1 - Setting Up and Processing Payroll

JUMP TO >> Part 2 - Payroll Compliance and Reporting

RETURN TO >> Table of Contents