About Me

Hi, and thanks for checking in to meet me, Laura!

A Perfect Spring Morning

The Habit of Walking Daily

Lethbridge storm pond

Lethbridge storm pondI'm all about establishing healthy habits and routines whether it's related to work or my personal life. If you work at a desk all day, I think it's really important to step away and establish the habit of the daily walk.

In Lethbridge this morning, the sun is shining with a very light breeze at 12 degrees C. I recently implemented recess as I've been doing a lot of desk work these past few months. Recess today was perfect "walking the dog" weather.

Lethbridge has these storm ponds in the newer subdivisions to handle flash flooding and overflows. It creates many lovely walking paths in the neighbourhoods throughout the city. One storm pond near me usually has geese, but this year some ducks have shown up as well as migrating pelicans.

Four other habits I'm in the process of implementing this year are:

- Desk Yoga - Here's a nice six minute chair sitting routine to ease "tech" neck (pain in the neck and shoulders caused by looking at computers, phones and other screens).

- Healthier Gut Biome - Following the plant based diversity plan of introducing 30 plant based foods to your existing eating habits every week. Plant based foods are nuts, seeds, oils, whole grains, legumes, beans, fruits, and vegetables. The purpose is to improve my gut biome naturally. They've proven that your gut is connected to your brain. You may want to consider trying the diversity diet if you experience a lot of brain fog or a lack of clarity in your thinking.

- Hit The Gym - I'm combining building muscle and cardio simultaneously with HIIT (High-Intensity Interval Training) workouts at the gym. It alternates short bursts of intense exercise with brief periods of rest or lower-intensity activity. Building muscle is important for desk bound workers. It improves strength and mobility, enhances your metabolism, supports your bone health, reduces your risk of chronic diseases, and improves your postures which reduces pain points in your body. All these things are important if you want to enjoy your go-go retirement years. HIIT workouts are typically shorter, often ranging from 10 to 30 minutes, making them an excellent option if you have limited time for exercise.

- Fall Soup Challenge - If you are trying to eat healthier for a sharper brain and just feeling better, Jen Hansard is holding a free autumn soup challenge. I've registered and am very interested to see what it entails. I don't know about you, but I eat differently once the cool weather arrives and soup fits the bill. Why don't you join me and expand your culinary taste buds.

Let's get the formalities out of the way ...

About Laura

Bachelor of Commerce 1978

Retired Certified Professional Bookkeeper

QuickBooks Online Canada

Certified Advanced QuickBooks Online ProAdvisor

Re-certified 2024

Qualifications and Expertise:

- Web Master of my sister site Bookkeeping-Essentials.com since 2009

- Part-time self-employed bookkeeper specializing in Canadian sole proprietor bookkeeping and tax preparation since 2006 ... 11 years exclusively on a virtual basis. In June 2020, I retired and no longer accept clients.

- Obtained Certified Professional Bookkeeper designation in 2009 from the Institute of Professional Bookkeepers of Canada - IPBC (rebranded as Certified Professional Bookkeepers of Canada - CPB Canada).

- 14 years employed part-time as bookkeeper for small business and/or accounting technician private client services and/or seasonal tax professional at H&R Block

- 3 years full-time self-employed public Canadian small business experience in bookkeeping, management accounting/reporting, and basic tax preparation

- 20 years corporate head office experience in budgets, forecasting, financial planning, general accounting

