- Essential Bookkeeping Habits For Audit Ready Books in Canada

- Payroll Manual

- Part 1 - Setting Up And Processing Payroll

Setting Up And Processing Payroll In Canada

For Small Businesses With Less Than 10 Employees

Applies To Contract Of Service Relationships | Employer - Employee Status

By L.Kenway BComm CPB Retired

This is the year you get all your ducks in a row! Start by starting.

WHAT'S IN THIS ARTICLE

Table of Contents | Introduction | We Are Here | Key Terms | Where Do I Start? | What to Pay? | Different Ways to Pay People | Payroll Cycle Basics | The Bottom Line

Before you jump on hiring your first employee, it is wise to educate yourself about your payroll compliance responsibilities.

Before you jump on hiring your first employee, it is wise to educate yourself about your payroll compliance responsibilities.Published February 25, 2025

PREVIOUS SECTION >> Canadian Payroll Manual

NEXT SECTION >> Part 2 - Payroll Compliance and Reporting

JUMP TO >> Table of Contents

Part 1 - Setting Up and Processing Payroll

Table of Contents

1.1 Getting Started with Your First Employee

A. Introductory Information (content directly on this page)

B. Specific Topics (links to separate supporting articles)

- Is Your Worker an Employee or Contractor?

- Canadian Employment and Labour Standards (Find Minimum Wage Information Here)

- Step-By-Step Setup and Hiring Instructions

- Getting It in Writing: Employee Agreements

- 2024 Province of Employment Rules for Remote Workers

1.2 Running Your Regular Payroll

A. Introductory Information (content directly on this page)

- Payroll Cycle Basics

- Your Payroll Rhythm

- Payroll Processing Methods (Manual vs Software)

- Payment Options (Direct Deposit vs Cheque)

- A Short Word About Data Security

- Setting Yourself Up for Success

- Your Pay Run Checklist

- Top 5 Common Payroll Calculation Mistakes

- Building Good Habits

B. Specific Topics (links to separate supporting articles)

Part 1 - Setting Up And Processing Payroll For Less Than 10 Employees

Welcome to Part 1 - Setting Up and Processing Payroll

You're in the right place if you're just getting started with payroll. This section walks you through the essential first steps of hiring and paying employees in Canada.

While this is part of the larger Canadian Payroll Manual, I've designed this section specifically for new employers who need to:

- Open their first payroll account with the CRA

- Set up their payroll system

- Understand basic payroll calculations

- Process their first paycheques

- Get comfortable with the payroll cycle

Part 2 of the Canadian Payroll Manual will be dealing with:

- Keeping CRA happy

- Working with no-employees

- Your legal obligations around payroll

The best way to eat an elephant is one bite at a time.

Desmond Tutu

We Are Here (Let's Check In!)

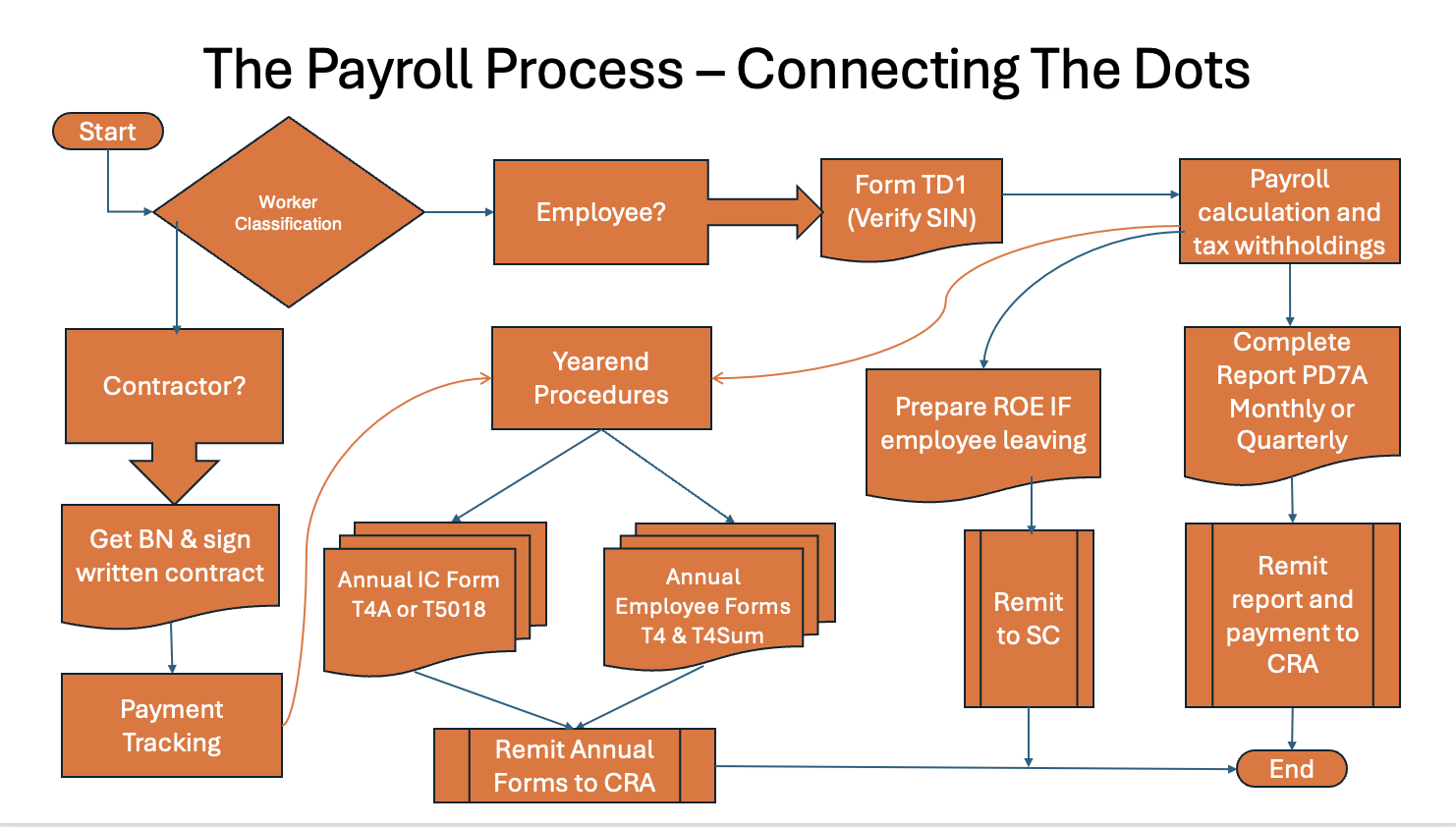

Before we jump in, let's see where we are in the overall payroll process. Remember our roadmap? You'll see this overview of the payroll process throughout the manual to help you stay oriented. Keeping referencing it if you are getting lost in the process.

Right now, we're starting at worker classification and working our way through to payroll calculation and tax withholdings. We'll slightly touch on contractor workers but that will discussed more deeply in Part 2 of the manual.

A simplified flowchart showing an overview of the payroll process.

A simplified flowchart showing an overview of the payroll process.See how the dots connect between the different forms and procedures.

Key Terms To Know

(Here are some important terms that are good to know)

- Gross Pay - Total earnings before any deductions.

- Net Pay - Take-home pay after all deductions ('the amount on the pay cheque').

- Statutory Deductions - Required government deductions: CPP (Canada Pension Plan), EI (Employment Insurance), and Income Tax.

- Remittances - Money you collect and send to CRA (your employee's deductions plus your mandatory portion as employer).

- Pay Period - Time frame covered by each paycheque (weekly, bi-weekly, semi-monthly, monthly).

- Source Deductions - Another term for payroll deductions taken 'at source' (directly from the paycheque).

Let's get started with setting up your first payroll ...

There are three types of worker relationships. How to proceed depends which type of contract you are entering into.

There are three types of worker relationships. How to proceed depends which type of contract you are entering into.Canadian Payroll Manual

1.1 Getting Started with Your First Employee

Section TOC

Specific Topics (links to separate supporting articles)

- Is Your Worker an Employee or Contractor?

