T4A Information Slips

Applies To Contract For Service Relationships | Independent Contractor Status

By L.Kenway BComm CPB Retired

Edited May 4, 2024 | Updated March 16, 2024 | Originally published on Bookkeeping-Essentials.com in 2014

WHAT'S IN THIS ARTICLE

Introduction | CRA Classification Rules | T4A Tax Reporting | Self-Employment Taxes & WCB | Retiring Allowances | Before You Hire a Subcontractor | T4A Requirements | FAQ About Independent Contractors

NEXT IN SERIES >> Understanding Your Investment Tax Slips

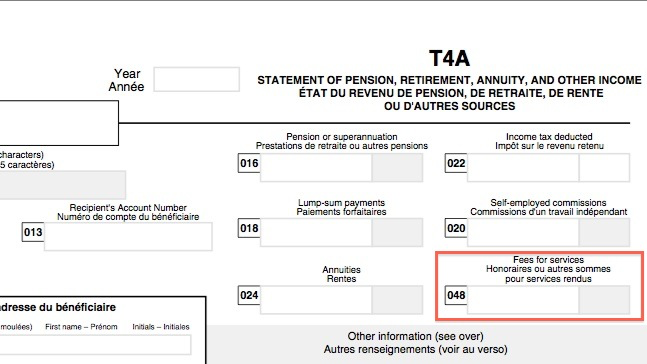

T4A Slip Box 048 For Subcontractor Services

Annual Deadline Last Day of February

T4A is for Non-Construction Self-Employed Contractors

T4A is for Non-Construction Self-Employed ContractorsThere are always lots of questions about T4A Information slips as they are where Canadian non-construction subcontractor activity is reported. It can be extremely costly to misclassify a worker ... so you want to get this right from the start.

Let's remove some of confusion by discussing:

- Canadian T4A Subcontracting Reporting Requirements

- T4A Tax Reporting Forms And Deadlines

- Subcontracting Self-Employment Taxes | Workers' Compensation

- Where to report retiring allowances

- Frequently Asked Questions About Hiring Independent Contractors

CRA Classification Rules

Canada Revenue Agency has rules they use to determine whether you have correctly classified your employees and contractors.

Over the years the courts have determined that four tests need to be met to determine employment status:

- the control test;

- the integration test;

- the economic reality test; and

- the specific results rest.

Find out more about these tests in the following articles:

- CRA checklist on how employment status is determined

- Is your worker an employee or self-employed? Why it's important to get it right.

Tax Reporting T4A Information Slips and Deadlines

T4A Information Slip Box 048 Fees for Services

T4A Information Slip Box 048 Fees for ServicesReporting Threshold over $500

- T4A slip to subcontractor services deadline February 28

- T5018 to construction subcontractors deadline February 28

- T4A Summary to CRA deadline February 28

- T4A-NR to cross border contractors deadline February 28

- Form 1009MISC US citizen contractors in Canada deadline January 31

Click here to determine whether you need to issue a T4A slip or a T5018 slip.

T4A subcontractor business services examples: bookkeeper, accountant, lawyer, janitor. DO NOT REPORT personal services such as hair salon service or dental work.

T5018 construction services examples: construction of buildings, roads, and bridge.

Subcontracting Self-Employment Taxes & Workers' Compensation in Canada

Independent contractors are responsible for their self-employment taxes. This is not the responsibility of the businesses hiring you.

Independent contractors are responsible for their self-employment taxes. This is not the responsibility of the businesses hiring you.From the Viewpoint of the Business Owner

Canadian subcontracting payments is a frequently audited by CRA.

Payments you make to a subcontractor are NOT pensionable or insurable by your business. They do NOT attract CPP contributions or EI premiums for your business.

This means, as a small business owner, your payments to a subcontractor do NOT attract the source deductions income tax withholding (ITW), employment insurance premiums (EI) or Canada pension plan contributions (CPP) as they are not in an employer-employee relationship with you.

ASSESS BUSINESS RISK

During an audit, if CRA determines the individual is really an employee disguised as subcontractor, the employer now becomes responsible for both the employee and employer contributions along with any penalties and interest assessed. CYA and get it in writing that the person is self-employed people!

From the Viewpoint of the Contractor

Independent contractors are responsible for calculating and remitting their self-employment taxes. This is not the responsibility of the businesses hiring you.

If you are an independent contractor in the construction industry, make sure you become familiar with workers' compensation requirements. Here are links to a few provinces requirements ...

Retiring Allowances Are Reported On T4 Slips

Retiring allowances must be reported on an employee's T4 slip. If you were in business before 2010, you are probably saying WHAT!!! I thought they were reported on the T4A information slip.