- Conferred Bachelor of Commerce degree from the University of Calgary in 1978

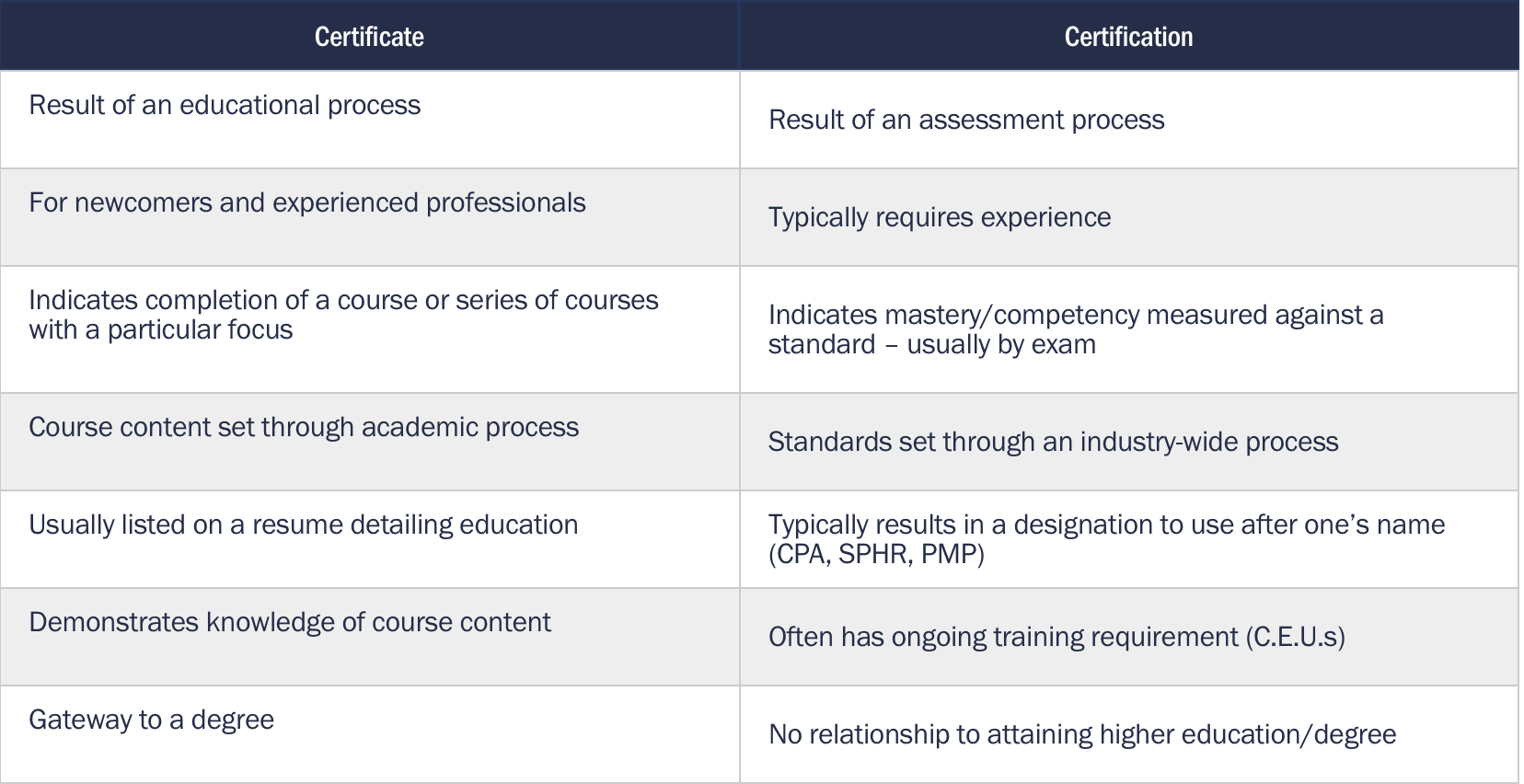

The Difference Between a Certificate and Certification

Professional certification is different than a certificate program. Courses in a certificate program (or a university degree) help prepare you to earn a professional designation in your specified field but earning a degree or certificate is not the same as becoming certified.

This table from the University of Virginia compares a certificate vs a certification.