- Canadian Employment and Labour Standards (Find Minimum Wage Information Here)

- Step-By-Step Setup and Hiring Instructions

- Getting It in Writing: Employee Agreements

- 2024 Province of Employment Rules for Remote Workers

This section of the Canadian Payroll Manual addresses common payroll challenges faced by micro-businesses hiring their first employee.

Canadian Payroll Manual

What To Do If You Are New To Payroll Administration

(Help! I'm New To Payroll - Where Do I Start?)

Before you jumping in on the instructions in this Payroll Tax Guide, it would be wise to educate yourself about your payroll compliance responsibilities. A good place to start are the CRA webcasts.

It's important these days to ensure you are getting your information from a reliable source. For that reason, I recommend using the Canada Revenue Agency's website as the final determinant. Over the years, CRA has published many informative webcasts located in the video gallery under videos for businesses.

If you are a new business owner with payroll, take time to watch the Canada Revenue Agency (CRA) 2024 28 minute webcast Payroll Responsibilities for Employers. I would review this BEFORE you bring your first employee on board. It covers responsibilities as an employer and the consequences of non-compliance (what happens if you don't follow the rules). Here is the general outline of what you'll learn.

- Payroll obligations to CRA

- Deductions and contributions

- Tools for calculating types of pay and withholdings

- Books and Records

- Remitting

- Reporting

Before you can start running payroll, you'll need to handle some paperwork basics. This includes getting your Business Number (BN) and setting up a payroll account with CRA.

Here's some good news. If you already have a GST/HST account (RT) - you've got your BN! You just need to add your payroll program account (RP). I talk about this in step 2 of hiring your first employee instructions.

__________

Sidenote: I'm disappointed that the CRA took down their 2019 webcast 'Payroll 101 - What you need to do if you're new to payroll administration'. It was a great resource for new employers, and I wish they had updated it after the CPP2 changes occurred in 2024 instead of removing it entirely.

__________

🦆 Duck Tip: If you're like me and prefer reading over watching videos, you'll be happy to know that every CRA webcast comes with a written transcript. It's a lot faster than sitting through the webcast!

In summary, the CRA's videos for business gallery is a good reliable source to learn about your compliance responsibilities around payroll tax deductions. Although, fair warning, they are usually a bit dry as the presenters usually read from a script I'm guessing to ensure the information is accurate.

What should you pay your first employee?

Additional considerations when you are about to hire your first employee is what to pay them. Robert Half International has Salary Guide tools available for free. The tools could help you determine how much the position should pay.

Canadian Payroll Manual

Understanding Worker Relationships

(The Basics on Different Ways to Pay People)

Before you write that first cheque or make that first direct deposit or e-Transfer, let's talk about worker relationships. Getting this wrong can cost you thousands in reassessments and penalties, so it's worth taking a few minutes to understand the basics.

Canadian payroll tax is a complex compliance obligation for many reasons. This payroll manual lays out some your responsibilities. You don't want to screw this up.

As a small business owner, this needs to be on your radar. You need to make this an important priority in your long list of things you need to get done in a day, a week, a month. I encourage you to be kind to yourself. It'll be easier on you if you get it right from the start.

There are three types of worker relationships. How to proceed depends which type of contract you are entering into.

- An employer-employee relationship is a contract of service;

- An independent contractor relationship is a contract for services.

- A personal services business (PSB) relationship which has its own special category called incorporated employee.

Think of it this way:

- Employee: An office manager who works set hours under your direction.

- Contractor: Your web designer who works for multiple clients.

- PSB: Your bookkeeper who only works for you but through their corporation.

The relationship type affects how much you pay in CPP, EI, and other deductions. For employees, you're responsible for both portions of CPP and EI. For contractors and PSBs, they handle their own deductions.

Learn More >> How CRA determines worker status

Learn More >> Why worker classification matters

A Note About PSBs:

CRA has a process to determine the employment status of an employee in their eyes. Sometimes a small business owner wants an incorporated employee relationship to avoid costly payroll taxes and clearly define the intent of their working relationship as not that of employer-employee.

This relationship is sometimes referred to as a disguised employee and may have negative tax effects for the incorporated employee and potential risk for the payer - the business hiring the incorporated employee.

An example:

Let's say Laura is a certified professional bookkeeper who works only for your company, but she's incorporated as 'Laura's Bookkeeping Solutions Inc.' You agreed to this relationship because, hey, no payroll deductions! BUT (and this is a big but) if CRA determines Laura is actually an employee disguised as a corporation, you could be on the hook for all those payroll deductions retroactively.

Laura might look like a contractor, but CRA might view her as a PSB if:

- She works only for you

- She uses your equipment

- She follows your schedule

- You control how she does her work

The PSB rules were actually created to prevent people from avoiding taxes by incorporating when they're really employees. As mentioned, this type of working relationship is what CRA calls 'incorporated employees'.

Learn More >> Should You Hire a Personal Services Business?

Still not sure? Keep reading below for a bit more information about personal services businesses.

References: CRA Publication IPG-069 Determining the Employer/Employee Relationship

Canadian Payroll Manual

1.2 Running Your Regular Payroll

At the beginning of each year, create a payroll master calendar for the WHOLE year. This becomes your payroll rhythm.

At the beginning of each year, create a payroll master calendar for the WHOLE year. This becomes your payroll rhythm.Section TOC

- Payroll Cycle Basics

- Your Payroll Rhythm

- Payroll Processing Methods (Manual vs Software)

- Payment Options (Direct Deposit vs Cheque)

- A Short Word About Data Security

- Setting Yourself Up for Success

- Your Pay Run Checklist

- Top 5 Common Payroll Calculation Mistakes

- Building Good Habits

Specific Topics (links to separate supporting articles)

- When to Tax Employee Perks and Benefits

- Vehicle Allowances & Reimbursements

- Paying Casual Labour in Cash The Right Way

The next section of this Canadian Payroll Manual addresses common payroll challenges faced by micro-businesses learning how to run payroll for the first time.

Let's get all your payroll ducks in a row by talking about one of the most important routines you'll establish in your business - your payroll cycle. Think of it as getting your ducks to march in perfect formation, each one following the other in a predictable pattern.

Canadian Payroll Manual

Payroll Cycle Basics

As this Canadian Payroll Manual explains, getting your payroll cycle right is about more than just choosing how often to pay your employees. It's about creating a reliable rhythm for your business that accounts for everything from pay frequencies and extra pay periods to statutory holidays and (spoiler alert!) why advances usually aren't a great idea. Let's walk through the basics of setting up and maintaining a smooth payroll cycle that keeps both you and your employees happy.

🦆Duck Tip: Set up a separate bank account for payroll right from the start. This makes it easier to track your payroll funds, plan for those months with extra pay periods, and ensures you always have enough set aside for payday and CRA remittances.

If you are worried about bank fees:

- EQ Bank has a business account with no monthly fees, free unlimited transactions and currently pays 3% in interest. After each Bank of Canada rate announcement, the interest rate is reviewed and modified as necessary. As it is beta mode, you have to join their waiting list to apply.

- Simplii Financial might be options if you will have only a few transactions as their bank accounts are meant for personal use.

- Tangerine has a business savings account. It's not a chequing account but does pay interest (currently 2.55%), has no monthly fees, and no minimum balance. You do have to have a business chequing account at another bank to open a Tangerine business savings account.

Now let's answer some questions about the payroll cycle you may have.

What's a Payroll Cycle?

What's a Payroll Cycle?

Basically, it's how often you pay your employees. In Canada, this usually means:

- Weekly (52 pays per year) - typically used in the construction industry and seasonal businesses, by temporary staffing agencies as well as some retail/service industries with high turnover.

- Bi-weekly (26 pays per year) - usually used for hourly paid workers as it makes tracking easier. Typically, they are paid with a one week pay delay on the same day, for example every other Friday.

🦆 Quack Fact: Remember, bi-weekly doesn't mean twice a month (that's semi-monthly) - there will be two months each year with three pay periods. You will have to plan ahead for this. This is one of the reasons I like to have a separate bank account for payroll. You can see where your payroll funding is at just a glance. - Semi-monthly (24 pays per year) - usually used for salaried employees which helps keep your cashflow predictable. Paydays are typically the 15th and last day of the month.

