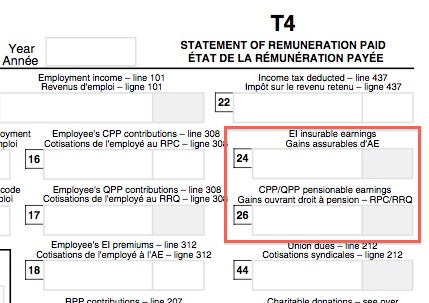

T4 Slip Boxes 24 and 26

Applies To Contract Of Service Relationships | Employer - Employee Status

By L.Kenway BComm CPB Retired

This is the year you get all your ducks in a row! Start by starting.

Updated February 19, 2025 | Originally Published on Bookkeeping-Essentials.com in 2010

WHAT'S IN THIS ARTICLE

Paid vs Earned Income | Filing T4 Return | T4 Deadline | Electronic T4s | Late Filing | Paper Filing Penalties | FAQ

BACK TO >> Canadian Payroll Manual - Keeping CRA Happy: Reports and Deadlines

T4 Information Slip Preparation

T4 Information Slip Preparation- Answers to common questions asked about the T4 slip boxes 24 and 26.

- Find a tip you want to read BEFORE you prepare your T4 slips as well as what you want to do in December.

- Learn what's new for 2024 paper filing thresholds.

- Learn what's new for 2025 T619 electronic transmissions.

T4 Deadline

The T4 deadline is the last day of February. If the last day falls on a Saturday or Sunday, the deadline moves to Monday. On February 19, 2025, CRA announced they are extending the deadline to March 7, 2025 due to issues with all their recent changes.

A good practice to save administration nightmares is to confirm with employees in December that you have their correct address and email address on file.

If you are an employee and haven't received your T4 slip by March 15, call your employer. They may have an incorrect mailing address or email address for you. This is why it is so important to let your employer know when you move.

Important Update: Paper filing is only allowed if you have five (5) or fewer slips to submit. Effective January 1, 2024, if you issue more than five (5) information slips, you must file electronically.

Highlights Of This Post

- Should T4 box 14 include paid income or earned income in the calendar year?

- What is the easiest way to file a T4 Information Return?

- What is the deadline to give employees their T4 slips?

- Can I send electronic T4 slips to employees?

- What happens if I late file T4 slips or fail to file the T4 information return?

- FAQ about the T4 slip such as ... Can T4 slip boxes 24 and 26 be left blank?

What's New

BOOKKEEPERS

Please Read This BEFORE

Preparing T4 Slips

It is important to remember that for the purpose of tax filing deadlines, income is reported in the calendar year it was paid not when the income was earned.

This applies to your payroll source deduction remittances as well as the preparation of the T4 slips.

Do not confuse this with GAAP / ASPE reporting where you accrue unpaid but earned wage income in the year the wage was earned.

If you are using an accounting software program like QuickBooks Online, it knows the rules and will correctly prepare the T4s provided you have entered your payroll correctly.

T4 (And T4A) Information Slips

The easiest way to meet your T4 slip tax filing deadline nowadays is to file your T4 Summary and slips online. You have online 3 options:

- Use CRA's online portals: You no longer need a Web access code if you sign in and file through My Business Account or Represent a Client.

- Use Web Forms: You will need (i) your CRA account number ending in RPxxxx (or RZxxxx), and (ii) a Web access code. Your access code used to be at the top of your personalized T4 Summary or on the Web Access Code for Electronic Filing letter. As CRA keeps expanding and changing their online services, I'm not sure if it still gets mailed out when you register. That said, you can use CRA's online web access code service to obtain one.

You can submit up to 100 T4 slips using the T4 Web Forms online. I like that it calculates the summary totals for you. I could not figure out how to get to it following their page or MENU drop down boxes because the it's nested under Digital Services and there is not link to it on the CRA home page, or on the Taxes home page. The easiest way I found to get to it is to google "CRA T4 Web Forms file a return". Once you arrive on the page, bookmark it for future use.

Note that Web Forms can also be used to file T4As and other T4 group information returns such as T4A-NR, T4RIF, T4RSP, T4E, T4FHSA; and T5 group information returns such as the T5, T5008, T5013T5, T5007, T5008, T5018, RRSP, TFSA, T5013, PRPP, PART XVIII, PART XIX, T2202; as well as other information returns like the NR4, T3, T1204. - Use Internet File Transfer: This method of filing is available if you use software developed to submit XML files, up to 150 MB in size, over the internet.

