- Essential Bookkeeping Habits For Audit Ready Books in Canada

- Hiring and Paying Your First Employee

Hiring and Paying Your First Employee in Canada

Applies To Contract Of Service Relationships | Employer - Employee Status

WHAT'S IN THIS ARTICLE

Introduction | Visual Roadmap | Hiring Your 1st Employee | CRA Tests | Employee or Self-Employed | Other PR Topics

Hiring your first employee is a very exciting milestone in your business journey.

Hiring your first employee is a very exciting milestone in your business journey.I'm excited for you!

By L.Kenway BComm CPB Retired

This is the year you get all your ducks in a row! Start by starting.

Published March 15, 2024 | Revised February 8, 2025

PREVIOUS SECTION >> Canadian Payroll Manual

NEXT SECTION >> Employment Contracts

Introduction to Hiring Your First Employee

Quick Note About Personal Services Businesses:

Sometimes, a potential worker might ask to work through their own corporation instead of becoming your employee. While this can be tempting (no payroll deductions!), you need to be careful and research CRA's position on this matter before making a decision. I cover this topic in detail here.

Hiring your first employee is a very exciting milestone in your business journey. I'm excited for you! It means your business is growing, but it also brings new responsibilities. Now's the perfect time to get your ducks in a row and establish good payroll habits from the start.

As a first-time employer in Canada, you need to understand and follow specific steps to set up payroll and pay your employee correctly. I think my step-by-step instructions will help you create a routine that makes payroll feel less overwhelming and more like second nature. My instructions are over simplified to get you started. Just remember to add notes to the steps as you figure out stuff tailored to your business and your routine.

This guide walks you through the process of hiring and paying your first employee in Canada. I'll cover everything from registering as an employer to running your first payroll. Whether you're a small business owner or a startup founder, you'll find step-by-step instructions to help you navigate this important transition.

Remember, getting it right from the start saves you time, keeps your employee and CRA happy, prevents expensive mistakes, and helps build a solid foundation for your growing business. Let's get those payroll ducks all lined up in a row!

