- Essential Bookkeeping Habits For Audit Ready Books in Canada

- Self Employed Tax Deductions

- How To Write-off Business Vehicle Expenses

How to Write-off Business Vehicle Expenses

Self-Employed Business Use of Personal Vehicle in Canada

Applies To Contract For Service Relationships | Independent Contractor Status

By L.Kenway BComm CPB Retired

This is the year you get all your ducks in a row! Start by starting.

Updated December 31, 2024 | Originally Published on Bookkeeping-Essentials.com in 2010

WHAT'S IN THIS ARTICLE

Introduction | T2125 Line 9281 | Expenses You Can Claim | Business Auto Insurance | Types of Auto Expenses | Buy Vehicle | Daily Interest Limits | Lease Vehicle | Monthly Lease Limits

NEXT IN SERIES >> Self-Employed Home Office Expenses

As the rules for writing-off business use of auto expenses are complicated and very inflexible, CRA auditors will always examine them. So follow the rules closely if you want your deduction to pass a tax audit.

To write-off business use of your personal car, the car must be used for earning business income. Personal use mileage is never deductible!

To write-off business use of your personal car, the car must be used for earning business income. Personal use mileage is never deductible!Introduction

There are three distinct areas of CRA rules pertaining to vehicles:

(1) tax deductions for self-employed individuals,

(2) allowances and reimbursements for employee supplied automobiles , and

(3) employer supplied automobiles - the company car.

This article will discuss the first area; self-employed individuals and their vehicles which was touched upon when we discussed employee auto allowances. Page 8 of Form T2125 Statement of Business or Professional Activities is devoted solely to motor vehicle expenses for the self-employed.

To write-off your self-employed business vehicle expenses in Canada when you use your personal vehicle, the vehicle must be used for earning business income. Personal use expenses are not deductible. A mileage logbook is required as well as supporting documents and receipts.

Highlights Of This Post

This article is for self-employed individuals.

- Introduction

- Writing-off business vehicle expenses for the self-employed

- Vehicle expenses you can claim

- Do you really need business insurance for your personal car?

- Fixed vs variable vehicle expenses

- Tax deductions when you purchase your vehicle

- Daily interest limits

- Tax deductions when you lease your vehicle

- Monthly leasing limits

Writing-off Business Vehicle Expenses for the Self-Employed Individual in Canada

Form T2125 -- Statement of Business Or Professional Activities

Vehicle Expenses on Line 9281

Soooo ... you use your personal vehicle for business and are wondering how and what to write-off for your business tax deduction.

If it is tax time and you are just sitting down to figure how to claim the use of your personal vehicle in your business ... you may be out of luck for this year. You need to do some advance tax planning in order to claim this deduction.

Here's a quick overview on how it works.

- Vehicle Use: For car expenses to be deductible, the vehicle must be used for earning business income. Personal use expenses are not deductible.

- Business Portion Only: Only the cost of operating the car for business purposes can be claimed. To find out what portion of total car costs can be claimed, divide the car’s business kilometers by its total kilometers driven.

- Keep Records: It's necessary to keep a detailed logbook of business travel for the year, noting each trip's purpose, destination, and distance in kilometers.

- Types of Expenses: Deductible expenses may include fuel, maintenance and repairs, insurance, license and registration fees, capital cost allowance (CCA) for depreciation of your car, buy or lease costs, interest on money borrowed to buy the vehicle.

- Leased Vehicles: If the vehicle is leased, the 2025 lease payments can be deducted to a maximum of $1100 per month (plus applicable GST HST and if applicable, provincial sales tax.) 2024 was a maximum of $1050 per month.

As stated, only the business portion of vehicle usage is tax deductible. The personal portion is not deductible. This means your business vehicle expenses are prorated based on kilometers driven. This presents a problem for you as a small business owner. How do you prove to the tax auditor how often your vehicle was used for business purposes?

The easy answer is a mileage logbook ... the hard answer is a mileage logbook! Remember I said writing-off this deduction required advanced planning. The auto logbook is easy to talk about but requires discipline to maintain. Take the time to develop the habit if you want to audit-proof your vehicle expense claims. Without it, the tax auditor can reduce or deny your claim.

AUDIT RISK

Do not confuse these two CRA published rates as a viable option for writing-off your business vehicle expenses:

- Travel rates for medical, moving or Northern residents deductions; or

- Employee tax-free per kilometre auto allowance.