T619 Electronic Transmittal Form - What's New

Effective January 2025, CRA is making changes to the T619 electronic transmittal form. Part of this change will require submitting only one type of information return per file. For example, you will no longer be able to submit T4s and T4As in the same file. They must be sent in separate files.

PAPER FILING - What's New

As of January 1, 2024, paper filing your T4 information slips and return is only available if you have less than 5 returns. Prior to January 1. 2024, the threshold for paper filing was less than 50 slips. Amounts greater than this must be electronically filed.

To paper file, go to the Businesses tab on the CRA website and select Payroll> Filing payroll information returns (slips and summaries)> T4 slip - Information for employers. You will find PDF fillable forms here. Don't forget you will to complete and submit the T4 Summary as well.

Please note that T2104 returns have no option but to be filed electronically, T4A-RCA returns must be paper filed.

Can I send an electronic T4 slip to my employees?

Prior to 2023, CRA said yes you can send an electronic T4 Slip to your employees "if you have received the employee's consent in writing or electronic format".

You needed to keep the response to the written consent permission in the employee's file in case you are ever challenged on the issue.

EFFECTIVE 2023

Distribution by secure portal:

Effective for the 2023 tax year, a change in legislation now allows employers and payers to distribute T4 slips, (as well as T4A, T5, T2202 or T4FHSA slips) using an employer or payer's secure electronic portal without obtaining written or electronic consent from the employees or recipients before distributing the slips unless any of the following apply:

- The employee or recipient requested for the slips to be provided in paper copy.

- The employee or recipient cannot reasonably be expected to have access to the slips in electronic format at the time the slips are issued.

- If you distribute T4 slips, the employee is on extended leave or is a former employee at the time they are issued.

If you distribute using an employer or payer's electronic portal, you must:

- Make the slips accessible to your employees or recipients on a secure portal from which they can print the slips in a secure manner

- Provide your employee or the recipient the option for paper copies

Distribution by email:

If you email the tax slips instead of using a secure portal, you must still receive consent from employees or recipients, in writing or in electronic format, before sending the slips by email.

Distribution by paper:

If you are distributing the tax slips by paper, you must abide by the following:

- You must provide your employee or the recipient with 2 copies of the T4, T4A, T4A-NR and T4A-RCA slip in person or by mail to the employee or recipient's last known address

- The CRA suggests that the 2 copies be generated on one sheet

- For security purposes, your payroll program account number should not be printed on these copies

- Once a slip is completed, you may distribute photocopies to your employees or the recipients

What happens if I don't file T4 slips on time ... or at all?

Late Filing Penalties for Information Returns

Effective January 1, 2012

Source: CRA Employers' Guide – Filing the T4 Slip and Summary

Generally most information returns are due by the last day of February.

The penalty for filing past the due date is the greater of $100 or as determined in the table below for the NR4, T4, T4A, T4E, T4A-NR, T5 and T5018 ... (and RRSP, T10, T215, T3, T4A-NR, T4A-RCA, T4PS, T4RIF, T4RSP, T5007, T5008, TFSA):

| Number of Slips | Penalty / Day | Maximum Penalty |

|---|---|---|

| 1-5 | N/A | $100 flat penalty |

| 6-10 | $5 | $500 |

| 11-50 | $10 | $1000 |

| 51 to 500 | $15 | $1500 |

| 501-2,500 | $25 | $2500 |

| 2,501-10,000 | $50 | $5000 |

| Greater than 10,001 | $75 | $7500 |

Electronic Filing Threshold Penalties for Information Returns

Effective January 1, 2024

Source: CRA Digital Services For Businesses - File information returns electronically (tax slips and summaries)

Effective January 2024, the thresholds for filing electronically changed. There are steep penalties for not complying with the new thresholds. So if you have been paper filing, heads up! Here are the penalties for failure to file electronically:

| Number of Information Returns (Slips) | Penalty |

|---|---|

| 1-5 | $0 |

| 6-50 | $125 |

| 51-250 | $250 |

| 251-500 | $500 |

| 501-2500 | $1,500 |

| 2,501 or more | $2,500 |

Penalty Charges: Not being tax compliant is expensive!

This strategy definitely takes money out of your pocket and does not help you achieve your goal of putting more money in your pocket.

$100 minimum penalty - $7500 maximum penalty ... OUCH! Penalties apply for errors, failure to file, or failing to file using the required method. See the sliding scale applied below.

If you can't meet your payroll tax filing deadlines, you absolutely need to consider hiring a bookkeeper to do your payroll.

FAQ T4 Slip Boxes 24 and 26

Following are the most common questions asked about the T4 slip including T4 slip boxes 24 and 26.

