- Essential Bookkeeping Habits For Audit Ready Books in Canada

- Tax Audits in Canada

- CRA Subcontracting Reporting Requirements

CRA Subcontracting Reporting Requirements

Applies To Contract For Service Relationships | Independent Contractor Status

By L.Kenway BComm CPB Retired

Updated July 27, 2024 | Edited May 4, 2024 | Originally published on Bookkeeping-Essentials.com in 2014

WHAT'S IN THIS ARTICLE

Classification? | NEW*Regulation 105 | T5018 or T4A? | Line 10400? | Schedule 8 CPP | Reporting on Financials? | Written Agreement? | FAQ

NEXT IN SERIES >> T4A Information Slips

Subcontractor Tax Form Filing Deadlines

- T4A - Annually Last Day Of February

- T5018 - Six Months After The End Of The Reporting Period You Have Chosen

T5018 is for Independent Contractors in Construction

T5018 is for Independent Contractors in ConstructionWhat are CRA subcontracting reporting requirements? It seems like a straight forward question ... but it can be confusing to figure out. Your first step is to ensure the worker has not been misclassified.

This chat will cover:

- NEW* Are subcontractor fees paid to a nonresident subject to 15% withholding tax?

- Employee or Self-Employed Classification ... It's Important

- Do you use a T5018 slip or T4A slip?

- Can you report subcontract amounts on Line 10400 - Other Employment Income?

- How do I report subcontractors expenses on the financial statements?

- Do You Need a Written Agreement?

I also have a chat about issues surrounding T4A slips you may want to check out:

- What information should you collect BEFORE you hire a subcontractor?

- What are CRA's T4A subcontracting reporting requirements?

CRA Changes Position On Subcontractor Fees For Service Reimbursed To Nonresidents

July 2024

CRA is reversing its position published in 2008 (Views 2008‑0297161E5 September 16, 2009) on reimbursements of subcontractor fee. Effective October 1, 2024, Regulation 105's 15% withholding tax for non-Canadian residents applies to fees paid by a Canadian resident corporation to a nonresident corporation as a reimbursement of subcontractor fees for services performed in Canada.

The 2008 position remains that reimbursement of travel and meal expenses are not subject to Regulation 105 withholding tax.

Takeaways

- EY recommends all non-resident contractor agreements are reviewed and amended to clearly state who will be responsible for the withholding tax liability.

- EY footnote 7 states, "The 2008 CRA document also notes that reimbursed subcontractor fees should be included in box 18 (Gross income) of Form T4A‑NR, Statement of Fees, Commissions, or Other Amounts Paid to Non-Residents for Services Rendered in Canada, issued to the nonresident. Travel expenses are reported separately on Form T4A‑NR."

More >> EY CRA announces a change in position with respect to Regulation 105 withholding tax on subcontractor fees

More >> pwc Tax Insights: Recent developments for Regulation 105 withholding (subcontractor fee reimbursements and waivers)

More >> Tax Interpretations 28 May 2024 External T.I. 2022-0943242E5 - Regulation 105

Everyone Has To Save For Retirement

Even the Self-Employed and Small Business Owners

Start Early To Cushion Future Setbacks

Employee or Self-Employed Classification ... It's Important

CRA Employment Status Determination

Employee payroll tax rates and benefits are more costly to an employer, so it can be advantageous to hire an independent contractor instead of an employee ... that's why it is a frequently audited area.

You need to be aware how CRA approaches and determines a person's employment status. CRA takes this seriously "because employment status directly affects a person's entitlement to employment insurance benefits under the Employment Insurance Act. It can also have an impact on how a worker is treated under other legislation such as the Canada Pension Plan and the Income Tax Act."

The Canada Pension Plan (CPP) and the Employment Insurance Act (EIA) do not define what a contract of employment is; therefore where the contract was formed becomes the basis for determination as provincial and territorial common laws kick in. The courts have established principles that CRA relies on to determine the status of a worker.

A business owner and a worker are free to setup either an employee or self-employed relationship. They CANNOT cherry pick aspects from both. Make your choice and ensure the contract reflects the appropriate terms and conditions of the working relationship to stay on the right side of established common law.