While this pay frequency aligns nicely with most monthly bills, it can be trickier to calculate for hourly employees since months have different numbers of working days and hourly workers often have flexible work schedules. - Monthly (12 pays per year) - while this pay option might work for owner-operators, it generally doesn't comply with provincial labour standards for employees. Most provinces require, by law, a minimum payment frequency of at least twice monthly. Employees have bills to pay too!

Here's the thing though - once you pick a cycle, stick to it! Your employees plan their lives around payday, and consistency is key. You might want to consider choosing your payroll around the cashflow cycle in your business. That way you can be pretty sure you will always meet payroll.

How Can You Plan for a Third Pay Period in a Month?

How Can You Plan for a Third Pay Period in a Month?

Sometimes, the calendar doesn't line up neatly with a payroll bi weekly schedule. For example, when you pay bi-weekly, you'll encounter two months each year with three pay periods instead of two. This can impact your cash flow, as you'll need to cover an extra payroll in those months.

You will have to plan ahead for these two months. It is also one of the reasons I like to have a separate bank account for payroll. You can see where your payroll funding is at just a glance. Let's take a look at how you could plan in advance for this payroll event.

Example of Planning Ahead

Let's say your regular payroll run for hourly workers is bi-weekly, and you usually pay on Fridays. In the month of July, paydays might fall on the 1st, 15th, and the 29th. How do you prepare for this event? (1) Allocate funds for three payrolls in those months when budgeting. (2) Consider keeping an emergency payroll reserve. (3) Shift some expenses in non-payroll cost categories to maintain the balance.

Switching from manual payroll calculations to payroll software helps you, as a business owner, save time, reduce errors, and maintain CRA compliance more efficiently. Tools like QuickBooks Online Payroll Core can help you automate scheduling. The system automatically accounts for the additional pay periods, offering prompts, so nothing sneaks up on you. Also, many platforms offer cash flow projection features, enabling you to see these additional expenses ahead of time.

By anticipating these scenarios, you can make sure that all your payroll ducks stay in line, no matter what the calendar throws your way.

What about statutory holiday pay?

What about statutory holiday pay?

Statutory holiday pay has different implications for different pay frequencies (this often trips up new employers). They can affect your payroll process, particularly when it comes to calculating pay for hourly employees and planning your pay schedule. Here’s how these holidays might impact your regular payroll routine:

- Scheduling Adjustments: Statutory holidays often mean a day off for workers, which can disrupt your standard payroll processing cycle. For example, if payday usually falls on a statutory holiday, you’ll need to adjust the pay date so employees receive their wages on time.

Example: If your regular payday is Friday and a statutory holiday falls on that day, you might need to process payroll earlier in the week, ensuring direct deposits clear by Thursday or even Wednesday. - Overtime Considerations: Workers who are required to work on a statutory holiday may be entitled to additional pay. Typically, this means paying an overtime rate for hours worked on the holiday itself.

Example: If Linda lives and works in Alberta with a regular hourly wage of $20, and Alberta's statutory holiday rate is 1.5 times the regular rate, the employee would earn $30 per hour for time worked on that holiday. In Alberta, if Linda does not work on the holiday, she is not eligible for holiday pay.

Note: If Linda were a salaried (as opposed to hourly) worker in Alberta, and the statutory holiday falls on a regular workday, Linda may receive the day off work and her full salary for the day. - Calculating Holiday Pay for Eligible Employees: Employees eligible for statutory holiday pay typically receive a day’s wage for the holiday. The calculation generally involves assessing their average daily earnings from a set period (like the previous 4 weeks).

Example: Janet who earned a total of $2,000 over the previous 4 weeks works five days a week. Janet's daily average earning would be $100, which is her statutory holiday pay.

Using payroll software can automate these adjustments for you, ensuring compliance with labor laws across different provinces, and saving you time from manual calculations. Always double-check specific rules applicable to your jurisdiction to ensure accuracy and compliance.

By keeping each holiday in mind, you can maintain workflow consistency and ensure your employee(s) is happy and compensated appropriately for their work.

First Reference has a free 'Statutory Holiday Guide Across Canada' as well as other great free guides such as 'Vacation Time and Pay Rules Across Canada Guide', 'Essential HR Policies by Jurisdictions', and 'AI in the Workplace'. You can find all of these free guides and more at firstreference.com/resources/guides/ .

Can I pay advances instead of a regular paycheque mid-month? What about non-regular employee advances?

Can I pay advances instead of a regular paycheque mid-month? What about non-regular employee advances?

This question often comes up when an employer is setting up payroll for their first salaried employee. While advances were common back in the day (think the twentieth century), they're now seen as a bit of a payroll headache. Here's why:

- They mess up your withholding calculations (imagine trying to keep your ducks in line when some keep swimming ahead!).

- They create extra administrative work.

- They can lead to compliance issues with CRA.

- They might put you at risk if an employee leaves before "paying back" the advance.

Instead of advances, most modern employers stick to regular, predictable pay schedules. It's easier to manage, cleaner for bookkeeping, and keeps everyone (including CRA) happy. Here's a real-world example showing why.

Illustration #1 - Semi Monthly Advance

Meet Mary, who just hired her first employee, Sarah, as a full-time office administrator on salary. Mary decides to pay Sarah with a mid-month advance on the 15th and then settle up with a final paycheque at month-end. She figures this will save her time by only having to calculate payroll deductions once a month.

At first, everything seems fine. Mary advances Sarah half her monthly salary mid-month, then on the last day of the month, she deducts the advance and calculates all the proper withholdings.

But six months later, Sarah gives notice and quits on the 18th of the month - just three days after receiving her mid-month advance. When Mary calculates Sarah's final pay, she discovers a problem. After calculating the proper withholdings on Sarah's earnings for those 18 days, there isn't enough to cover the advance she just paid. Mary is now in a tough spot trying to recover the difference.

The Lesson

This experience taught Mary an important lesson about getting her payroll ducks in a row from the start. Instead of using advances, she decided that with her next employee she would:

- Set up proper semi-monthly pay periods (1st-15th and 16th-last day of month).

- Calculate proper withholdings for each pay period, and remit on her assigned schedule.

- Keep her payroll process clean and compliant from day one.

🦆 Quack Fact: Remember while mid-month advances might seem like a simpler solution, they can create unexpected headaches. Setting up proper semi-monthly payroll runs from the start is actually easier in the long run - and it keeps both you and CRA happy!

Another scenario may also arise around advances. It occurs when an employee asks for an occasional advance to cover unexpected expenses they didn't plan for.

While offering pay advances might seem like a kind gesture for an employee facing unexpected expenses, it can actually create more challenges than solutions for your payroll process. Let me share a common scenario to illustrate why:

Illustration #2 Non-Regular Employee Advances

Meet Mark, who just hired his first employee. Zack is hourly and paid bi-weekly. When Zack asks for a $500 advance for unexpected car repairs during his second week of work, Mark wants to help. Without established policies or much payroll experience, he agrees.

This well-intentioned decision quickly becomes complicated. Mark's payroll service can handle advances, but he realizes he doesn't know important details like:

- How much of each paycheque should go toward repayment?

- Should he get the repayment agreement in writing?

- What happens if Zack calls in sick or quits before repaying the advance?

The situation becomes even more stressful when Zack misses several shifts the following week. Mark realizes he's put himself in a vulnerable position by not having clear policies in place first.

The Lesson

This experience taught Mark an important lesson about getting his payroll ducks in a row before making exceptions. Instead of offering any more advances, he decided to:

- Create clear, written payroll policies before hiring his next employee.

- Set up proper pay schedules from the start.

- Keep communication open about pay dates so employees can plan accordingly.

🦆 Quack Fact: Remember when you're just starting out as an employer, it's tempting to make decisions based on goodwill alone. But having clear policies and proper pay schedules from the start helps everyone - you'll feel more confident, and your employees will know exactly what to expect!

Any tips for holiday and special pay processing?

Any tips for holiday and special pay processing?

