- Essential Bookkeeping Habits For Audit Ready Books in Canada

- Tax Audits in Canada

- CRA Mileage Log Requirements

7 Keys to CRA Mileage Log Requirements

Applies to Self-Employed, Employee Owned Vehicles, Company Owned Vehicles

By L.Kenway BComm CPB Retired

This is the year you get all your ducks in a row! Start by starting.

Edited May 4, 2024 | Updated January 30, 2024 | Originally Published on Bookkeeping-Essentials.com in 2009

WHAT'S IN THIS ARTICLE

Overview | Detailed Logbook | Driving To Work | Simplified Logbook | CRA Mileage Alternative Records | Why Use Simplified Method | Which Method is Better?

NEXT IN SERIES >> Vehicle Expense Reimbursement Options

The Canada Revenue Agency (CRA) requires diligent tracking of mileage for the purpose of business deductions. If you use your personal vehicle for business purposes, you need an mileage logbook.

Whether you are an employee or self-employed, being able to write-off your vehicle expenses related to business use --- through employee reimbursement or auto allowances, or a self-employed tax deduction --- is a valuable perk you don't want to lose. To avoid CRA disallowing your vehicle expense tax deduction, you need an auto logbook to support your claim.

Highlights Of This Post

- Overview | CRA Mileage Log Requirements - 7 Keys

- In Depth | CRA Mileage Log Requirements

- Detailed Logbook Method

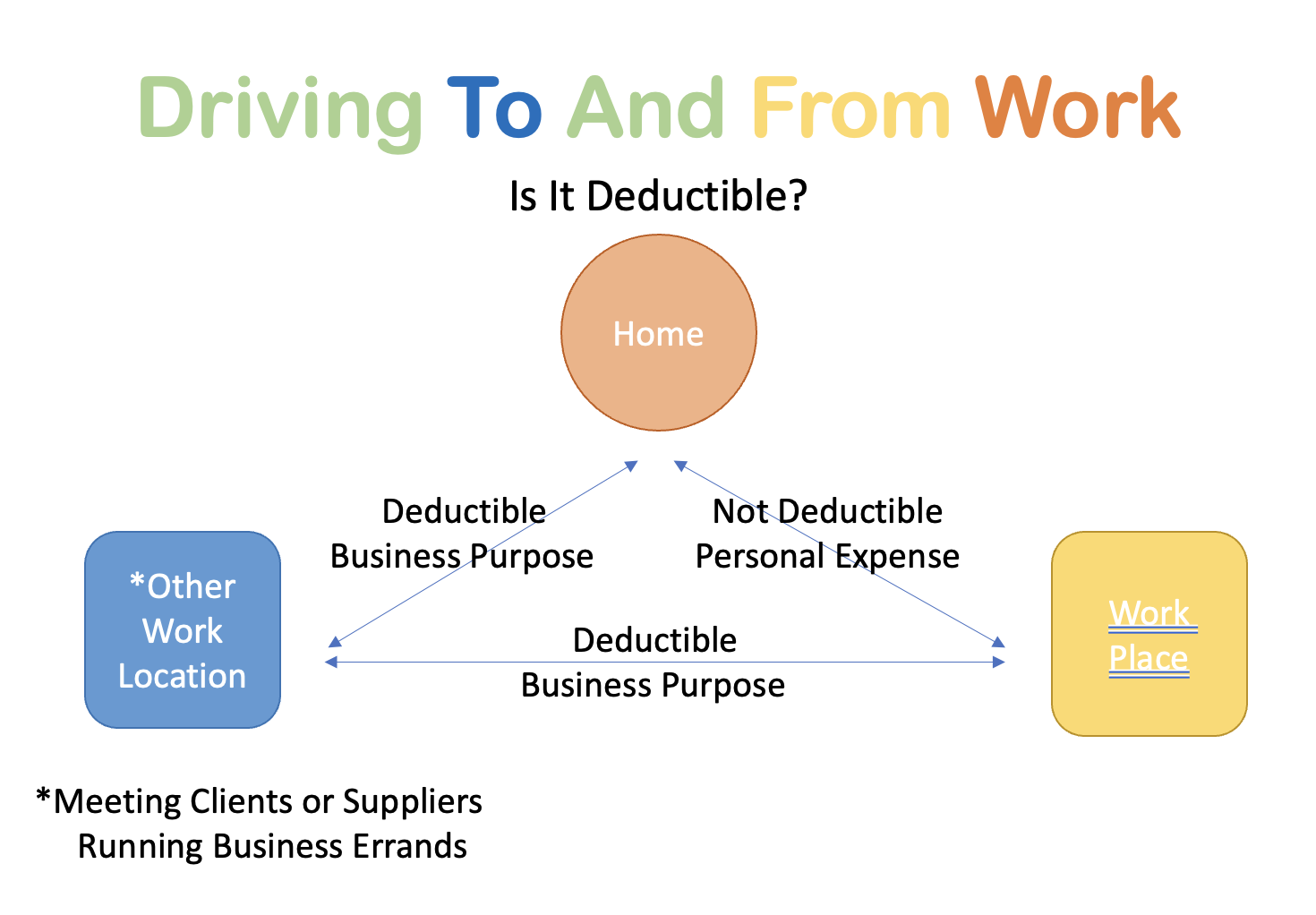

- Is Driving To and From Work Deductible? Diagram

- What Are The Conditions That Must Be Met To Use A Simplified Logbook Period?