Well you aren't wrong ... it's just that things change. Retiring allowances used to be reported on the T4A slip. The change in reporting was effective January 1, 2011 for the 2010 tax year.

The retiring allowance is now reported in the "other information" area and the codes to use will be:

Code 66, Eligible retiring allowances;

Code 67, Non-eligible retiring allowances;

Code 68, Status Indian (exempt income) - eligible retiring allowances; and

Code 69, Status Indian (exempt income) - non-eligible retiring allowances.

Retiring allowances are not considered to be pensionable or insurable earnings and are NOT to be included in Box 14.

You will still report amounts pertaining to 2009 and earlier on T4A slips.

This change was done in conjunction with the 2010 redesign of the T4A slip.

The "back" of the current T4A slip has a list of all the applicable categories by box number that are taxable along with what line of the tax return the information tax slip / box should be reported on.

BEFORE You Hire A Subcontractor ...

Even though the CRA Guide RC4157 states it "is not assessing penalties for failure relating to completion of box 048", completing the T4A is still a requirement (and has been since 1998 I believe). Make it easy on yourself and implement the following practices:

1. Create a form they must complete to capture their legal business name, SIN or BN and address PRIOR to hiring them ... so you can actually issue a T4A slip if necessary.

2. Ask for a copy of their business license for your file. It helps provide proof you are not hiring an employee.

3. NEVER pay a subcontractor if they haven't given you a legitimate invoice / business receipt. Again, it provides proof you are not in an employer-employee working relationship.

It is recommended you receive an invoice from your subcontractor which contains the following information to keep an auditor happy:

- their personal name and/or their business name if applicable ... this means the invoice should state the legal name they are doing business under

- their address ... of course

- their GST/HST number if applicable ... if there is no GST/HST number, don't pay any sales tax charged

Canadian T4A Subcontracting Reporting Requirements

If you pay a contractor $500 or more for their services (non-construction), regulations state you must issue a T4A information slip. The amount should NOT include GST HST paid to the recipient.

The way the rule is written in the tax act, a T4A should be issued for any individual or company that you pay for any fee or service. This excludes the buying of physical goods and supplies. We are only talking about services here. Any payments to sub contractors OUTSIDE the construction industry are reported on T4a slips.

Fees for services generally relate to any expenses you, as a small business owner, paid to a person to provide a service that is outside of the employer-employee relationship. It includes payments paid between sole proprietor businesses and corporations.

Box 48 Fees for services is found on the T4A information slip. The amount is entered on the appropriate self-employment line (lines 13499 to 14300 on T1) on a subcontractor's income tax return. Self employment income is not the same as employment income which is reported on a T4 slip and appears on line 10100 of a T1.

More >> You might be wondering why can't I report it on line 10400 Other Employment Income, it's simpler?

Sidebar: Self-employed commissions are reported in box 20 of T4A information slips. Construction services are reported on T5018 Statement of Contract Payments.

T4A slip preparation will require the subcontractor's SIN (social insurance number) if they are operating as a sole proprietor and aren't a GST/HST registrant ... or their BN (business number) if they are incorporated ... and/or the GST/HST registration number for any GST/HST registrant.

FAQ About Hiring Independent Contractors

How do you define an Independent Contractor in Canada?

How do you define an Independent Contractor in Canada?

An Independent Contractor is a person paid to provide a service that is outside of the employer-employee relationship.

Why would I want a written agreement with an independent contractor? What would I include in the written agreement?

Why would I want a written agreement with an independent contractor? What would I include in the written agreement?

The simple answer is to avoid misclassification risk. As an independent contractor is their own boss, the written agreement should lay out the terms of the engagement including professional liability and dispute resolution. To mitigate "misclassification of a worker" risk, clearly discuss and include a section for each of CRA's criteria for determining work status.

The contract should not be a template but one you customize for each written agreement you enter into. Robert Woods, tax lawyer, author and blogger says the written agreement should cover who has "the right to control the manner in which services are performed. Consider obligating the employer to pay for a finished product." ... where the company, not the independent contractor, details the FINAL product specifications.

As a small business owner, I would include a requirement that payment will be made on presentation of invoice(s) which is preferably not billed by the hour, week or month but on progress of contract completion.

It's always a good idea to write the contract in tandem with a lawyer ... or at a minimum, have a lawyer review what you have drawn up.

Does CRA enforce T4A Box 48 regulations during payroll audits?

Does CRA enforce T4A Box 48 regulations during payroll audits?