T4 Preparation Questions:

- Can the T4 slip boxes 24 and 26 be blank?

- Can I override the numbers in T4 slip boxes 24 and 26?

Employee T4 Questions

- Why is box 14 blank but T4 slip boxes 24 and 26 aren't?

- Why is box 26 higher than box 14?

- What to do if your T4 slip is not released on time?

Bookkeeper / Payroll Clerk Question

- What needs to happen to payroll slips if the owner of a business dies?

- What needs to happen to payroll slips if a business owner declares bankruptcy?

Continue reading for the answers to these questions.

It is no longer an acceptable practice to leave T4 slip boxes 24 and 26 blank due to the changes in CPP that came into effect in 2012.

It is no longer an acceptable practice to leave T4 slip boxes 24 and 26 blank due to the changes in CPP that came into effect in 2012.T4 Slip Preparation Question

Can the T4 slip boxes 24 and 26 be blank?

T4 Slip Preparation Question

Can the T4 slip boxes 24 and 26 be blank?

I've been asked whether the same number in box 14 needs to be entered into box 24 (EI insurable earnings) and box 26 (CPP/QPP Pensionable earnings) or can they be left blank when preparing the T4 slip.

CRA introduced new rules for completing a T4 slip as a result of the changes to CPP. Boxes 24 and 26 must ALWAYS be completed now. Prior to 2012, it was acceptable and normal to have T4 slip boxes 24 and 26 blank when they matched box 14. That is no longer an acceptable practice due to the changes in CPP that came into effect in 2012.

These days, for each box, you need to enter the total amount up to the maximums for the year OR zero if exempt. If there are no insurable and/or pensionable earnings, you need to enter "0" in the field.

Examples of amounts to exclude in Box 24 - EI insurable earnings, "Do not report in box 24 amounts paid to your employee for employment, benefits, or other payments that should not have EI premiums deducted ... or the unpaid portion of any earnings from insurable employment that you did not pay because of your bankruptcy, receivership, or non-payment of remuneration for which the employee has filed a complaint with the federal, provincial, or territorial labour authorities."

For more details on how to complete Box 24 google "CRA Filling Out The T4 Slip".

Box 26 Examples - CPP pensionable earnings, "If you provide pensionable taxable benefits (non-cash) and no other remuneration is paid in a tax year (for example, an employee is on an unpaid leave of absence and the employer continues to provide benefits during the leave), enter "0" in box 26. For security option benefits, report the amount of the benefit in box 26 at all times. Do not code the slip CPP-exempt in box 28, since the employee may want to elect to pay CPP on the amount."

See the next question for excluded amounts for CPP purposes.

The CRA website details the types of box 14 employment income that must be subtracted and not included in box 26. In many cases, box 14 and 26 will be the same.

For more details on how to complete Box 26 google "CRA Filling Out The T4 Slip".

There is also a bit more information about T4 slip boxes 24 and 26 in the next Q&A.

T4 Slip Preparation Question

If I override and remove the number in the T4 slip boxes 24 and 26 that comes up automatically on the tax return, I get a larger refund. Could you please explain to me why this happens? Is that way acceptable?

T4 Slip Preparation Question

If I override and remove the number in the T4 slip boxes 24 and 26 that comes up automatically on the tax return, I get a larger refund. Could you please explain to me why this happens? Is that way acceptable?

As a general rule, if you are overriding any calculations in your tax program ... you are doing it wrong.

Tax software has generally paid computer programmers to code in all the tax rules. When an override is necessary ... the deduction is usually optional or an advanced tax calculation.

Box 24 represents the amount of insurable earnings subject to the maximum limit used to calculate the employee's EI premiums. This means it is box 14 less any earnings that are not subject to EI premiums. (See above for exclusion examples.)

There is no age limit to deducting EI premiums. However, the following employment is not insurable:

- casual employment - see the definition here

- non-arm's length employment - i.e. related people

Box 26 represents the pensionable earnings subject to the maximum limit. This means it is box 14 less any earnings that are not subject to CPP contributions.

So what are some of the exceptions? Some examples for CPP contributions when the income is not pensionable are:

- an employee is under 18 or over 70 years of age;

- an employee is between 65 and 70 years of age and elected to stop CPP contributions by submitting Form CPT 30 with parts A, B and C completed; prior to 2012, the exception was the employee received a CPP retirement pension

- an employee is between 65 and 70 years of age and elected to restart CPP contributions by submitting Form CPT 30 with parts A, B and D completed; prior to 2012, the exception was the employee received a CPP retirement pension

- the employee received CPP disability pension;

- any income or benefits listed in CRA's publication RC4120 chapter 2 of Employer's Guide - Payroll Deductions and Remittances.