Good question. Let's talk about those times when your regular payroll rhythm needs adjusting - primarily around holidays and year-end bonuses.

Statutory Holiday Pay Periods

- Process payroll early when a regular payday falls on a holiday.

- Allow 3-4 extra banking days for processing around major holidays.

- Remember bank closures affect direct deposit timing.

🦆 Duck Tip: At the start of each year, mark statutory holidays on your payroll calendar and note which paydays might need early processing. (I know, I've said this already. Yikes I'm starting to sound like my mother always reminding me about stuff!)

Year-End Considerations

- December often has extra complexity with holiday closures.

- Plan ahead for Christmas, Boxing Day, and New Year's.

- Remember pay dates determine the tax year (not when work was performed).

Bonus Pay Timing

- Decide if bonuses will be processed with regular payroll or separately.

- Consider tax implications of December vs. January bonus payments.

- Allow extra processing time for bonus calculations and approvals (if applicable).

🦆 Duck Tip: Create a simple holiday processing schedule at the start of each year. For example:

- Christmas falls on Wednesday → Process Monday's payroll by previous Thursday

- New Year's falls on Wednesday → Process Monday's payroll by previous Friday

Canadian Payroll Manual

Your Payroll Rhythm

Getting your payroll ducks in a row starts with establishing a consistent rhythm. Each pay cycle follows these six steps:

- Collect timesheet information.

- Calculate gross pay.

- Figure out deductions (the fun stuff like CPP, EI, and income tax).

- Process the net pay.

- Keep your records straight.

- Remit those withholdings and contributions to CRA.

🦆 Duck Tip: For small businesses (under 10 employees), cloud-based payroll services like QBO Payroll Core, Wagepoint, PaymentEvolution, or Rise make these steps much easier. They handle calculations, direct deposits, and even generate your remittance forms!

Timing Recommendations

Here's how to time these steps for the two most common pay schedules:

BI-WEEKLY (Hourly Workers):

Remember there is usually a one week time delay from working the hours to being paid.

- Day 1-2: Timesheet collection/review

- Day 3: Process payroll

- Day 4: Run payroll (likely 3-4 banking days before payday)

- Day 5: Payday (for example every other Friday)

SEMI-MONTHLY (Salaried Employees):

- 15th & Last day of month: Payday

- 3-4 banking days before: Process payroll

- 5 days before: Review any changes (benefits, raises, etc.)

🦆 Duck Tip: When a payday falls on a holiday, most employers process payroll early to ensure employees are paid on the last business day before the holiday. Your payroll service can help you plan for these adjustments.

Creating a Payroll Calendar

At the beginning of each year, create a payroll master calendar for the WHOLE year. This becomes your payroll rhythm. Mark these key dates:

- Timesheet deadlines

- Processing deadlines (check your payroll service's requirements)

- Pay dates (including holiday adjustments)

- CRA remittance due dates (typically 15th of following month or it maybe once a quarter)

- Quarter-end reviews (catch any mistakes early so you can have a smooth year-end)

- ROE deadlines when needed

- Year-end deadlines (February 28th)

🦆 Duck Tip: Most payroll services offer calendar features that automatically adjust for holidays and help you track these deadlines. Take advantage of these tools - they're like having a dedicated duck keeper for your payroll flock!

Why Getting This Right Matters

Look, I get it - payroll can feel overwhelming at first. But here's the good news: once you establish your routine, it becomes second nature. Plus, staying on top of your payroll obligations:

- Keeps your employees happy (happy ducks!)

- Keeps CRA off your back

- Helps you sleep better at night (and believe me, you need a good night's sleep to have the energy to run your business!)

Let me share a quick success story:

Meet Brenda, who started a small graphic design business last year. At first, she dreaded payroll days - she'd procrastinate until the last minute, scramble to gather information, and worry constantly about making mistakes. Sound familiar?

Then she decided to get her payroll ducks in a row so she:

- Set up a simple payroll calendar.

- Created a consistent routine.

- Signed onto a reliable payroll service. She chose QBO Payroll Core because she was already using QBO Canada to do her bookkeeping and wanted to keep things as simple as possible.

- Setup a system to keep her records organized.

The result? These days, Brenda handles payroll in about 30 minutes twice a month. Her employee gets paid on time, every time. Her CRA remittances are always accurate and punctual because she used QBO's auto pay feature. Best of all? She no longer loses sleep wondering if she's done everything right.

"I wish I'd established these habits from day one," Brenda says. "Now payroll is just another routine task - like checking my email or updating my project schedule. The peace of mind is worth every minute I spent setting up the system."

🦆 Quack Fact: Remember your goal isn't perfection - it's progress. Start with good habits now, and you'll thank yourself later. After all, organized ducks are happy ducks!

Canadian Payroll Manual

Payroll Processing Methods

Let's talk about processing your payroll - one of those tasks that can feel overwhelming when you're just starting out. Trust me, payroll has never been my favourite task either. Whether you have one employee or nine, you're facing the same question: Should you go with an online payroll platform or handle it manually?

Here's the thing - while manual payroll might seem more cost-effective at first glance (especially if you only have one or two employees), I almost always recommend going the online route. Why? Because getting your payroll ducks in a row isn't just about cutting cheques - it's about building a reliable system that won't keep you up at night wondering if you calculated CPP correctly or remembered to submit your remittances on time. It's about being able to run payroll from anywhere even if you are sick or travelling.

Even with just one employee, online payroll platforms like QuickBooks Online or Wagepoint can be worth their weight in gold. They automatically calculate deductions, generate T4s, and remind you when payments are due. Yes, there's a monthly fee, but consider it insurance against costly mistakes and time spent double-checking calculations. Plus, as your business grows, you won't need to change systems - your ducks will already be lined up!

Here's an idea. Track how long it will take you to do payroll manually. I mean every task related to payroll including yearend slip preparation and monthly bank reconciliations. Assign a per hour dollar value to your time - what you would be paid if you worked for someone other than yourself? Compare your total labour calculation to the cost of the monthly payroll subscription fee. Does that change your mind on how much a payroll service would cost your business?

That said, I understand some businesses prefer to maintain more direct control or have budget constraints that make manual processing more attractive. Below, I'll walk you through both methods so you can make the best choice for your situation. Remember, whichever method you choose, the key is establishing a consistent routine that becomes second nature.