- Simplified Logbook Method

- CRA Mileage Logbook Alternative Records

- Why Would Someone Want To Use A Simplified Logbook Rather Than A Detailed Logbook?

- What Is Better From A Canada Revenue Agency Perceptive -- A Detailed Logbook Or A Simplified Logbook?

Overview | CRA Mileage Log Requirements

CRA requires meticulous (emphasis on meticulous) tracking of mileage for the purpose of business deductions. Here are seven key requirements:

- Detailed Logbook: The CRA typically requires a detailed logbook of motor vehicle operations for the entire year. It should include the total distance driven and the distance driven to earn income during each business trip.

- Simplified Logbook: If you meet the conditions set by the CRA for a simplified logbook period, you are allowed to keep a logbook for a representative portion of time and extrapolate the results for the entire year. CRA uses 3 months in their examples.

- Essential Information: The logbook should have information including the date, destination, purpose of your trip, the number of kilometres you drive on each trip, the odometer reading at the beginning and end of the fiscal period.

- Sustaining Records: The motor vehicle expense records should be sustained to document fuel costs, maintenance, repairs, insurance, license and registration fees, and other costs. Evidence of both payment and the reasonableness of the amount should also be maintained.

- Accurate Documentation: The documentation must be precise and verifiable in order to satisfy the CRA's requirements and to reduce the risk of penalties in the case of a tax audit.

- Consistency: The logbook should be kept consistently from year to year.

- Separate Logbooks: If you use more than one vehicle for your business, you need to maintain a separate logbook for each vehicle.

By adhering to these requirements, you can demonstrate to the CRA that your claims for motor vehicle expenses are accurate and policy compliant, potentially reducing your tax liability. These requirements can change, therefore you should always refer to the CRA’s official resources or consult with a professional tax advisor for accurate information.

Let's look at them in more detail.

CRA Mileage Log Requirements In More Depth

The CRA typically requires a detailed logbook of motor vehicle operations for the entire year.

You are allowed to keep a simplified logbook for a representative portion of time (CRA uses 3 months in their examples) and extrapolate the results for the entire year provided you meet the conditions set by the CRA discussed above.

With either method, you can track your business mileage the old fashioned way -- pen and paper, or using one of tech savvy mileage tracking apps out there.

Let's look at both logbook methods in more detail.

CRA Mileage Log Requirements Using Detailed Logbook Method

CRA requires a mileage logbook that diligently tracks business mileage to claim vehicle expenses if you are:

- You are a self-employed sole proprietor

- An employee using their own vehicle and are receiving a flat rate allowance

- An employee using their own vehicle and are receiving an unreasonable per kilometre allowance.

- An employee using their own vehicle and are receiving a reasonable per kilometre allowance.

Your auto log should capture:

- the date,

- the mileage drive (you can add starting and ending mileage columns too if you like),

- your starting point,

- a description of destination, and

- the reason for the trip if it is not obvious.

At the beginning of each year (January 1), you need to record your odometer reading. This figure becomes the last entry for your prior year log. It's a good idea to diarize this date so you don't forget.

Is driving to and from work tax deductible?

Is driving to and from work tax deductible?Remember you are NEVER allowed to record your mileage driving to and from work. CRA classifies this as a personal expense.

You are allowed to add mileage for all your business errands such as going to:

- business lunches and/or functions,

- the bank,

- the mailbox,

- the office supply store

- the bookkeeper's office

What are the conditions that must be met to use a Simplified logbook period?

Develop the habit of tracking your CRA mileage log or possibility lose this valuable tax perk.

Develop the habit of tracking your CRA mileage log or possibility lose this valuable tax perk.To use a simplified logbook period, according to the Canada Revenue Agency (CRA) several conditions must be met:

- A detailed logbook must be maintained for a full 12 month period that is typical of the vehicle's use.

- The 12 month detailed logbook from the base year must show a clear pattern relating to the total number of kilometres driven and the business use percentage of vehicle expenses.

- The business use percentage of vehicle expenses must not vary by more than 10% from the base year to the current year.

Once the detailed logbook is kept for a complete year, you’re then able to maintain a simplified logbook for a shorter representative period. This period should correspond with the 12 month period. The data from the simplified logbook is used to gauge the business use percentage for the entire year.

CRA mileage Log Requirements Using SIMPLIFIED Logbook Method

On June 28, 2010, the Finance Minister announced a new simplified logbook for motor vehicle expense provisions.

In order to claim your business vehicle expenses using the simplified logbook method, you need to meet the conditions discussed above.

CRA mileage log requirements for a simplified logbook require a calculation based on a specific formula. The business use of the vehicle in the second year has to be calculated using CRA's formula as follows:

(Sample year period % ÷ Base year period %) × Base year annual % = Calculated annual business use

If once you have made your calculations, the number is more or less than 10 points off your base year, you cannot use the simplified system. You will need to keep a mileage logbook for the entire 12 months and try again next year. This is why it is probably best to use the first three months of your fiscal or calendar year as your sample period.