Visual Roadmap

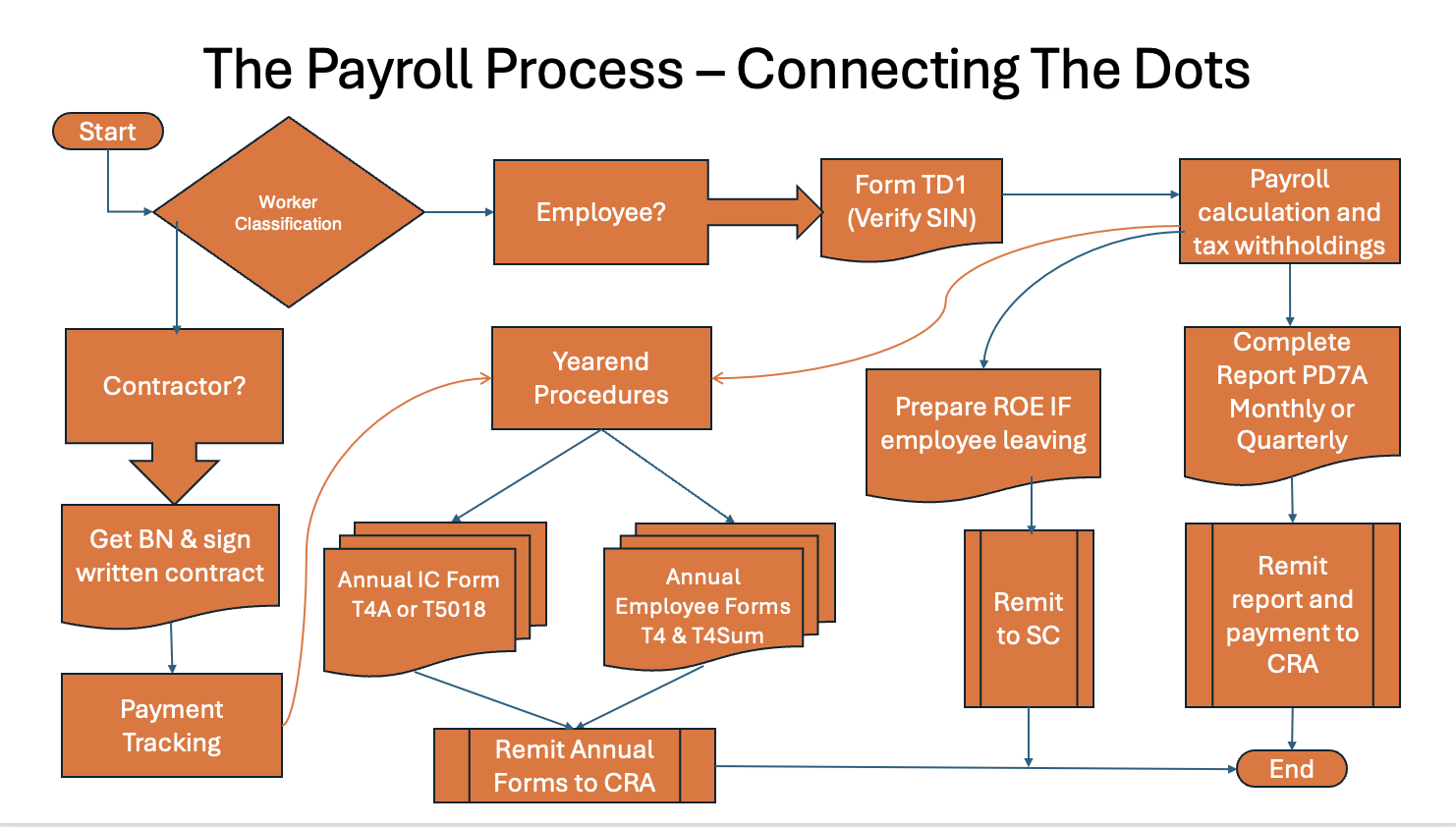

Remember this flowchart. I introduced you to it at the beginning of the payroll manual. Before we jump into the details, here's a quick reminder of the overall payroll process. This flowchart shows you the big picture - now we'll be following the "Employee?" pathway and focusing on hiring and paying your first employee.

A simplified flowchart showing an overview of the payroll process.

A simplified flowchart showing an overview of the payroll process.See how the dots connect between the different forms and procedures.

Now, let's break down each step you need to take to get all those ducks lined up in a row.

Hiring and Paying Your First Employee

Simplified Step-By-Step Instructions

Let's get all those payroll ducks lined up in a row!

Let's get all those payroll ducks lined up in a row!Step One - Determine the worker's employment status in accordance with Canada Revenue Service (CRA) criteria. Employer - Employee relationship? Or Independent Contractor relationship? Or Personal Services Business?

Step One - Determine the worker's employment status in accordance with Canada Revenue Service (CRA) criteria. Employer - Employee relationship? Or Independent Contractor relationship? Or Personal Services Business?

As the payroll tax rates are different for an employee versus a self-employed independent contractor or an incorporated employee, misclassification of a worker can be extremely costly to the employer. Let's examine how CRA tests and monitors employment status.

CRA Employment Status Tests

Over the years the courts have determined that four tests need to be met to determine employment status - (1) The Control Test, (2) The Integration Test, (3) The Economic Reality Test, and (4) The Specific Results Test.

After a 2013 Federal Court of Appeal hearing - Connor Homes vs Canada National Revenue - CRA has taken these tests and monitors the following areas for consistency in making their determinations of whose business is it:

- Determination of intent - Is it a contract of service (employee) or a contract for services (business relationship) or a personal services business (incorporated employee)? Is there a written contract? Or is the agreement verbal? Does the subcontractor have multiple clients / customers ... or just one (you)? Were invoices issued? Is the independent contractor a GST HST registrant?