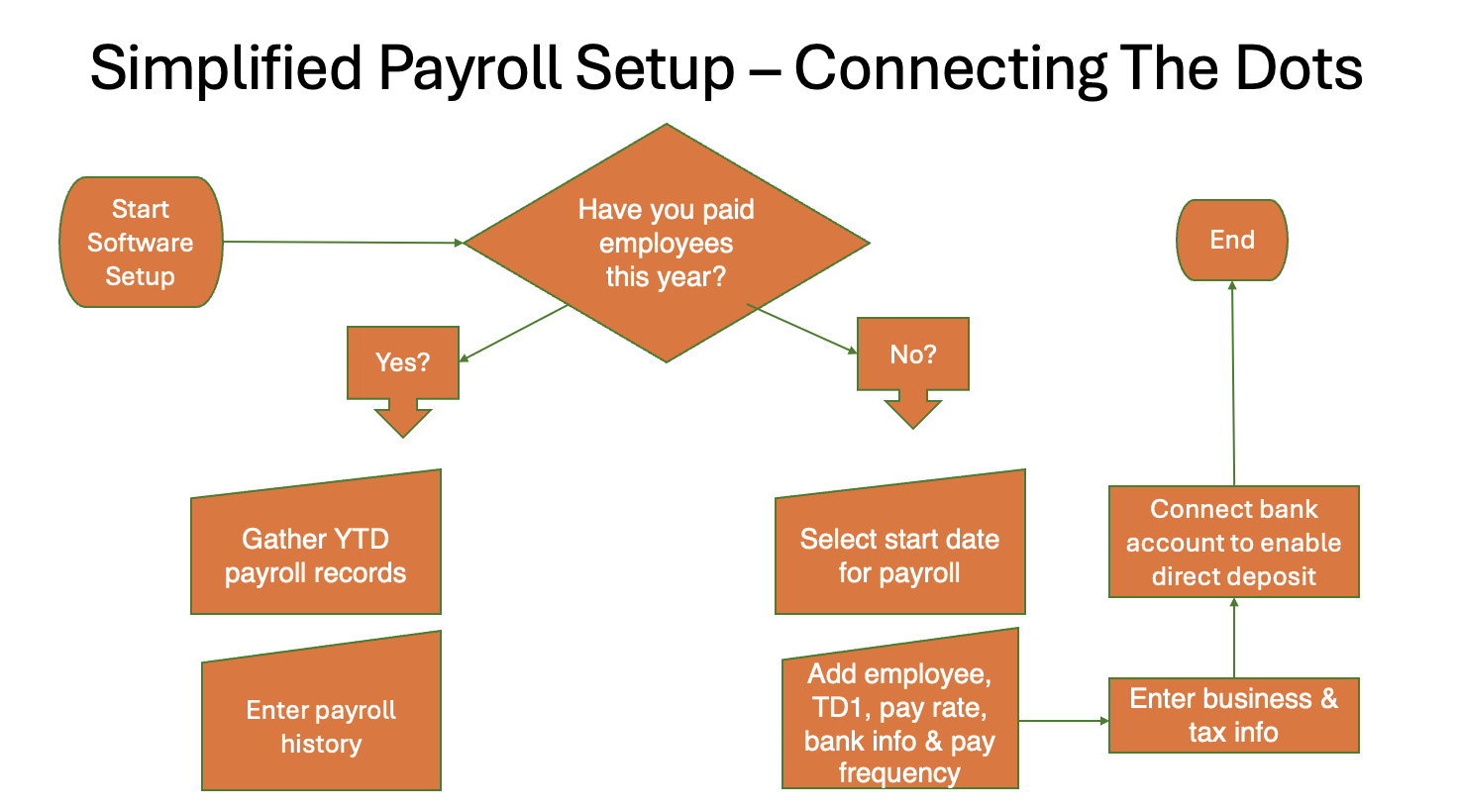

Option 1 Affordable Tech SaaS Payroll Run Routine

This flowchart gives you an idea of the steps to setting up payroll on payroll platforms. It shows how the dots connect in the process.

This flowchart gives you an idea of the steps to setting up payroll on payroll platforms. It shows how the dots connect in the process.Here are some of the key decision points when setting up payroll on an online platform:

- Previous payroll history (if applicable).

- Payment method (direct deposit vs. cheques).

- Pay schedule selection.

- Setup completion verification.

🦆 Quack Fact: Remember this is a basic setup flow just to give you an idea of what automating payroll would look like. Your payroll host provider will give you detailed instructions and specific steps. The goal is to get your 'ducks in a row' with a simple, repeatable process that makes your payroll administration efficient especially if you take advantage of any automation benefits they offer.

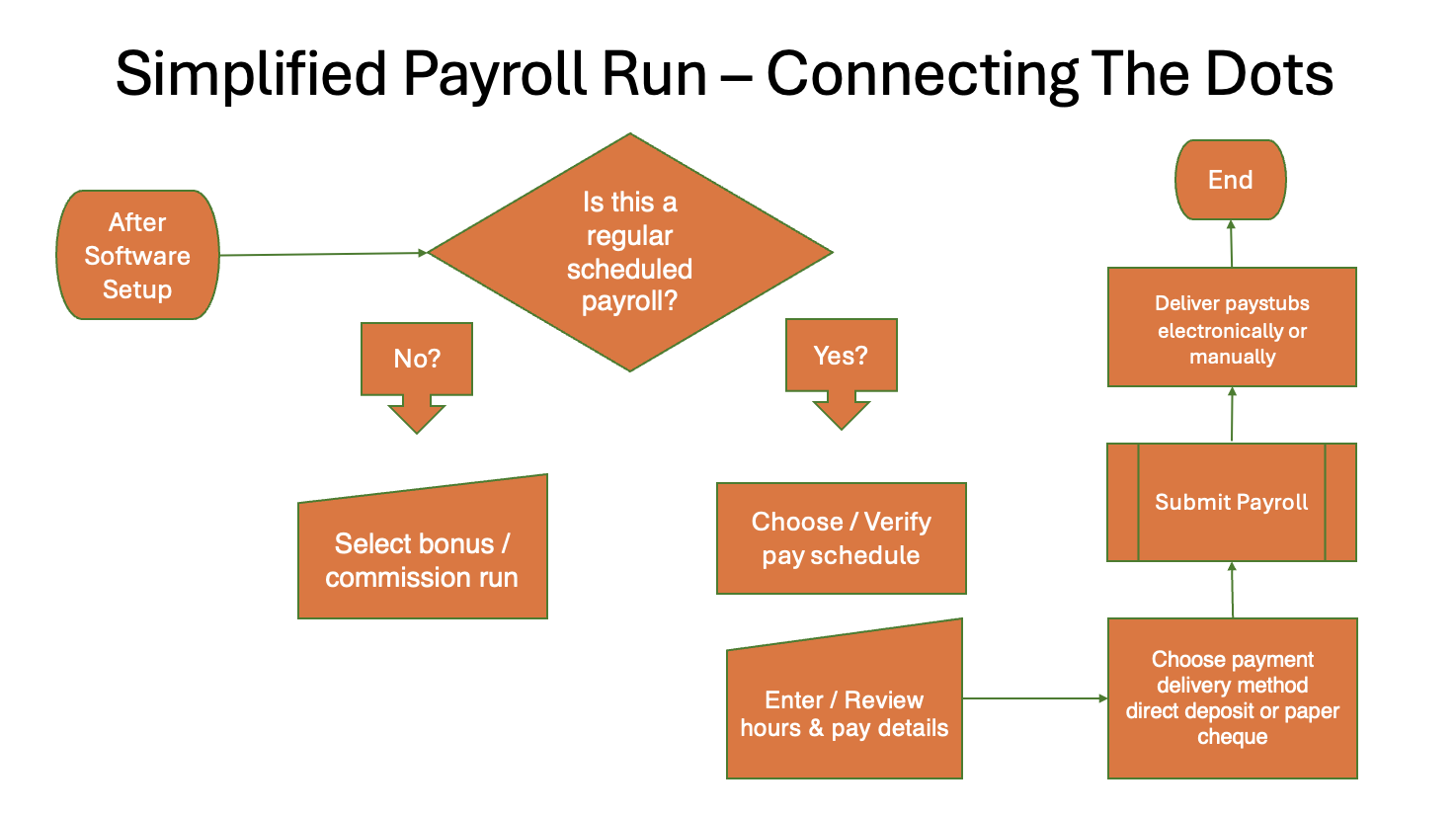

This flowchart gives you a simplified overview of what an online payroll run looks like. It shows how the dots connect in the process.

This flowchart gives you a simplified overview of what an online payroll run looks like. It shows how the dots connect in the process.Here are some of the key decision points when making a payroll run on an online platform:

- Regularly Scheduled vs. Special or Unscheduled Payroll Run - normally you pick the scheduled run.

- Pay Period Verification - After your first run, you usually don't have to change the pay period.

- Accuracy Check - If you want happy employees and no CRA headaches.

- Payment Method - Online payroll makes direct deposits easy.

🦆 Duck Tips:

- Always run payroll 3-5 days before pay date. QBO Canada Payroll sends you a notice telling you when you have to have your payroll ready for processing.

- Keep your payroll calendar handy (you created one right?).

- Double-check hours before submitting.

- Save PDF reports for your records.

🦆 Quack Fact: Remember getting your payroll ducks in a row means establishing a routine. Once you've done it a few times, it becomes second nature. And honestly, I find online payroll takes 95% of the stress around payroll away. The key is consistency and attention to detail.

Option 2 Low-Tech Manual Processing Payroll Run Routine

Your second option is to handle payroll manually for your small business. While most businesses use software these days, there are valid reasons for doing it manually when you're just starting out or have very few employees. You may have budgetary constraints, want to understand the basic payroll calculations, or just like having hands on control of the process.

First, here's what you will need to do payroll manually:

- CRA's Payroll Deductions Tables (T4032).

- A basic Excel spreadsheet (or even a notebook, but Excel makes life easier).