For Those Of You That Like To See Certificates

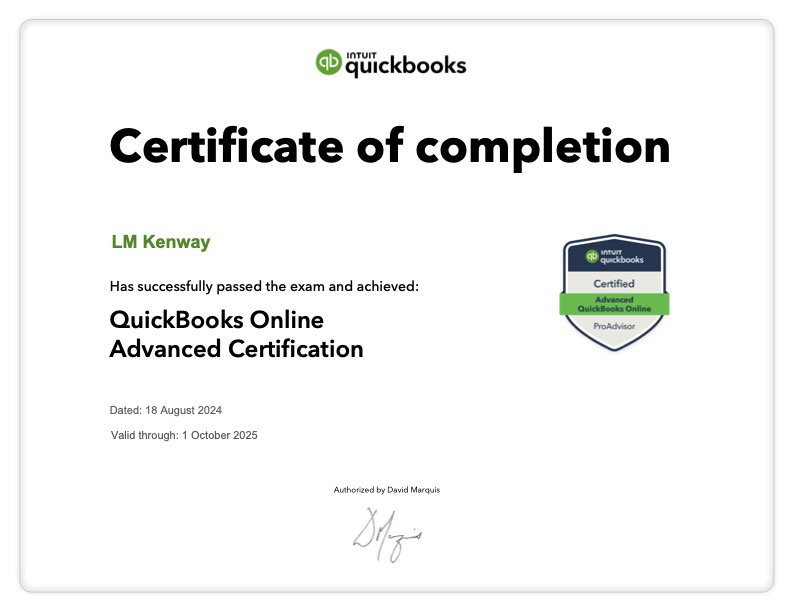

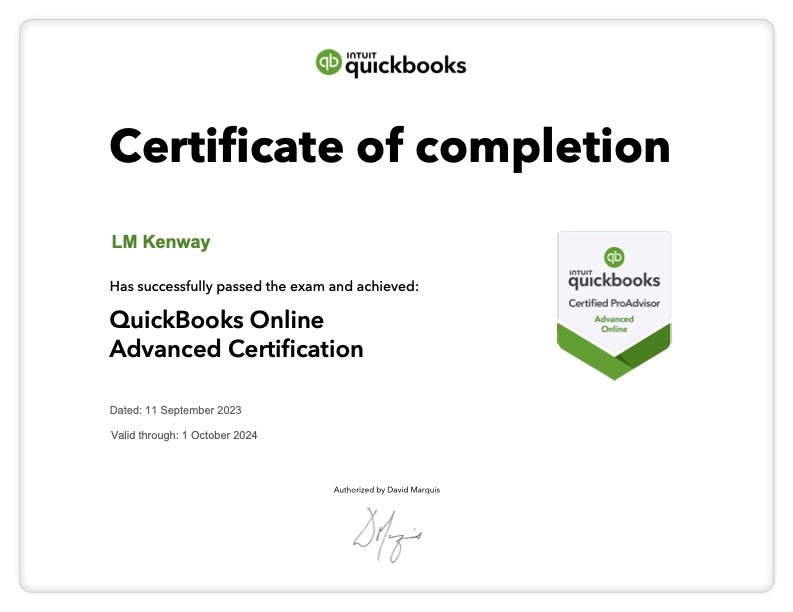

Intuit began requiring certification in 2017. In 2021, Intuit began the requirement of annual recertification. I have been using QBOA (QuickBooks Online Accountant) since 2013. Prior to that I used QuickBooks Desktop from 2000-2020.

QBOA 2024 Certification

QBOA 2024 Certification 2024 QBOA Badge

2024 QBOA Badge QBOA 2023 Certification

QBOA 2023 Certification QBOA Badge

QBOA Badge QBOA 2022 Certification

QBOA 2022 Certification QBOA 2021 Certification

QBOA 2021 Certification QBOA 2017 Certification

QBOA 2017 CertificationLife Happens When You Are Planning Other Stuff

When life through me a curve ball, I gained other experiences I wasn't looking for ... like:

- 8.5 years serving on strata board for BC not-for-profit condominium complex (I learned more than I wanted about fund accounting!) after purchasing a condominium unit for the first time. It was a large investment so I wanted to understand how the corporation worked. I meant to only join the board for a year! As serving President for many of those years, I lead the Corporation through a successful law suit for a failing envelope structure and the initial renovations to restore the structures.

- 5 years part-time estate executor experience settling estates and distributing the property to beneficiaries. Life hit hard when multiple family members died within a short period of time. It was another huge learning curve and took years to settle the estates.

- 3 years part-time financial caretaker experience for seniors providing assistance in managing their personal day-to-day monetary affairs and eventually palliative care. I felt blessed to be able to do this for my parents and youngest brother.

- 2+ years rearranging my life to manage and accommodate a chronic illness. I learned to be very kind to myself during this period ... and flexible. This is why you see so much part-time work. I still needed to be productive and working from home in a part-time capacity was the solution to a good life and quality of life.

The Path to Your Goal is Rarely Straight ... Keep Moving

Chartered Professional Accountant? No.

Certified Professional Bookkeeper? Yes.

Just so there is no confusion ...

While I have taken professional accounting courses through the CGA Association of Alberta and H&R Block ...

I was NEVER a licensed accountant (CPA CA, CPA CGA, CPA CMA) and never engaged in nor provided review or audit services.

I was a CPB Certified Professional Bookkeeper, registered and in good standing with the Institute of Professional Bookkeepers of Canada (IPBC) / CPB Canada from 2009 until I retired in 2020. Also, from February to November 2011, I worked part-time for IPBC, helping out in Member Services and assisting in the transition to a new website platform and data base.

What is a Certified Professional Bookkeeper?