For most people, T4 slip boxes 24 and 26 will match box 14. Prior to 2012, if the amounts did match box 14, they were generally left blank. That is no longer an acceptable practice due to the changes in CPP that came into effect in 2012.

T4 Slip Preparation Question

What line on my tax return does box 24 EI Insurable Earnings on my T4 slip go?

T4 Slip Preparation Question

What line on my tax return does box 24 EI Insurable Earnings on my T4 slip go?

Box 24 is an information box. It does not go anywhere on your tax return. The T4 slip shows a line number on where to report a box on your income tax return. If there is no line number provided, then it does not get reported on your tax return.

If you look at your T4 slip, you should notice that most of the boxes have a line reference except boxes 24 and 26. CRA's publication Employers' Guide Filing the T4 slip and Summary says they use T4 boxes 24 and 26 information for "pensionable and insurable earnings review (PIER) reports to check your T4 slips for CPP and EI deficiencies."

Employee T4 Slip Question

What if my employer put an amount in BOX 24 and 26 and left BOX 14 blank? Can I assume that it's the same?

Employee T4 Slip Question

What if my employer put an amount in BOX 24 and 26 and left BOX 14 blank? Can I assume that it's the same?

I believe box 14 should be blank if there is an employment code in box 29 of :

11 - Placement or employment agency workers

12 - Taxi-drivers or drivers of other passenger-carrying vehicles

13 - Barbers or hairdressers

17 - Fishers - Self-employed

These tax individuals are special situations with separate rules. Check out CRA's site at Businesses> Payroll> Completing Returns> T4> Special situations.

You should see your gross earnings listed under other information with the appropriate code for your industry. These industries get to claim additional deductions if they received Form T2200 Declaration of Conditions of Employment from their employer.

Employee T4 Slip Question

My box 26 is about $20 higher than what I actually earned and is written in box 14. What does this mean exactly, and what should I do?

Employee T4 Slip Question

My box 26 is about $20 higher than what I actually earned and is written in box 14. What does this mean exactly, and what should I do?

Your best bet is to contact your employer and/or payroll department and ask them how it was calculated. It is likely the amount is from a taxable benefit you received from your employer.

Employee T4 Slip Question

Who can I speak to when a company has not released my T4s yet? It's March. And what can I do about it?

Employee T4 Slip Question

Who can I speak to when a company has not released my T4s yet? It's March. And what can I do about it?

First thing I would do is sign onto your CRA My Account. Check to see if your T4 information has been shared with CRA yet by looking at the tax slip information section. Employers are fined by CRA if they have not submitted their T4 information to CRA by the end of February.

If it's not there, you have two other options.

(1) Phone your Payroll Department (or talk to your boss) ... or whoever handles payroll in your company ... to see if they can give you a time estimate as to when you will be receiving your T4.

- If your company is still mailing the T4 slips out, you need to check to see if they have your correct address on file. If they don't, it is possible that your T4 went to your old address.

- If your company is sending the T4 slips electronically, then make sure you check that they have your correct email address. It's even possible it's sitting in your junk mail if they are using a payroll service.

(2) If neither of those work options work, you can still file your tax return using the information from your last year-to-date pay stub from the previous year (currently 2023). Most of the information on your last pay stub for the year will match the T4 slip that will be issued. The only amounts that may not be right will likely be related to employee taxable benefits.

While it is stressful to have not received your T4 yet ... and it is really great that you are actually following up ... don't stress out too much yet. There is still time. Remember you have until April 30 to file your income tax return.

I hope this response helps you out.

Bookkeeper / Payroll Clerk Question

What needs to happen to payroll slips if the owner of a business dies?

Bookkeeper / Payroll Clerk Question

What needs to happen to payroll slips if the owner of a business dies?

When the owner of a business dies, it is classified as a special situation with regards T4 and T4A slips.

The payroll information return(s) must be filed within 90 days of the death if the owner of the business dies.

Don't forget that you will have to close all CRA accounts after all final returns have been processed and paid.

Bookkeeper / Payroll Clerk Question

What needs to happen to payroll slips if a business owner declares bankruptcy?

Bookkeeper / Payroll Clerk Question

What needs to happen to payroll slips if a business owner declares bankruptcy?

When the owner of a business declares bankruptcy, it is classified as a special situation with regards T4 and T4A slips.

The payroll information return(s) must be filed within 30 days from the date the business ceases to operate.

Note: Payroll source deductions must be remitted within 7 days from the date the business ceases.