- A calendar marked with payroll and remittance due dates.

- A simple filing system for your records.

Before we jump into the manual payroll, let's be honest about this process. It's more time-consuming than using software, but it helps you understand the basics of payroll calculations. This knowledge will serve you well even if you switch to software later.

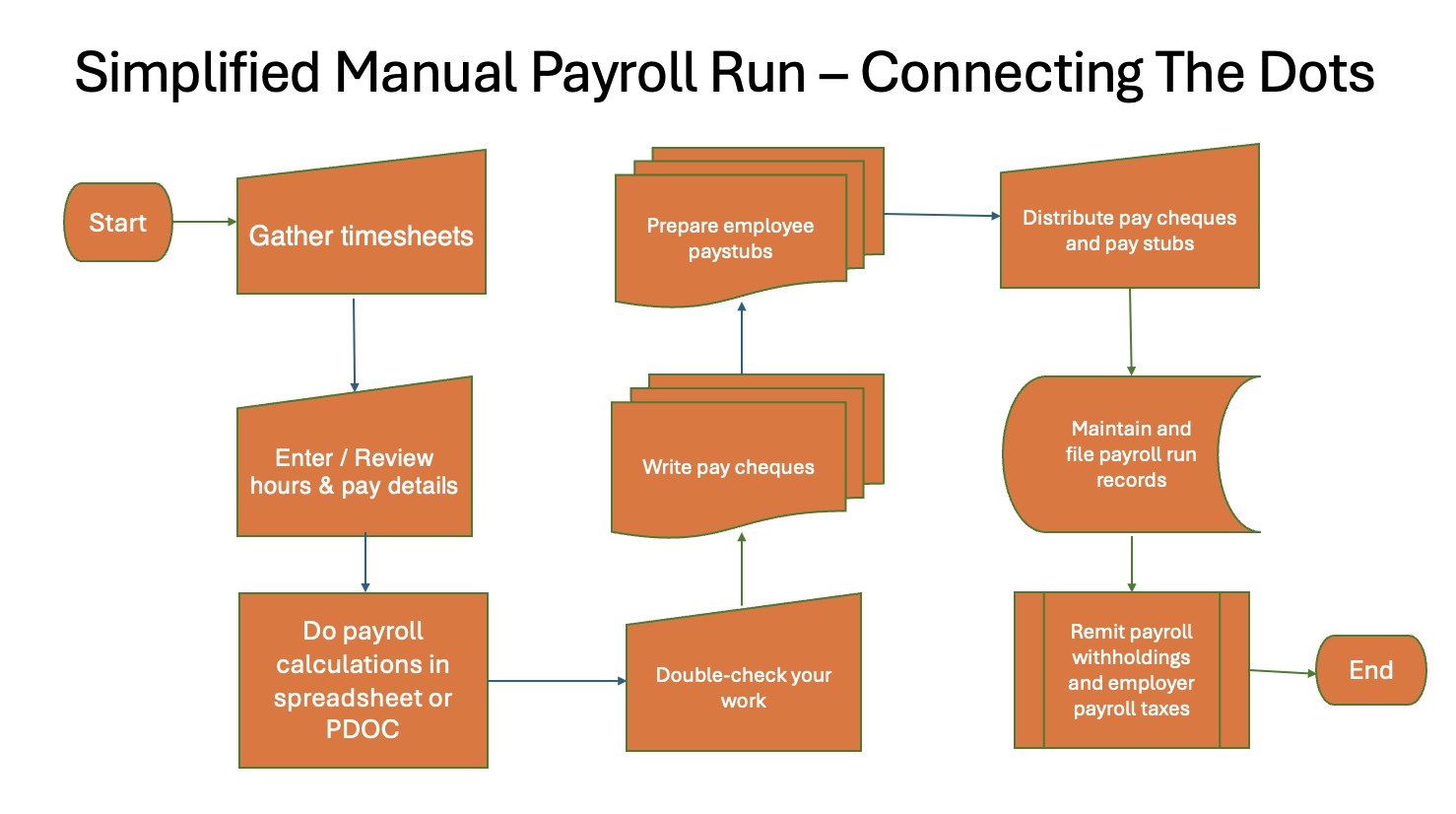

This flowchart gives you a simplified overview of what a manual payroll run looks like. It shows how the dots connect in the process.

This flowchart gives you a simplified overview of what a manual payroll run looks like. It shows how the dots connect in the process.The key to success with manual payroll is establishing a routine. Pick a specific day and time for payroll tasks and stick to it. This becomes your 'payroll habit'.

If you are going to choose this option, you need to be comfortable with the math behind the payroll which includes, regular pay calculations, overtime calculations, statutory holiday pay calculations, vacation pay calculations, and CRA payroll withholdings. You will need to not only have an understanding about the payroll formulas, you also need to understand how everything flows together.

Let's look at an example to help you get a feel for whether this option is a good choice for you.

It's Thursday (your regular payday), and you're processing payroll for your one employee. Here's what needs to happen:

- Gather and verify their hours.

- Calculate their gross pay.

- Apply the correct deduction rates form T4032 Payroll Deduction Tables.

- Double-check your math using PDOC (see sidebar below).

- Write out their paycheques.

- Prepare their pay statements (yes, this is legally required!).

- Record everything in your payroll register.

- File away your payroll records.

Speaking of pay statements - this is often where manual payroll gets a bit sticky. The law requires you to provide employees with a detailed statement showing their earnings and deductions each pay period. With manual payroll, this means either:

- Using pre-printed pay statement forms you can buy from office supply stores

- Creating your own template in Excel (just make sure it includes all required information!)

🦆 Duck Tips: Make it a habit to prepare pay statements while the calculations are fresh in your mind. Don't leave them for later - trust me on this one! Nothing's worse than trying to reconstruct payroll details two days later when an employee asks questions about their deductions.

Set up a payroll routine where you:

- Process payroll the same day each pay period.

- Write cheques and prepare statements in one sitting.

- Keep copies of everything in an organized filing system.

When you first start, you might need to look up every rate and double-check every calculation. But once you get your payroll rhythm going, it becomes more intuitive. You'll develop a feel for when numbers 'look right' or when something seems off.

If you are going manual, I'm going to assume you want to understand the calculations. So let's take a brief look at three connected tabs in an Excel spreadsheet (password protected, of course!) and what they would contain. I caution you, I'm going to use a very simple setup and example.

Tab 1 - Employee Basic Sheet - no sensitive information is kept here. That will be in each individual employee file kept under lock and key when not in use or encrypted and passworded online. Access to any payroll data is restricted and always on as needed basis.

- Employee name

- Position/job title

- Start date

- Pay rate

- Contact information

- Emergency contact

🦆Quack Fact: Remember, the fewer places you store sensitive information, the fewer places you need to protect. Sometimes the simplest solution is the safest!

Tab 2 - Payroll Register (where the magic happens) - For this example, list your sole employee (Susan) in the row immediately under Employee Name. We are calculating the pay for the two-week period ending January 14, 2025. Set up the following columns and enter the data or calculation:

- Employee Name - Susan

- Hours Worked - 75

- Pay Rate - $20

- Regular Pay [calculation (Rate × Hours)] - 75 × $20 = $1,500

- Overtime Hours - 5

- Overtime Rate [calculation (typically 1.5 × Regular Rate)] - 1.5 x hourly rate = $30

- Overtime Pay [calculation (OT Rate × OT Hours)] - 5 × $30 = $150

- Gross Pay [calculation (Regular Pay + Overtime Pay)] - ($1,500 + $150 = $1,650)

- Vacation Pay - [calculation (Gross Pay x 4%)] - (4% x $1650 = $66)

- CPP1 deduction (from T4032 tables) - $94.09

- CPP2 deduction (from T4032 tables) - $0.00

- EI deduction (from T4032 tables) - $28.14

- Income tax (from T4032 tables) - $211.05

- Net Pay [calculation (Gross Pay + Vacation Pay - CPP - EI - IT)] - ($1,650 + $66 - $94.09 - $28.14 - $211.05 = $1,382.72)

- ROE info tracking (hours and insurable earnings)

- Note: there are also employer contributions for CPP ($04.09) and EI ($28.14 x 1.4 = $39.40) that you need to calculate and include with your remittance to CRA. Total remittance for this pay period is ($94.09 x 2) + ($28.14 + $39.40) + $211.05 = $466.77)

Tab 3 - CRA Remittance Tracker - track those government payments!