The CRA is permitted and entitled to rely on any available evidence in court to try and establish that the written agreement does not reflect the agreement when submission of oral testimony or additional source documents presented contradicts the terms of the written agreement.

CRA Subcontractor Reporting Requirements

What Is The Difference Between T5018 And T4A slips?

Definition of Construction and Non-Construction Services

If an employer hires someone else to do the work on their behalf (maybe you?), this would be considered subcontracting. This means the employer may need to issue a T4A or T5018 slip.

CRA’s definition of construction encompasses buildings, roads, and bridges. Construction subcontracting services are reported on a T5018.

Subcontractors who provide non-construction services such as janitorial work, bookkeeping, tech services are not reportable on the T5018. Non-construction services are reported on the T4A slip box 048.

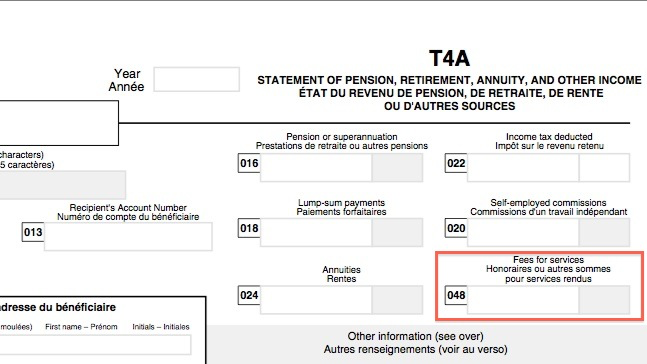

T4A Slip Box 048 Fees for Service

T4A Slip Box 048 Fees For Service (Non-Construction)

T4A Slip Box 048 Fees For Service (Non-Construction)From The View Point Of The Business Owner

Let's start with why the confusion arose. In 2010, CRA redesigned the T4A slip. One of the changes was the addition of box 048 Fees for services. Previously these fees were usually reported in box 028 Other income.

Box 048 is where you report fees paid for subcontracting non-construction SERVICE payments totalling over $500 in one year to one supplier / vendor. The fees should exclude GST/HST.

Examples are fees paid to your freelance bookkeeper, accountant and lawyer or janitor. Service fees for tutors or examiners for educational institutions would also be reported here. You should NOT include fees paid for personal non-business related payments to your dentist or hair dresser or the like.

From The View Point Of The Self-Employed Worker

What to do If You received a T4A slip

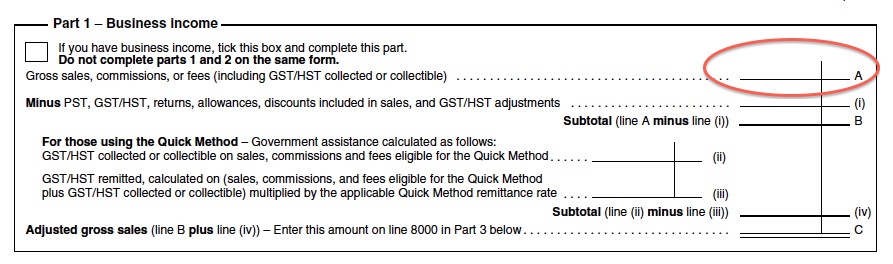

T4A and T5018 amounts flow through to T1 Schedule T2125

T4A and T5018 amounts flow through to T1 Schedule T2125If you received a T4A slip with an amount in box 048, you enter it into your tax program like any other tax slip. The tax program should automatically report it on your T2125 Schedule Part 1, Line A Sales, commissions, or fees. (See the picture above.) The amounts reported on the T2125 Schedule flow through to line 13500 of your T1 jacket.

Normally, the tax program adds a line like "Income reported on T4A" to the section so you can clearly see that it has been reported. This helps to ensure you don't double count your income. If the amount pulls through, adjust the business income you have input and/or imported to reflect this.