Vehicle Expenses You Can Claim On Line 9281

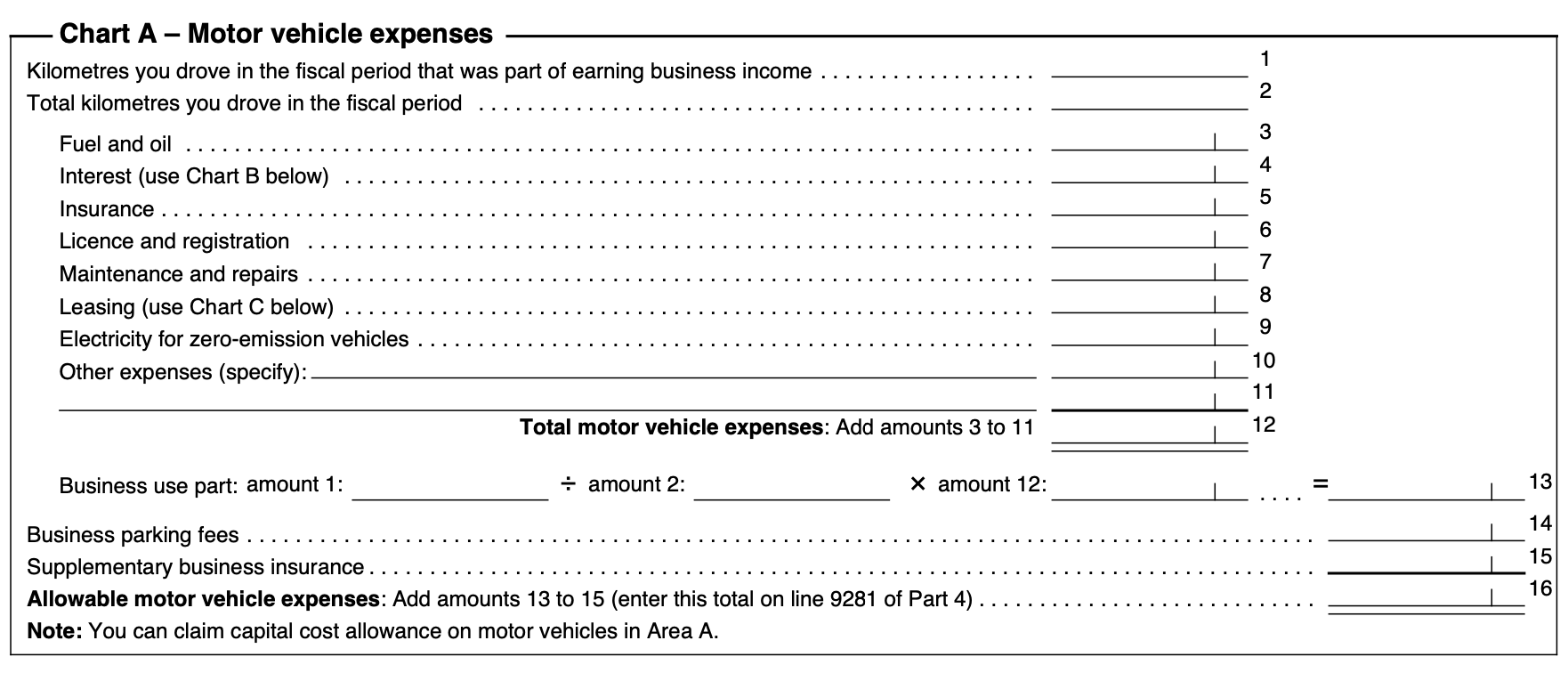

The image below shows how business vehicle expenses are claimed on Chart A on your tax return. It is found on page 8 of Form T2125 Statement of Business or Professional Activities.

Page 8 of T2125 tax form deals with motor vehicle expenses

Page 8 of T2125 tax form deals with motor vehicle expensesThings to observe:

- The mileage information from your auto mileage log is entered onto lines 1 and 2. This determines the percentage of your business vehicle expenses that are tax deductible on line 13.

- You must keep all supporting documents and expense receipts in order to make the claim

- Whether you buy or lease your car, you are allowed the same operating expense deductions.

Looking at Chart A above, notice that you can claim all your operating expenses such as:

- fuel and oil on line 3,

- interest on line 4,

- insurance on line 5,

- license and registration (including Canadian Auto Associaton) on line 6,

- Repairs and maintenance (includes car washes and new tires) on line 7,

- leasing expenses on line 8,

- electricity for zero-emission vehicles on line 9,

- the full amount of your business parking fees on line 14,

- supplementary business insurance on line 15,

- but no fines or penalties.

AUDIT READY

Capital cost allowance (CCA) is calculated and claimed in Area A on page 5. It is important to note that CCA is an optional deduction allowing you to choose when to claim the deduction to receive maximum benefit. Use it only if your other expenses were not enough to reduce your business income to zero.