- Is the actual relationship consistent with the intent - Degree of control between parties becomes an important criteria. Who exercises control over (a) what work is done, (b) who does it, (c) how it is done, and (d) where it is done?

- Is the actual relationship consistent with the intent - Who provides/owns the tools and equipment?

- Is the actual relationship consistent with the intent - Can the work be subcontracted out? Can assistants be hired to help?

- Is the actual relationship consistent with the intent - Who is at financial risk? Who makes the capital investment? Does the independent contractor have a business presence?

- Is the actual relationship consistent with the intent - Does the self-employed worker have an opportunity for profit as well as a risk of loss?

- Is the actual relationship consistent with the intent - From the worker's perspective, how integrated is the worker to the business? Is the work performed as an integral part of the business, or done on behalf of the business but not integrated into that business? Does the worker behave in a "businesslike" manner as someone in business for themselves?

For more in-depth information and specific questions to ask, refer to the CRA publication RC4110 Employee or Self-Employed?

In September 2010, Deloitte's newsletter Privately Speaking published a column authored by Tracy MacKinnon that is still relevant today. She noted:

"Whether an individual is an employee or a contractor is not a question of choice but a question of fact. And yet, making such a determination is not perfectly clear, as represented by a series of court cases on this issue. In a relatively recent case, the court concluded that the intent of the individual and the company must be one of the factors that is considered in determining the status of the individual."

The article explained that the CRA payroll tax guide at that time did not mention intent. [It does now.]

Before you decide to misclassify an employee to avoid the numerous payroll tax rates, consider the severity of the penalties. Ms. MacKinnon explained the consequences if the CRA deems a subcontractor to be an employee that are still pertinent today:

- "Penalties of 10% on income tax, CPP and EI which are not withheld on the first failure to withhold, with the penalty potentially increasing to 20% for repeated offences, as well as non-deductible interest on the amounts owing;

- Payment of both the employee and the employer’s portion of CPP and EI plus penalties and interest;

- Late filing penalties on the failure to file T4 Statement of EI forms."

Ms. MacKinnon recommended that all support documentation supporting your decision that the person is an independent contractor should be available BEFORE CRA comes knocking. This recommendation still holds today.

Step Two - If you determine you will have an Employer - Employee relationship, open a payroll account with CRA.

Step Two - If you determine you will have an Employer - Employee relationship, open a payroll account with CRA.

If you are already registered for GST, opening a payroll with CRA is easy. Just call them.

If you have not applied for your Business Number (BN) from CRA yet, you will have to do this first. During the registration process, they will assign you a payroll account as well.

It is important to note that the business has to register for a payroll account BEFORE their first remittance due date.

CRA states, "The first remittance due date is the 15th day of the month following the month in which the business began withholding deductions from the employee's pay, unless CRA tells the business to remit using a different frequency."

Step Three - Have the employee complete a CRA Form TD1 - Personal Tax Credits Return.

Step Three - Have the employee complete a CRA Form TD1 - Personal Tax Credits Return.

Before starting work, have the employe fill out the TD1 form.

The TD1 form provides information including their social insurance number. You will need the TD1 form to:

- setup your employee in your payroll program;

- determine their payroll withholdings each pay period; and

- prepare a T4 slip - Statement of Remuneration Paid, in February each year.

Step Three A - How To Verify Their SIN

Step Three A - How To Verify Their SIN

For SIN (Social Insurance Number) verification in Canada, here is my understanding of the regulations:

MUST DO

1. Obtain their social insurance number. While best practice was previously to view the original SIN document, 2013 Employment Insurance Regulations say you don't need to provide proof as neither the SIN card* nor the confirmation of SIN letter is an identity document or a piece of identification. Employers should now rely on the employee providing the number.

* As of 31 March 2014, Service Canada no longer issues plastic SIN cards. Instead, an individual will receive a paper "Confirmation of SIN" letter.