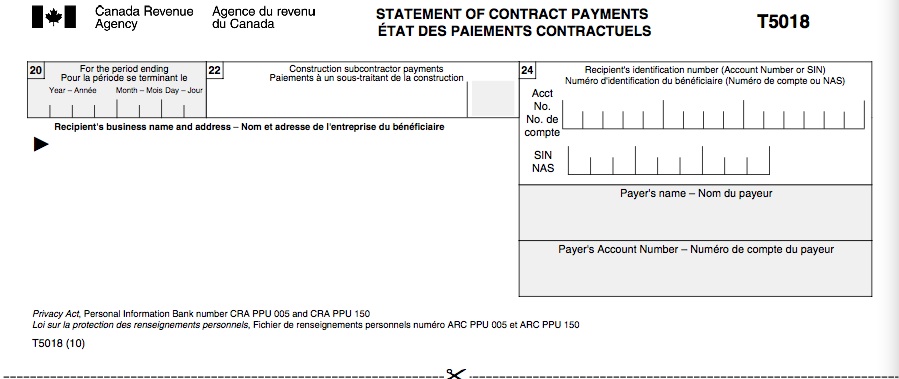

T5018 Statement of Contract Payments

T5018 Statement Of Contract Payments

T5018 Statement Of Contract PaymentsFrom The Viewpoint of The Construction Contractor

The T5018 Statement of Contract Payments reports to CRA the amounts you paid for subcontractor construction services. It is a tax deduction to the construction contractor.

The slip is for CRA informational purposes only on payments over $500 before sales tax to a subcontractor that provided construction services if your primary source of business income is more than 50% from construction activities. Unlike the T4A, the total in box 22 might include GST/HST/PST amounts.

TIPS

- You must report all the amounts in Canadian dollars.

- You have to submit a separate T5018 Summary for each payroll account.

- Do not change your address using the T5018 Summary.

- If you have no reports to amount, simply do not file a T5018 Summary.

YIKES YOU DIDN'T ISSUE THE REQUIRED T5018 SLIPS?

Here's what you need to do.

If you did not send out the required T5018 slips, you are still not off the hook. CRA requires you send them:

- A line-by-line listing in columnar format of all the payments you made to subcontractors. The list needs to include everything you would have been required to provide on a T5018 slip.

- A printout summarizing all the information that would have been reported on the T5018 Summary including total payments to each contractor, the total number of subcontractors, as well as an authorized signature of the person CRA can contact if they have more information.

From The Viewpoint of The Subcontract Worker

What To Do If You Received A T5018

The T5018 Statement of Contract Payments reports to CRA the income you made as a subcontractor. It is taxable income.

The reported figures represent amounts you have invoiced a construction contractor. This means you should be able to reconcile it back to your invoices issued. If you are not a GST/HST registrant, it will not include the sales tax. If you are a GST/HST registrant, it will include the sales tax.

You need to report your T5018 income on your personal tax return (T1), Schedule T2125 - Statement of Business Activities, Part 1, Line A Sales, commissions, or fees. (See picture above.)

TIP

- Be sure you are not counting the income twice in this section as the income should already be accounted for in your books when you sent out your invoices.

If you are a GST/HST registrant, you would have remitted the sales tax collected to CRA on a regular pre-determined basis.

The sales tax you remitted to CRA was eligible to be reduced by eligible input tax credits ... GST/HST you paid to purchase supplies for your business. I explain input tax credits in my article on GST/HST.

CRA Subcontractor Reporting Requirements

Can you report Subcontract amounts on Line 10400 - Other Employment Income?

If you don't have any expenses to offset your T4A slip or T5018 slip income, do you still have to prepare a T2125 Schedule, or can you just report the income on line 10400?

I want to point out that while you may decide to not claim any expenses, the T2125 form shows the expenses you are legally allowed to claim as deductions to reduce your taxable income.

The answer would be NO to line 10400 reporting unless the amount earned is less than $3500. Why $3500? Once you earn over $3500, you have to declare the income as self-employed so that your CPP contributions can be calculated and assessed. Amounts under $3500 can be report as other employment income.

Line 10400 is for employment income not reported on T4 slips. Usually this is related income like occasional earnings, tips, group term life-insurance premiums paid by an employer, GST/HST rebates claimed in the prior year for employment expenses, clergy housing allowances, etc.

CRA always reviews any amounts reported on line 10400 because, unlike Schedule T2125 - Statement of Business Activities, it does not trigger CPP contributions. The T2125 Schedule triggers Schedule 8 to calculate your CPP premiums owing on net income earned.