Business Insurance for Your Personal Vehicle

Do You Need It?

Do I need business insurance on my personal car?

Do I need business insurance on my personal car?If you are driving your personal vehicle for business purposes, make sure you are insured for business driving. It is not enough to just have personal pleasure coverage or drive to work (like an employee) coverage.

You are making this deduction because you say it is a business expense. ... so don't skimp here. Keep all your ducks in a row and your story line congruent with your main premise ... that you are incurring this expense with the expectation of earning profit sooooo ... all your supporting documentation must support this premise.

You can deduct the full amount of the business vehicle supplemental insurance on line 15.

What happens if you get in an accident while driving your car for business and you aren't insured for business use of your car?

If you get into an accident while using your personal vehicle for business purposes, and you're not insured for business use, it might create some complications, particularly when it comes to claiming from your insurance provider. Personal auto insurance policies typically do not cover accidents that occur during business-related activities.

If your insurance company determines you were using your vehicle for business purposes when the accident occurred, they may deny your claim based on the exclusion for business-use of the vehicle. This could leave you responsible for all costs associated with the accident, including repair costs and any potential liability for damage to other vehicles or property, or injuries to others.

In the worst-case scenario, if you're found to have misrepresented the use of your car to your insurer (i.e., stating it's for personal use when in fact it's for business use), the insurance company could potentially cancel your policy.

It's always recommended to discuss with your insurance agent or provider about your car usage to ensure you have the necessary coverage, whether it is for personal or business use or both.

AUDIT READY

- Ensure you have supplemental business insurance on your personal car if you are using it for business purposes.

- Accident repair expenses are 100% (net of recoveries) deductible if the car was being used for business at the time of the accident. Catch 22 -- you need supplemental business insurance for this to happen.

- If you want to claim 100% of your business vehicle expenses, it will need to be a company vehicle. That requires you park the vehicle during non-business hours. If the vehicle is available for personal use during non-business hours, it is considered personal. Self-employed individuals must extract the personal use portion. (It gives rise to a taxable benefit for employees.)

- If you use more than one business vehicle, each vehicle must be tracked separately.

Types of Business Vehicle Expenses

As It Relates to Business Use of Your Personal Vehicle

Variable expenses are the expenses you incur by driving the vehicle; using the vehicle creates "wear and tear" expenses on the vehicle. For example, fuel, tires, repairs and maintenance are variable operating costs.

Fixed expenses are the expenses you incur that are not "caused" by driving the vehicle but as a result of owning the vehicle. They are all the costs you still have to pay even if you don't drive the vehicle. For example, depreciation, auto insurance, license and registration, financing charges, leasing payments are fixed costs.

Fixed expenses usually have associated legal paperwork you need to retain for record keeping purposes.

AUDIT READY

- You should keep all leasing and purchase documents pertaining to your vehicle.

- Be cognizant that there are limitations on interest, leasing, and depreciation deductions.