2. Record the SIN number. Recording the SIN is generally only necessary for payroll and tax purposes (like the TD1 form). Unnecessary recording should be avoided. For example, it should not be used as an employee ID, on an employee badge, or on timesheets; never transmit it in unencrypted emails. It is not required information on a job application.

3. Verify the SIN starts with a valid number:

- 1-7: Canadian citizens/permanent residents. SINs are assigned by geographical location in Canada. The first digit is equated to a province or a region in Canada.

- 9: Temporary residents (ensure work authorization is valid and monitor expiry). These are tied to work permit expirations so you must track the expiry dates.

- 8 and 0: As far as I know, no SINs in Canada start with either of these numbers.

4. Verify the work permit / authorization.

You need to request and examine the individual's original work permit or other authorization document, for example a study permit with work authorization. Verify:

- It's valid (not expired).

- The document is genuine (be aware of potential forgeries).

- The conditions of the permit allow them to work for you, for example the correct employer, occupation, location.

- For certain work permits, you can verify their validity online through the Employer Portal on the Government of Canada website.

- If you have any doubts, consult the official Immigration, Refugees and Citizenship Canada (IRCC) website or contact them directly for guidance.

🦆 DUCK TIP

From an employer's perspective, if the SIN starts with a 9, you are required you to verify a valid work authorization and monitor the expiry dates. Don't assume someone with a 9 SIN has automatic work authorization. You must still check their work permit. You cannot hire someone who does NOT have valid work authorization in Canada.

TIMING

- Must get their SIN on or before first day of employment

- If the employee doesn't have a SIN, they must apply for a SIN as soon as they are eligible. There's no longer a specific 3-day timeframe for providing proof of application or the SIN itself to the employer. However, the employee MUST provide it before they can be paid. They must show proof that they have applied for one within 3 days

- You must follow up to get actual SIN within 3 days of the employee receiving it

RECORD KEEPING

- Keep a record of the employee's name and SIN (i.e. file the TD1 form).

- Do not write a SIN on documents that don't require it.

- Protect the SIN's privacy and confidentiality (i.e. restrict access to it).

- Keep records for 6 years after last use.

SPECIAL SITUATIONS

- SINs beginning with '9' expire - you must have a system to track the expiry date.

- You must match the work permit expiry date.

- You must get new SIN information if the employee gets permanent residency (i.e. the employee get issued a new SIN starting with 1 through 7 once they become a permanent residence).

Who is not Eligible For Hire?

- Anyone without a valid Social Insurance Number (SIN). While you can start the onboarding process, they cannot legally be paid without a SIN.

- Anyone without valid work authorization. This includes individuals whose work permits have expired, have conditions not applicable to your job offer, or are in Canada without legal status to work.

- Individuals whose SIN starts with 9 and whose work permit has expired. Even if they have a SIN, it's invalid for work if their associated permit has expired. They must stop work. If they applied for an extension, the worker has authorization to work without a permit until we make a decision on your application.

IMPORTANT

You can't withhold pay while waiting for an employee's SIN, but you must still make reasonable efforts to obtain it.

My understanding is that you must pay employees for work performed, even without a SIN. You must deduct CPP, EI, and income tax even without a SIN. You cannot withhold or delay wages due to a missing SIN. Again, you must make reasonable efforts to obtain the SIN.

What To Do If You Have No SIN?

1. Have employee show proof they've applied for SIN.

2. Process payroll normally.

3. Keep documentation of your attempts to get the SIN.

4. Follow up with employee.

5. If you file T4 before getting SIN, leave SIN field blank.

What are the Employer's Obligation Regarding the SIN?

1. Ask for SIN on their first day of work.

2. Inform your employee of requirement.

3. Keep records of your requests.

4. Follow up within reasonable time.

5. Document all efforts to obtain SIN.

6. I've seen it suggested on the internet that you consult an employment lawyer on what to do after 60 days if you still don't have a SIN as this is a grey in employment law.