That means frequent eBay sellers should be reporting their activities on a T2125 Schedule.

Your other option if you have no expenses to claim relating to the income on the slips is to manually report the income on line 13000 or line 13500. The problem with this is you will now have to paper file your return. It is so much simpler to just let the numbers flow through the T2125 Schedule to ensure it gets reported correctly and that the related CPP premiums are calculated.

Schedule 8 CPP Contributions on Self-Employment or Other Earnings

With regards to CPP ... self-employed individuals pay both parts of the CPP premiums ... the employee and employer portions.

Your CPP contributions owing are calculated on Schedule 8 CPP Contributions on Self-Employment or Other Earnings when you file your tax personal return . The amount this schedule calculates forms part of the tax you pay when you file your return with CRA.

CRA Subcontractor Reporting Requirements

How do you reflect a payment to a subcontractor (non-construction) for services provided on the financial statements?

Record / post any subcontractor payments/expenses to a separate account under the Cost of Goods Sold (COGS) account section of your chart of accounts. The account would be named Subcontract Labour or Subcontract Services or something similar.

If you are using QuickBooks, change/setup your vendor to be a T4A vendor by:

- Going to the Additional Info tab under Edit Vendor.

- Entering their CRA BN or SIN.

- Check the box for "Vendor eligible for T4A".

- Save your changes.

CRA Subcontracting Reporting Requirements

Do You Need a Written Agreement?

It's important to get all your ducks in a row.

It's important to get all your ducks in a row.The purpose of having a written agreement is to reduce risk for your business ... remember if it looks like a duck, swims like a duck, quacks like a duck, it is probably a duck.

Consider creating a written agreement to help solidify CRA subcontracting reporting requirements. If you go this route, you want to ensure you do not execute the contract in a contradictory manner through actions or source documents.

Is your worker an employee or self-employed? Why it's important to get it right.

As stated when discussing "Employee or Self-Employed?", CRA is permitted and entitled to rely on any available evidence in court to try and establish that the written agreement does not reflect the agreement when submission of oral testimony or additional source documents presented contradicts the terms of the written agreement.

CRA checklist on how employment status is determined

Your written agreement should deal with the areas CRA test and monitor when making their determination of a worker's employment status. It also signals that the contractor is acting like a business person and not as a employee.

Keep a copy of their business license on file. You may also want to confirm they have registered their business name with your province as proof they are in fact operating a business.

More >> Find more information on why you would want a written agreement when hiring a subcontracting.

CRA Subcontracting Reporting Requirements

FAQ Subcontracting in Canada

Subcontracting in Canada has specific CRA reporting requirements

Subcontracting in Canada has specific CRA reporting requirementsThese questions deal indirectly with CRA subcontracting reporting requirements. They help you understand the context of subcontracting in Canada and why it exists.

What is a subcontract agreement?

What is a subcontract agreement?

A subcontract agreement in Canada defines the rights, duties, and obligations of a contractor and a subcontractor. It outlines specifics like the scope of work, time frames, payment terms and conditions, indemnities, dispute resolution mechanism, and quality expectations.

A subcontract agreement is different from an employment contract. In an employment contract, the employer has a higher degree of control over the worker, including set working hours, specific working methods, and the provision of employment benefits.

A subcontractor, however, operates independently, often using their own methods and may use their own equipment. They don't have the same employment rights and are responsible for their own taxes and insurance. Additionally, employment contracts are ongoing until termination, while subcontract agreements are usually project-specific. Under CRA subcontracting reporting requirements, this is what distinguishes them from employee-employer relationships.

How is a subcontractor different than a contractor?

How is a subcontractor different than a contractor?

A contractor is a person or a company that undertakes a contract to provide materials or labor to perform a service or work for others, typically for construction projects. A subcontractor, on the other hand, is hired by a general or prime contractor to perform a specific task as part of the overall project. They specialize in certain areas of the construction process.

The term independent contractor can refer to both a subcontractor or a contractor. It's a term used to describe a person or business who provides goods or services to another entity under terms specified in a contract but is not an employee. They have more control over how they complete their work.

That said, a freelance contractor is not necessarily a subcontractor. They can be both a contractor or a subcontractor, depending on the nature of their work and agreement. They perform their services for several clients while not being officially employed by any of them.