- Payment due dates - quarterly (April 15th, 2025)

- Source deductions owing - CPP, EI, Tax - $466.77 per pay period if hours and overtime don't change

- Amount paid - $466.77 x 6 pay periods = $2,800.62 for first quarter

- Payment confirmation number

- Running balance

🦆 Duck, Duck, Do! Add a simple dashboard on the first tab showing the next payroll date, the next remittance due date, the current period source deductions. This keeps your key 'must-do' items front and center.

This isn't about creating the world's fanciest spreadsheet, it's about having a reliable system that helps you process payroll consistently and correctly. When you're looking at this every pay period, you want it to be straightforward and stress-free.

CRA's PDOC - A Handy Tool

(But Not Your Complete Solution!)

The CRA's Payroll Deductions Online Calculator (PDOC) is like having a helpful friend at the CRA do quick calculations for you. It's free, it's online, and it's updated with the latest tax rates. Nice, right?

BUT (and this is a big but) - PDOC is just a calculator, not your complete payroll solution. Here's what you need to know:

What PDOC is good for

- Quick calculations of payroll deductions

- Double-checking your manual calculations

- Getting a rough idea of deductions for a new hire

What PDOC is NOT

- Not a replacement for pay stubs (CRA never intended it for this!)

- Not a payroll register

- Not a record-keeping system

WARNING: Some employers print PDOC calculations and use them as pay stubs. Your employees need proper pay stubs that show YTD amounts, vacation pay, and other important details that PDOC doesn't include.

🦆Duck Tip: Make PDOC part of your manual verification process, not your entire process.

Want to try it? Find PDOC here: canada.ca/en/revenue-agency/services/e-services/digital-services-businesses/payroll-deductions-online-calculator.html

Payment Options: Direct Deposit or Paper Cheque

One of the decisions you need to make is what method you will use to distribute your employee's earnings. Here's some information to help you decide whether to go low-tech (paycheques) or affordable tech (the convenience of direct-deposit). I'm going to show my bias and only chat about the pros and cons of direct deposit as you already know about cheques if that is your tried and true workflow. Let's start this off with a tip.

🦆Duck Tip: While both payment methods are legal in Canada, direct deposit can save you time and reduce the risk of lost or stolen cheques.

Pros of Direct Deposit

- Funds are available to employees on payday without fail.

- No lost or stolen cheques to deal with, eliminating associated bank fees.

- Saves time (no printing, signing, or distributing cheques).

- Most payroll software includes this feature.

- Creates an automatic audit trail.

- Employees generally prefer it.

Cons of Direct Deposit

- If you are a self-employed unincorporated work and use a separate personal bank as your business account, it may require upgrading to a business bank account.

- May require additional manual effort if you are doing your payroll manually.

- Initial setup requires collecting banking information.

- There may be a small monthly fee from your bank.

- Need to plan processing time (usually 2-4 business days before payday).

Important Direct Deposit Requirements

Before setting up direct deposit, check that you:

- Have a business bank account that supports direct deposit services.

- Meet any minimum balance requirements your bank may have, if any.

- Double-check all banking information - incorrect details will cause rejection.

- Have sufficient funds in your account at least one business day before processing day.

🦆Duck Tip: Ask your bank or payroll provider about their direct deposit cutoff times. Missing the cutoff could delay your employees' pay. For example, Intuit Payroll Services have very clear notifications regarding the cutoff date.

🦆 Quack Facts

- You can't legally require existing employees to accept direct deposit, but you can make it a condition of employment for new hires.

- Most Canadian banks offer direct deposit services for both personal and business accounts.

- Your payroll software likely includes step-by-step setup instructions.

- Some banks offer fee waivers on direct deposit services (ask about small business packages).

- Going paperless with direct deposit helps reduce your environmental footprint.

For small businesses, I like:

- Offering direct deposit as your primary payment method. Maintain cheque capability as backup but don't advertise this option.

- Including direct deposit authorization (no banking details on the authorization form) in your new hire paperwork that will be kept on file as proof of permission.

- A separate bank form for banking details as you will shredding it or handing it back to the employee after a successful payroll run.

- Using void cheques or direct deposit forms to collect banking information securely. Keep copies of both the void cheque AND the signed direct deposit authorization form in a secure location. The authorization form proves the employee gave permission for the deposits, while the void cheque confirms the banking details.

Handling Employee Banking Information

From a real-world post COVID point of view, what should you do with the employee's banking information once it's been entered into the payroll program for direct deposit if you work from home? It's not a corporate environment with controlled access, and digital storage isn't foolproof either these days.

Thinking practically about small business owners working from home, I'd probably do the following:

Once you've:

1. Entered the banking information into your payroll system.

2. Run at least one successful payroll cycle.

3. Confirmed with the employee that the deposit went through correctly.

You could:

1. Return the void cheque to the employee (documented). (My preference.)

2. OR shred it immediately (documented).

Then simply note in their file:

'Direct deposit authorization form filed on [date]. Banking details verified and entered on [date]. Void cheque returned to employee/shredded on [date]. First successful deposit confirmed [date].'

This approach:

- Keeps proof of authorization.

- Minimizes risk of data theft.

- Acknowledges real-world home office limitations by removing sensitive banking information from your home office.

- Still maintains a clear paper trail.

- Protects both employer and employee.

🦆Duck Tip: Some payroll software lets you scan and attach the authorization form to the employee's digital file. Just make sure your computer is password protected, regularly backed up and you logout if you are just stepping away for a second.

Canadian Payroll Manual

A Short Word About Data Security

The Canadian Payroll Manual's security guidelines are especially relevant for home-based businesses where work and personal space overlap.

So, let's talk about something that's become super relevant with so many of us working from home - keeping your employee information private when your office is also your living space.

Here's the thing. Your dining room table might be your favorite spot to work, but if you share your home with family, roommates, or even have friends dropping by, you need to think twice about where you handle payroll.

Let's Talk About Your Primary Business Device

Here's something to really think about. You need one dedicated device (usually a computer or laptop) that's just for sensitive business stuff. Think of it as your business vault - it's where you handle payroll, banking, taxes, and anything with employee or confidential and sensitive information.

"But I like working from my phone!" 🙄 Sure, you can check email, send invoices, text employees from your phone, but payroll, banking, tax? Those stay on your primary business device. No exceptions.

Why? Because mixing sensitive business data across multiple personal devices is like leaving copies of your house key all over town. One dedicated device = less risk.

Some Home Office Tips

- Set up a dedicated workspace where others can't peek over your shoulder.

- Never leave employee files or payroll info out in shared spaces (or unattended in your dedicated office space).

- Keep a lockable file box for physical documents.

- Use password protection on your computer.

- Position your screen so others can't see it when you're working or better yet, install a privacy screen filter on your computer or devices such as your laptop, tablet or smart phone.

- Log out of payroll software when you step away (even for a quick coffee break!).

🚫 Never:

- Email sensitive employee information.

- Store information on unsecured devices.

- Leave confidential files on your desk.

- Share passwords.

- Skip 2FA 'just this once' (Yes, it's annoying to wait for that code).

- Process payroll from your smart phone.

- Handle sensitive employee (or business) data on personal devices.

✅ Always:

- Use strong passwords (via a reputable password manager - don't try to remember them all yourself!).

- Use 2FA on every business account that offers it (it's like locking your front door - not foolproof but it helps).

- Keep security software updated.

- Keep payroll, banking, and tax work to your primary business device. (You have one right?)

- Think before mixing business and personal devices.

- Lock up physical documents.

- Limit access to authorized personnel.

- Have a data breach response plan.

🦆Quack Fact: Remember your employees trust you with their personal information. Whether you're working from an office downtown or your home office, protecting their privacy isn't just good business - it's your legal obligation!