Step Four - Open a separate bank account for source deductions collected.

Step Four - Open a separate bank account for source deductions collected.

Payroll withholdings are held in trust for the government until such time as you are required to remit them to CRA. These amounts must not be used as operating capital for your business or to fund your personal lifestyle.

Step Five - Choose a payroll software as a subscription service (SaaS) to calculate and send employee pay cheques. Use the app to do your first payroll run.

Step Five - Choose a payroll software as a subscription service (SaaS) to calculate and send employee pay cheques. Use the app to do your first payroll run.

The easiest way to do these calculations is to subscribe to payroll software as a subscription service (SaaS) like QuickBooks Online (which also tracks all your business transactions and your sales tax). QuickBooks Online offers direct deposit of employees' earnings as part of their SaaS.

Personally, I like to keep things simple, especially when first starting out. Therefore, I try to find an integrated, affordable solution that gets the job done. You probably don't need a lot of bells and whistles when you are first starting out. You can learn more about how I select an app on my other site.

CRA does have an online payroll calculator but it is tedious to use, does not save your results so does not provide the year-to-date information you will need to calculate your annual T4 slip for the employee.

A SaaS app will calculate the employee's gross pay first. You will have to decide if the employee's earnings will be based on an annual salary or an hourly rate or commission or some other method.

You must take into consideration labour laws in your province which may require vacation pay or overtime pay. The SaaS program usually takes care of this for you.

The SaaS app will take into consideration any tax credits that apply to the employee based on the information on their TD1 form.

Payroll deductions are calculated for each pay period next - both the employee (CPP, EI, WIT) and employer (CPP and EI) portions.

Employers are required to calculate and remit their portions of CPP and EI contributions at the same time as the employees' source deductions. Find our the employer-employee contributions rates here.

Step Five Sidebar 1: Are there government regulations to paying employees by direct deposit? Can a business make it mandatory to pay by direct deposit?

Step Five Sidebar 1: Are there government regulations to paying employees by direct deposit? Can a business make it mandatory to pay by direct deposit?

Generally, payroll direct deposits must be paid into the employee's account NOT third party accounts and side deals are illegal.

Each province / territory has a labour code dealing with the rules around paying employees by direct deposit. Federally regulated employers follow the Canada Labour Code.

Quick overview of some of the provinces rules for direct deposit:

- BC's Employment Standards Act provides for direct deposit. An employer must pay all wages (a) in Canadian currency, (b) by cheque, draft or money order, payable on demand, drawn on a savings institution, or (c) by deposit to the credit of an employee's account in a savings institution, if authorized by the employee in writing or by a collective agreement.

- Quebec's Labour Standards Act allows employers to implement a direct deposit system after having obtained the employee's written consent and as long as the employee has access to a bank account from a financial institution. If an employee does not have access to a bank account from a financial institution, the employer must continue to pay that employee's wages by cash or cheque. However, this rule does not apply where the transfer as well as the institution has been determined by collective agreement.

- Newfoundland and Labrador's Labour Standards Act states the employer must pay the wages: (a) at the place of employment during regular working hours, (b) at the employee's normal residence, (c) by mail, (d) personal delivery, (e) by direct deposit into the employee's bank account with the employee’s consent. The wage must be paid in a lawful Canadian currency by cheque, money order, or direct deposit into the employee's bank account.

- Ontario's Employment Standards Act brought in direct deposit regulations in 2000. An employer may pay an employee's wages by direct deposit into an account of a financial institution if the account is in the employee's name; and no person other than the employee or a person authorized by the employee has access to the account.

- All other provinces and territories allow employers to pay wages direct deposit into the employee’s account at an institution insured by the Canada Deposit Insurance Corporation (CDIC).

- Federally regulated employer follow the Canada Labour Code. It allows an employer to pay its employees any wages to which they are entitled “as established by the practice of the employer.” As such, if the employer has an established practice of paying by direct deposit, an employee of a federally regulated employer cannot insist her wages be paid other than by direct deposit.