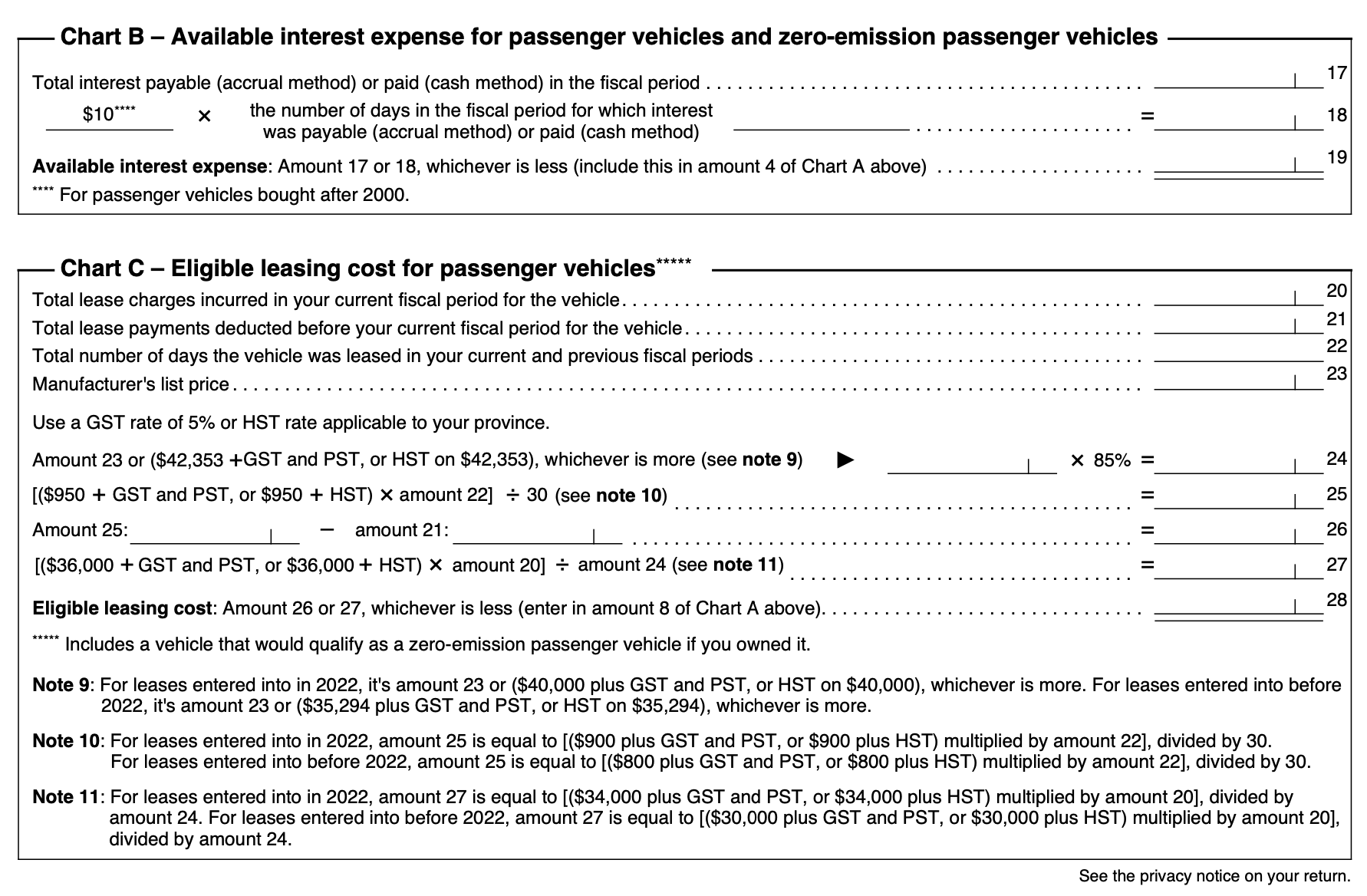

Chart B below calculates deductible interest expense; and Chart C calculates your eligible leasing costs for the passenger vehicle category.

Chart B and Chart C calculations are carried up into Chart A on lines 4 and 8 respectively.

Chart B & C page 8 of T2125 form deals with interest deduction limits and eligible leasing expenses.

Chart B & C page 8 of T2125 form deals with interest deduction limits and eligible leasing expenses.

Tax Deductions When You Purchase Your Vehicle

If you have purchased your vehicle, you are eligible to claim the expense over time through use of CCA (capital cost allowance). The amount your deduction is affected by the type of vehicle you have and which CCA category your vehicle fits into. The purpose of the limits is to prevent business owners writing off luxury vehicles as required for business purposes.

Caution - Talk to Your Accountant

Please use the information in this section more for talking points with your accountant ... so you have a better feel for what kind of information you are seeking. Your accountant will customize advice specifically for your situation. Think of it like this ... Having a map BEFORE you enter the forest is so much better than getting lost in the forest!

The types of vehicles and their 2025 (2024) capital cost restrictions are:

- motor vehicles - designed for use on highways and streets

CCA Class 10.1* - $38,000 ($37,000) plus tax less maximum ITCs (input tax credits) - passenger vehicles - owned by taxpayer seats a driver and no more than 8 passengers

CCA Class 10.1* - $38,000 ($37,000) plus tax less maximum ITCs (input tax credits) - zero emission passenger vehicles - owned by taxpayer seats a driver and no more than 8 passengers; cannot be a leased vehicle

CCA class 54 - $61,000 ($61,000) plus tax less maximum ITCs - zero emission vehicles - owned by a taxpayer and meets a long list of conditions

CCA class 54** - $61,000 ($61,000) plus tax less maximum ITCs

*Use class 10 if the cost of the vehicle is less than the threshold. Terminal losses and recapture rules are not available for class 10.1 vehicles.

** if purchased after March 18, 2019. Prior to this it was classed as 10 or 10.1. A new class 56 was introduced March 1, 2020 for ZE automotive equipment that is not designed for use on highways or streets.

ACCELERATED CCA FOR ZEVs

In 2019, the government introduced accelerated CCA rates for ZEVs. They expanded the write-off in 2020 for other ZEVs.