The most recent CRA Guide RC4157 states it "is not assessing penalties for failure relating to completion of box 048".

The November 2016 Final Report for Audit, Evaluation, and Risk Branch noted that "the CRA guide states the CRA is not assessing penalties for failing to complete box 048, or reporting payments made by a person for "fees, commissions or other amounts for services". Some employers interpret this to mean that they are not obliged to complete this box on the T4A slip. There are two consequences to this interpretation: first, employers may not capture the Social Insurance Number (SIN) or other relevant identifier information of the worker; and second, ECA auditors may have trouble gathering the information necessary to complete the slips. These findings suggest that the current enforcement strategy for box 048 T4A slips is not cost effective."

The report recommended "employers’ obligations surrounding the filing of box 048 T4A slip" be clarified; and that "more cost effective methods to enforce T4A slip reporting compliance" be adopted.

Expect this to change in the near future as CRA undertook an online survey in 2024 about businesses' readiness to comply with the Fee For Service reporting requirements.

What are the reporting requirements if a US citizen is contracted by a Canadian company?

What are the reporting requirements if a US citizen is contracted by a Canadian company?

If you are a Canadian company and hire a US citizen under independent contractor rules, you will need to send the IRS Form 1099-MISC.

To do this, you will need the US citizen's social security number.

Don't forget to give the US citizen a copy of the IRS Form 1099-MISC for their records to use for their income tax preparation.

You can find a copy of the IRS Form 1099-MISC at www.irs.gov/pub/irs-pdf/f1099msc.pdf ... BUT you can't file the online form as it is not scannable.

You order the form from IRS free of charge. If you are located in the U.S., contact the IRS toll free at 1-800-TAX-FORM.

However, if you are in Canada, alas the toll free number does not work. You will have to telephone or FAX the Philadelphia Service Center office for assistance at:

Tel: 215-516-2000 (not toll-free) or Fax: 215-516-2555

What are the penalties for misclassifying a worker as an independent contractor?

What are the penalties for misclassifying a worker as an independent contractor?

Penalties of 10% on income tax, CPP and EI which are not withheld on the first failure to withhold, with the penalty potentially increasing to 20% for repeated offences, as well as non-deductible interest on the amounts owing.

Both the employee and the employer’s portion of CPP and EI plus penalties and interest are born by the employer.

Late filing penalties on the failure to file T4 Statement of Earnings slips.

What are the requirement for cross border contractors?

What are the requirement for cross border contractors?

I'm not an expert on cross border contractors so I'd like to respond as follows:

A September 14th, 2011 article at the Canadian Tax Law Blog (www.canadiantaxlawblog.com) discussed CRA's technical interpretation of Article V(9)(b) where CRA confirmed " that multiple non-resident parties to a subcontracting agreement may be deemed to have permanent establishments in Canada".

Two great articles you will want to read if you hired foreign contractors. They will be bring you up to speed on your Canadian and U.S. reporting and withholding obligations. These are older articles so please talk to your accountant for customized advise suitable for your situation. Use the information in the articles for the talking points you wish to discuss.

Canadian companies using independent contractors in the U.S. by Philippe Brideau, CRA spokesperon.

Tax Bulletin: Tax consequences for Canadians doing business in the U.S. by BDO January 2021

Do you record GST HST on the amount paid to a subcontractor in box 48 Fees for Services on the T4a tax slip?

Do you record GST HST on the amount paid to a subcontractor in box 48 Fees for Services on the T4a tax slip?

The amount included in box 48 on the T4A should exclude GST HST paid to the recipient.

If I am self-employed, who issues my T4A?

If I am self-employed, who issues my T4A?

It is the business owner's responsibility to issue your T4A slip but many don't as the CRA is currently not assessing penalties for failure to complete box 048 of a T4A slip.

You can still do your books without T4A information slips as you should have been issuing invoices that the business made payment on. If you do receive any T4A slips, make sure when preparing your Schedule T2125 that you do not double count your income.

In most tax software, once you input your T4A slip, the program will add it to your Schedule T2125 Gross Sales. Check that the T4A income is also not included in the income you manually entered from your own Profit and Loss statement.

RECONCILING THE T4A SLIPS TO YOUR SUPPLIER INVOICES

Ideally, you should reconcile your T4A slips to the invoices from that business for the year. The amounts should match. If they don't, you should call the business and request backup for the amount reported so you can determine where the problem lies. If the T4A slips turn out to be incorrect, the business would amend the slip and resubmit it to CRA. If your bookkeeping is the source of the issue, you will adjust your books to rectify the problem.