However, if the number is within the 10 points allowed by your base year, you are allowed to use the simplified system for the rest of the year. In the third year, you need to repeat your sample period and test again whether or not you are eligible to use the simplified mileage method of tracking your mileage.

CRA Mileage Log Requirements -- Alternative Records

The simplified method makes it a little easier to prove your claim as there are now alternative records that you can use as your audit trail to substantiate your claim and your guesstimates. This is what CRA has to say on alternative records for vehicle travel:

"The fact that a viable business exists is usually a strong indicator that a person incurred vehicle expenses, because it is extremely difficult to carry on a business without doing at least some driving. Claims for a very low amount of business use do not require extensive records to demonstrate business travel. As the percentage of business use and the related expense claims increase, more documentation, .... , is expected to be available."

Some of the things CRA will look at to establish the necessity for business travel in your business when an auto logbook is not available are:

- The books and records they already maintain as part of their business

- An appointment calendar

- A log of service calls

- Purchase or sales invoices that indicate items were picked up or delivered by the business owner.

The auditor will also look at:

- whether you have another vehicle for personal travel,

- the type of business travel likely required for your business,

- who drives the vehicle besides yourself,

- how the vehicle is insured (remember if you are going to tell CRA you are a duck, you need to quack like a duck and have supplementary business insurance on your car)

Pre June 28, 2010 it would be tough going without a full year mileage log as your audit trail. It's very likely your deduction would have been denied or arbitrarily reduced. Under the old rules, this is how an audit could end up with a ruling like this fellow.

Feb 25th, 2009 Diaz vs. the Queen et al (Federal Court of Appeal) The taxpayer's auto claim was reduced by 72% because he did not have auto mileage logs to present to the court. Instead he produced an auto log from the 1999 taxation year and said this was the basis for his deductions. The court felt his method was too arbitrary and the business income did not reflect the need for substantial auto expenses. As there was not sufficient evidence to conclude the Minister's assessed mileage allowed was incorrect, the onus of proof was not met and the appeal was dismissed.

This is one area which is audited regularly and it will be a lot of work (interpret this as time and money) to defend your guesstimates without a full log book or a simplified log book. Your best defence is still a well documented defence.

These new rules mean that CRA expects you to be able to provide evidence demonstrating that the business trip claimed in your log was actually for business. You will need to show them appointment diaries or service call logs or other appropriate documentation.

Conclusion? ... Create your audit trail. Log it ... or open your business up to the potential to lose this valuable tax deduction! Your decision.

Why would someone want to use a Simplified logbook rather than a detailed logbook?

For me personally, it is hard to establish good habits. Once I've established the habit of tracking mileage in my logbook, I would find it tough to stop and start. For me, it would just be easier to always track my mileage once I've established the habit.

However, it is not the same for everyone. I'm guessing the main reason someone would likely opt to use a simplified logbook rather than a detailed logbook would be convenience. Maintaining a detailed logbook for every trip can be time-consuming and somewhat laborious. However, a representative simplified logbook provides much of the same information about the vehicle's usage without having to detail every single trip. This can save time and simplify the record-keeping process.

Please note, the use of simplified logbooks is not permitted unless the base-year logbook is maintained and can be submitted when requested by the CRA.

What is better from a Canada Revenue Agency perceptive -- a detailed logbook or a Simplified logbook?

From the Canada Revenue Agency's perspective, both a detailed logbook and a simplified logbook can be acceptable if they meet their respective criteria. However, CRA's website states "The best evidence to support the use of a vehicle is an accurate logbook of business travel maintained for the entire year."

A detailed logbook, when kept properly, provides precise information about all business-related vehicle use. This can make it a more reliable record from the CRA's perspective because it leaves little room for estimation or error.

On the other hand, a simplified logbook might be used as long as it is based on a detailed logbook that has been kept for a full 12 month period, and if it accurately reflects the vehicle's use.

As previously mentioned, the CRA might require the detailed logbook from the base year to be presented upon request, even if a simplified logbook is usually maintained. Therefore, it's essential to always keep and preserve your base year detailed logbook.

It's also important to remember that even with a simplified logbook, some level of detailed record-keeping is necessary to ensure the sample period is representative.

Ultimately, the choice between a detailed logbook and a simplified logbook may depend more on your personal preferences, the nature of your vehicle use, and your ability to consistently maintain accurate and detailed records. Keep in mind that the primary goal is to create a reliable record of your business vehicle use to support your tax claims. Always consult with a tax advisor or the CRA directly for personalized advice when making choices about this valuable perk available to employees and the self-employed.

Vehicle Expense Reimbursement Options

Learning about the essential bookkeeping habits for reimbursement will keep your books audit ready. Because the rules for writing-off business use of auto expenses are complicated and very inflexible, CRA auditors will always examine them. So follow the rules closely if you want your deduction to pass a tax audit.

CRA has three distinct sets of rules for vehicles used for business purposes. Choose the one that fits your circumstances to stay CRA compliant.