The CPB designation is a national bookkeeping standard set and maintained by CPB Canada. It reflects the level of knowledge, education, and skills necessary to carry out all key functions through Accounts Payable, Accounts Receivable, Payroll, Sales Taxes, Inventory and General Bookkeeping. It also means annual continuing professional development requirements must be met and a code of conduct must be adhered to.

Look for CPB Canada's digital credentials as proof a bookkeeper is a member in good standing. It validates the member's knowledge and experience.

CPB Canada has three levels of competencies. Employers can download their checklist to determine a bookkeeper's mastery of essential knowledge areas.

Formal Post-Secondary Education

I do have a Bachelor of Commerce degree and have taken numerous post graduate courses in economics through the University of Calgary, Canada.

I have also, in the past, engaged in formal studies of accounting through the Certified General Accountants Association of Alberta, Canada ... achieving the 5th Level (of 6 levels in the Program 91).

If you are wondering why I didn't complete the CGA Program ... well let's just say that this was one of those times life happened while I was making other plans :0(

... and leave it at that. Everything worked out in the end ... just not the way I planned! :0)

Tax Professional? No. Basic Tax Courses and Experience? Yes.

I am not a tax expert either.

My tax background is limited to the formal study and preparation of very basic Canadian tax returns. In the late nineties, I completed the H&R Block Tax Preparation 1 course (which included capital expenditures, CCA, business 1, employment expenses, capital gains 1 and rental income) in addition to the above mentioned CGA instruction, which included basic personal and corporate tax.

I also took some T1 and T2 tax courses from The Jacks Institute (now The Knowledge Bureau) around the turn of the century.

I worked part-time at H&R Block for the 2009 & 2010 tax season. All H&R Block employees are required to annually take tax courses. I completed the H&R Block Tax Course 1 again in December 2009 as part of my professional development, and earned "Tax Professional" status. In December 2010, I completed H&R Block Tax Course 2. I have not been professionally trained in trust taxation, but do have some experience with basic trusts tax filing through necessity.

Self Development

I attended many small business seminars while transitioning to self-employment; and webinars as part of my on-going professional development required by IPBC / CPB Canada. I also like reading, so I enjoyed reading online about small business issues or through hard copy; it was one of the ways I spent my leisure time. Even in retirement I spend a portion of my day reading.

Currently I am learning how to be retired. Restructuring life around not working is harder than you would think! LOL

I have learned a few things over the years and I thought I could share with you what I have learned ... but remember information is not advice.

Always speak with your accountant before implementing any of the information on this site ... as your accountant can give advice specific to your situation.

How I Create Content - Blending Experience with AI Tools

As technology continues to evolve, I believe in being transparent about the tools I use to create content for this site. Since launching this site in January 2024, I have been learning how to integrate AI tools into my workflow, similar to how the introduction of personal computers (PCs) revolutionized accounting workflows in the 1980s. I can still remember how developing departmental budgets became so much easier and faster using an Apple MacIntosh to create our spreadsheets.

It seems to me that the current AI debate aligns with historical discussions about photography - whether the tool or the human creates the final product. Just as photographers make creative choices in their work, I maintain creative control over my content while using AI as a tool in my workflow process.

Currently, I use AI tools to:

- Assist with gathering and organizing my research in addition to my dear friend Google;

- Help organize content into better structure and flow;

- Support editing my articles to improve clarity and catch my grammatical errors; and

- Sometimes generate initial drafts which I then refine.

However, all content is under my human oversight. It is:

- Fact-checked and verified;

- Enhanced with my professional experience; and

- True to my unique voice and expertise.

This approach has actually improved my writing skills, helping me create better-structured, clearer content for you. My aim is to blend AI's efficiency with human insight to deliver reliable, well-articulated information to my readers.

Thank you for joining me in these interesting times as I continue to learn to navigate and transition how to work and create content in 2025. I am so excited and eager to continue exploring and learning how to integrate AI tools into my workflow to make it more efficient while still delivering practical and relevant content. I keep reminding myself, "Remember change is hard but not changing is harder!" [Catherine Matthews, Author]

One Last Thing

When selecting apps for my work stack, one criteria I have is whether the app is Canadian. It's not my only criteria, but it is always a consideration as I like to support Canadian companies.

Welcome to my site. I hope you enjoy your visit ... and come back often.

I no longer accept questions. There are so many social media groups that do this now, I feel it is not the best use of my time now that I am retired. But if for some reason you need to contact me, you can do so below. Fair warning, I don't check my email on a regular basis so you may have to be patient for a reply.

Back to top