Employers cannot change the way it pays an employee's earnings unilaterally if it is fundamental term of the employment contract. Best practice is to require new employees to participate in direct deposit as a condition of employment and obtaining written consent where required.

References:

- Can a Canadian company mandate direct deposit or is there a legal requirement to make it optional? By Brian Kenny Canadian at HR Reporter Feb 15, 2006

- Payment and Statement of Wage Requirements in Quebec by Yosie Saint-Cyr LL.B. at HRinfodesk August 2006.

- Labour Standards Act in various provinces

Step Five Sidebar 2: How do you determine the payroll tax rates for statutory holidays?

Step Five Sidebar 2: How do you determine the payroll tax rates for statutory holidays?

To determine the pay rates for statutory holidays, refer to your provincial labour standards if you are under provincial regulations ... or federal labour standards for those under federal jurisdiction.

For BC ... There are two links about the BC Ministry of Labour on Statutory Holidays ...

- www2.gov.bc.ca/gov/content/employment-business/employment-standards-advice/employment-standards/statutory-holidays

- www2.gov.bc.ca/gov/content/employment-business/employment-standards-advice/employment-standards/statutory-holidays/calculate-statutory-holiday-pay

Statutory pay equals an average day's pay. BC employees are entitled to statutory holiday pay if they work or take the day off. Employers should base their calculations on the last 30 days worked prior to the statutory holiday – including vacation days.

It should also be noted that Easter Sunday, Easter Monday, and Boxing Day are not statutory holidays in B.C..

For Alberta ... alberta.ca/paid-holidays-directive

If a general holiday falls on a regular workday, an employee may receive the day off work and their full salary for the day. If a general holiday does not fall on a regular workday and the employee does not work on the holiday, no general holiday pay is owed.

For Ontario ... ontario.ca/document/your-guide-employment-standards-act-0/public-holidays

In Ontario, an employee is generally entitled to take all statutory holidays off work and be paid public holiday pay. Most employees qualify for stat holiday pay if their workplace is covered by the Ontario Employment Standards Act and they meet the requirements of 'the first and last rule'.

For federal standards and all other provinces / territories, try this link ...

- canada.ca/en/employment-social-development/programs/employment-standards/holidays.html

An employee working for a federally regulated employer is entitled to a day off with pay for the general holidays.

Reference: Peninsula Group Limited has great Stat Holidays & Pay information for a lot of the provinces updated to 2025.

Step Six - Remit source deductions to CRA by assigned due date.

Step Six - Remit source deductions to CRA by assigned due date.

The easiest way to file and pay your source deductions is to file the PD7A form - Statement of account for current source deductions. It is online using CRA's My Payment or My Business account.

Learn more about making payments online here.

As mentioned in step two above, the frequency of your remittance is determined by your remitter type and assigned to you by CRA when you open your payroll account.

Generally, CRA assigns NEW small business owners a quarterly remitting frequency. Find more information on source deduction remittances here.

Step Seven - Request employees submit a new TD1 form by the end of December. Prepare and issue the annual T4 slip - Statement of Remuneration Paid.

Step Seven - Request employees submit a new TD1 form by the end of December. Prepare and issue the annual T4 slip - Statement of Remuneration Paid.

At the beginning of every calendar year, employees need to submit a new TD1 form to you so you can setup the new year's payroll information. It's also a way to confirm the employee's contact information for T4 preparation.

Report the income paid to the employees and any qualifying deductions on a T4 slip - Statement of Remuneration Paid. The T4 slip must be issued annually to employees by the last day of February. Learn more about your T4 reporting obligations here.

Dig Deeper Into Other Payroll Issues

Canadian Payroll Manual

Where do you want to go next?

More >> Payroll Filing Deadlines

References: CRA Publication IPG-069 Determining the Employer/Employee Relationship

Back to top