Accelerated ZEV Rates for eligible vehicles:

- 100% write-off from March 18, 2019 to 2023

- 75% write-off in the first year for 2024 & 2025

- 55% write-off in the first year for 2026 & 2027

AUDIT READY

Be aware there are strict acquistion, disposal, and personal use rules (including possible taxable benefits for employees who use a company vehicle) and restrictions for vehicles ... and auditors love to audit this deduction just to make sure you have followed those rules.

Prescribed Daily Interest Limits

If you purchased your vehicle, you are eligible to claim an interest deduction up to a limit set by CRA. In 2025, the daily interest limit is $11.67 per day ($350 / 30 day period).

Example: Your interest cost is $700 a month. The rules restrict your interest expense claim to $11.67 a day. If you used your passenger vehicle 65% for business (usage supported by your mileage log), you can only deduct $11.67 x 65% = $7.59 a day. The 35% personal use component is not tax deductible.

This type of calculation is important because loan interest is often calculated on a daily basis, and vehicle purchases or sales might occur partway through a month, requiring prorated calculations.

Important points to note:

- This limit applies to vehicles that meet the CRA's definition of a 'passenger vehicle'.

- The interest must be related to money borrowed to purchase the vehicle for business use.

- The deduction is prorated based on your business use percentage of the vehicle.

- The limit applies regardless of whether you use the vehicle for business or professional purposes.

You can see how to calculate your deductible interest expense in Chart B above. Historical daily interest limits are shown below.

- Jan 1, 2024 to present -- $11.67 (maximum $350 per month)

- Jan 1, 2001 to Dec 31, 2023 -- $10.00 (maximum $300 per month)

- Jan 1, 1997 to Dec 31, 2000 -- $8.33 (maximum $250 per month)

- Sep 1, 1989 to Dec 31, 1996 -- $10.00 (maximum $300 per month)

- Jun 17, 1987 to Aug 31, 1989 -- $8.33 (maximum $250 per month)

Source of Historical Rates: CCH publication 'Preparing Your Income Tax Returns' 738

Tax Deductions When You Lease Your Vehicle

A long term leased passenger vehicle is not entitled to claim CCA.

A long term leased passenger vehicle is not entitled to claim CCA.A long term leased passenger vehicle is not entitled to claim CCA (capital cost allowance). However, you are allowed to claim a percentage of your lease payment to a limit of $1,100 before taxes in 2025 ($1,050 before taxes in 2024). Personal use is not deductible.

Example: Your lease cost is $1,200 a month before GST, HST, or GST + PST. The rules restrict your claim to $1,110 ($1,050 in 2024). If you used your passenger vehicle 65% for business (usage supported by your mileage log), you can only deduct $1,100 x 65% = $715.00 before tax ($1,050 x 65% = $682.50 in 2024). The 35% personal use component is not tax deductible.

This limit is reduced again based on the list price of the vehicle; referred to as a capital cost ceiling. The purpose of this second restriction is to prevent businesses writing off luxury cars as a business expense.

TIP

The amount of your lease payment you can deduct decreases as the price of your vehicle goes up. It can make the deduction on a high-end car very small.

Reference: CRA's publication IT-521R Motor Vehicle Expenses Claimed by Self-Employed Individuals; also publication T4002 Self-Employed Business, Professional ... has a nice chart to help you classify your vehicle so you know which rules to follow.

Your eligible leasing cost claim is calculated in Chart C shown above. Historical monthly lease limits are listed below.

Prescribed Monthly Lease Limits

These limits apply not only to self-employed individuals but also employees who use their personal vehicles for business purposes.

- Jan 1, 2025 to present -- $1,100 plus taxes

- Jan 1, 2024 to Dec 31, 2024 -- $1,050 plus taxes

- Jan 1, 2023 to Dec 31, 2023 -- $950 plus taxes

- Jan 1, 2022 to Dec 31, 2022 -- $900 plus taxes

- Jan 1, 2001 to Dec 31, 2021 -- $800 plus taxes

- Jan 1, 2000 to Dec 31, 2000 -- $700 plus taxes

- Jan 1, 1998 to Dec 31, 1999 -- $650 plus taxes

- Jan 1, 1997 to Dec 31, 1997 -- $550 plus taxes

- Jan 1, 1991 to Dec 31, 1996 -- $650 plus taxes

- Sep 1, 1989 to Dec 31, 1990 -- $650

- Jun 17, 1987 to Aug 31, 1989 -- $600

Source of Historical Rates: CCH publication 'Preparing Your Income Tax Returns' 738