No matter what type of contractor you are in Canada, all of CRA subcontracting reporting requirements must be met.

Does an agreement benefit the contractor, subcontractor, or both parties?

Does an agreement benefit the contractor, subcontractor, or both parties?

A well-drafted subcontract agreement benefits both the contractor and the subcontractor. It provides legal protection to both parties, sets clear expectations, and helps prevent misunderstandings. Subcontractors should be cognizant when entering into a contract that the contractor is not unfairly pushing their responsibilities and obligations onto you. Things to watch out for:

- scope of work is too broad or ill-defined

- supply chain issues not under your control

- unfair indemnification clauses

- preventing or limiting the ability to use a lien in the event of non-payment or late payment

- arbitration clauses may deny the subcontractor to take a dispute to court

- get legal advice if the term conditional payment is used

Can a subcontractor outsource (hire other subcontractors) when working on a project under contract?

Can a subcontractor outsource (hire other subcontractors) when working on a project under contract?

It depends. In Canada, a subcontractor can outsource to assist with a project under contract. This is often done if the subcontractor needs additional expertise or manpower to complete their portion of the project.

However, it's important to check your contract. This should typically be outlined and agreed upon in the original subcontract agreement between the primary contractor and the subcontractor. Remember point 4 of step one of determining whether you are a contractor or employee is whether the work can be subcontracted out and assistants hired to help.

It's always recommended to have clear communication and understanding about the involvement of additional subcontractors.

Why do certain industries use subcontractors instead of hiring employees?

Why do certain industries use subcontractors instead of hiring employees?

Some industries will rely on subcontracts over employees for the following reasons:

- They are hired to save costs and to speed up completion of projects.

- The industry demands a wide range of skills and talents that may not exist within a single company.

- Competition and the rapid pace of technological change means specific skills may not be available within one contracting company.

- Subcontracting allows firms to be flexible and agile, adapting to the needs of individual projects.

Here are five examples of certain industries in Canada that hire subcontractors in addition to or instead of employees:

1. Construction Industry: Subcontractors are widely used in the construction industry in Canada. General contractors often hire various subcontracting firms who specialize in different areas such as electrical, plumbing, and concrete work. Subcontractors are hired based on their specific skill sets and capabilities that the general contractors might not possess. They are also often hired to save costs and to speed up completion of projects.

2. Information Technology (IT) Industry: In the IT industry, subcontractors are often hired for their specific skill sets such as software development, network installation, or cybersecurity. IT projects often require diverse skills that may not be available within the contracting company, making subcontracting an efficient solution. Competition and the rapid pace of technological change also contribute to the extensive use of subcontractors in this industry.

3. Marketing Industry: The practice of hiring subcontractors in the marketing industry is common especially for skills that are not required on a continuous basis, or for specific campaigns or projects that require specialist skills. These can include areas such as digital marketing, event planning, market research, public relations, or SEO (Search Engine Optimization) expertise. Subcontracting allows marketing firms to be flexible and agile, adapting to the needs of individual campaigns or projects.

4. Film and Entertainment Industry: This industry often relies on subcontractors, particularly for production work. For example, a film production company may contract out aspects like special effects, animation, and sound production to firms that specialize in these areas. The industry demands a wide range of skills and talents that may not exist within a single company, making subcontracting a beneficial strategy.

5. Healthcare Industry: The use of subcontractors in healthcare allows institutions to enjoy specialist services, reduce costs, increase operational efficiency, and focus on their core duty of providing medical care. Examples would be:

- Specialized services: outsourcing highly specialized medical services or procedures that they may not have the facilities or experts for. This can include complex diagnostic tests, certain types of surgeries, or specialized therapeutic services.

- Supporting services: providing services like cleaning, security, catering, laundry, and equipment maintenance. Having these tasks taken care of by subcontractors allows the healthcare providers to focus on their core responsibilities of patient care.

- IT solutions: Many healthcare institutions subcontract IT services for the management of health records, telemedicine, and other digital solutions. This not only improves efficiency but also ensures a specialist service that might not be available in-house.

- Medical research: outsourced to specialized companies or academic institutions allows healthcare institutions to get relevant research done without having to invest in all necessary resources and manpower.