Setting Yourself Up for Success

The Canadian Payroll Manual has gathered some best practices for micro-business owners.

Banking Best Practices

- Keep at least one extra pay period's worth of funds in your payroll account as a buffer.

- Use a separate bank account for payroll transactions only.

- Set up email alerts for when your payroll account balance drops below a certain threshold.

- Consider scheduling automatic transfers from your operating account to your payroll account.

- Review bank statements within 30 days of receipt.

- Keep digital copies of bank reconciliations for 7years.

Reconciling Your Payroll Bank Account

Now that you've set up your banking practices, let's talk about keeping those accounts balanced. Think of it as making sure all your ducks are accounted for at the end of each month.

One of the most important habits you can develop is regularly reconciling your payroll bank account (as well as your operating bank account).

What to Look For If You Pay By Direct Deposit:

- Direct deposits. (Did they all process successfully?)

- Any manual adjustments or corrections.

- Bank fees.

- Rejected/returned payments.

- NSF (Non-sufficient funds) notifications.

- Account balance matches your payroll register.

What to Look For If You Pay By Cheque:

- Uncashed paycheques. (Has everyone cashed their cheques?)

- Void or cancelled payments. (Are they properly recorded?)

- Stale-dated cheque.s (Cheques older than 6 months)

- Stop payments. (Have you recorded any?)

🦆 Duck Tip: Set a monthly reminder to reconcile your payroll account. It's much easier to fix issues when they're fresh! Also, most of these problem goes away if you have direct deposit.

🦆 Another Duck Tip: Still using paper cheques? Consider making direct deposit a condition of employment for new hires. Your future self will thank you!

Documentation Habits

- Create a simple checklist for each pay run (I have provided a simple checklist in the next section for you to customize to your business as you refine your routine).

- Keep a payroll diary to note any special situations (like advances or corrections).

- File all payroll-related emails in a dedicated folder.

- Store sensitive employee information securely (both digital and paper records).

Common Small Business Pitfalls to Avoid

- Don't forget to account for statutory holidays when scheduling payroll processing.

- Watch out for bank processing times, especially around holidays.

- Be careful with manual calculations - even small errors compound quickly. There's nothing worse than dealing a PIER (Pensionable and Insurable Earnings Review) report from the CRA. Ugh! PIER reports from CRA happen when your reported earnings don't match your deductions. Common causes can include incorrect calculation of CPP/EI deductions, missing or late remittances, errors in T4 reporting.

Time-Saving Tips

- Process payroll at the same time on the same day - make it a ritual.

- Keep employee information sheets easily accessible but still private and secure. Protect employee privacy by:

- Using password protection for digital files,

- Locking physical documents in a secure cabinet,

- Limiting access to payroll information to only those who need it,

- Never sharing employee information via unsecured email. - Have a backup person trained for emergencies. If you are a small business owner on your own, you could consider your bookkeeper, your spouse, a trusted friend, and eventually one of your employees.

- Set up a quarterly payroll review meeting with yourself to catch any issues early.

Emergency Preparedness

- Keep these numbers easily accessible:

- Your payroll software provider's support number

- CRA business inquiries (1-800-959-5525)

- Your bank's business support line

- Your backup person's contact information - Have a backup plan for if your internet goes down on payroll day.

- Keep copies of essential forms both digitally and in print.

🦆 Quack Facts: Remember the key to an stress-free payroll is creating habits and sticking to them. No more scrambling at the last minute or wondering if you've missed something important. Seriously consider having a separate payroll account. It helps manage the variability in employee payments and additional pay periods in a month. When your ducks are in a row, payroll becomes just another routine task!

Your Pay Run Checklist

Before You Start Each Pay Run

- Gather time records and approve overtime

- Review any changes (salary updates, benefits, garnishments)

- Check statutory holiday eligibility

- Note: TD1 changes are covered in Section 1

Processing Your Payroll

- Calculate regular hours/salary

- Add variable pay (commissions, bonuses)

- Apply deductions in correct order

- Double-check your calculations

- Note: Benefit calculations are covered in detail under 'When to Tax Employee Perks'

Finalizing and Distributing Pay

- Review for accuracy

- Process direct deposits/print cheques

- Distribute pay stubs

- File documentation

- Note: Cash handling procedures are detailed in 'Handling Employee Cash Pay'

Post-Payroll Tasks

- Record journal entries

- Update year-to-date totals

- Prepare remittance amounts

- Note: Remittance procedures are covered in Section 3

Top 5 Common Payroll Calculation Mistakes

Let's look at the most common payroll calculation mistakes so you can avoid them:

Overtime Pay Miscalculations

- The Mistake: Using regular hourly rate instead of 1.5x or 2x for overtime hours.

- The Fix: Check your provincial labour standards for overtime rates and when they apply.

- 🦆 Getting Your Ducks Aligned: Most payroll software calculates this automatically - another reason to ditch manual calculations!

Statutory Holiday Pay Errors

- The Mistake: Not calculating average daily wage correctly or missing eligibility requirements.

- The Fix: Review your province's holiday pay formula and eligibility rules.

- 🦆 Getting Your Ducks Aligned: Keep a simple spreadsheet tracking statutory holiday eligibility for each employee.

Vacation Pay Problems

- The Mistake: Using wrong percentage or not including all eligible earnings in calculations.

- The Fix: Confirm your provincial requirements (usually 4% for under 5 years, 6% for 5+ years but check).

- 🦆 Getting Your Ducks Aligned: Include commissions and bonuses in vacation pay calculations - not just regular wages!

Worker Classification Confusion

- The Mistake: Treating employees as contractors (or vice versa).

- The Fix: Use CRA's guidelines to determine proper classification.

- 🦆 Getting Your Ducks Aligned: When in doubt, err on the side of employee classification - it's safer!

Remittance Mistakes

- The Mistake: Incorrect calculation of CPP, EI, or income tax deductions.

- The Fix: Use CRA's Payroll Deductions Online Calculator to verify your calculations.

- 🦆 Getting Your Ducks Aligned: Most of these mistakes disappear when you use payroll software that automatically calculates deductions.

Remember, these mistakes can be costly - both in terms of money and time spent fixing them. When in doubt, double-check your calculations or consult a payroll professional.

🦆Duck Dynasty: The National Payroll Institute (formerly known as the Canadian Payroll Association) is Canada's leading payroll authority. While they tend to keep their best resources behind a membership paywall, their website (payroll.ca) allows non-members to attend their webinars for a reasonable fee. They're worth checking occasionally, especially if you're considering getting more formal payroll training for yourself or future employees. At the very least, keep an eye on their 'Late Breaking Payroll News' section.

Building Good Habits

- Create a payroll calendar

- Set up reminders

- Establish review procedures

- Keep emergency contacts handy

Start transforming your payroll from chaos to clockwork by looking at some special topics for a more in-depth view!

- When to Tax Employee Perks and Benefits

- Vehicle Allowances & Reimbursements

- Handling Employee Cash Pay Cheques Properly

The Bottom Line

Look, I get it - payroll seems overwhelming at first. Every new employer feels that way. But here's the thing: payroll isn't rocket science. It only feels like it when you start out. Yes, there are rules to follow and deadlines to meet, but with a good system in place, it becomes just another business routine.

In Part 1, we've covered the essential groundwork: figuring out if your worker is an employee or contractor, getting your CRA payroll account set up, understanding the basics of different payment methods, and making sure you've got proper employment agreements in place. For those of you with remote workers, we've even sorted out which provincial rules apply.

We've also tackled the nuts and bolts of running your regular payroll - from setting up your payroll cycle and rhythm to processing those pay runs efficiently. You now have practical tools like the pay run checklist and know how to handle things like taxable benefits and vehicle allowances.

In Part 2, we'll focus on your ongoing obligations as an employer - specifically around CRA deadlines and reporting requirements. But for now, pat yourself on the back. You've learned the basics of both hiring and paying employees properly.

Remember, at this stage of your business, you don't need to be a payroll expert - you just need to be organized and consistent. Keep this manual handy, and let's move on to CRA's requirements in Part 2.

JUMP TO >> Part 2 - Payroll Compliance and Reporting

RETURN TO >> Table of Contents