9 Most Popular Blogs Of 2024

By L.Kenway BComm CPB Retired

Published December 14, 2024

Can you believe Bookkeeping-Essentials.ca is turning one? 🎉 Time flies when you're having fun with numbers! (Yes, some of us actually enjoy this stuff!) Thanks for making this site's first year amazing! Here's to many more years of turning tax terrors into triumphs! 🚀

Each chat breaks down scary topics into bite-sized, digestible pieces. Think of it as your business's recipe book - follow the steps, and you'll cook up success!

Remember, even seasoned business owners started as beginners. This site is here to help you navigate the journey, one spreadsheet at a time.

P.S. Why was the bookkeeper so excited about her new calculator? Because she could count on it! (I know, I know... bookkeeping humour can be a bit taxing! 😉)

Let's look back at the most popular blogs of 2024 that caught your attention - our greatest hits of the year if you will.

9 Most Popular Blogs Of 2024

The "Chart-Toppers" (See what I did there? 😉)

- Small Business Tax Compliance (Because nothing says "fun" like keeping the CRA happy!)

- CRA Subcontracting Reporting Requirements (AKA: Who's who in the tax zoo)

- Canadian Self Employed Tax Deductions (Turn those receipts into rewards!)

- T4A Information Slips (Not as scary as they sound, promise!)

- T4 Slips Boxes 24 and 26 (Making sense of those mysterious boxes)

- Cancel Your GST HST Account: The Financial Impact (Breaking up with the CRA - respectfully)

- Meals and Entertainment Expense Deduction (Yes, some business lunches are tax-deductible - woohoo!)

- 7 Keys to CRA Mileage Log Requirements (Because your car deserves some tax love too)

- Maintaining The Corporate Minute Book (Your business's diary - keep it juicy!)

#1 Small Business Tax Compliance

Starting a business is exciting, but keeping up with tax stuff? Not so much, right? No worries! The most popular blog of 2024 - Tax Compliance For Small Business - makes it easy to understand your responsibilities.

Think of tax compliance as just another part of the business puzzle that, once you get the hang of it, can become as routine as your morning coffee. The article walks you through the specific filing deadlines and obligations regarding sales, payroll, and income taxes in Canada without the stress. It's all about forming good habits from the start, using apps to keep track of receipts and saving yourself from last-minute panic attacks. This blog post advocates for a disciplined approach to ensure the long-term success of your business.

So relax and take a tea break with me to learn what you need to know. You'll walk away feeling ready to tackle tax season like a pro, with plenty of tips to keep your business running smoothly.

#2 CRA Subcontracting Reporting Requirements

Navigating the world of subcontractor reporting? The second most popular blog of 2024 was 'CRA Subcontracting Reporting Requirements'. It is your go-to guide. Whether you're hiring someone for non-construction services or construction projects, understanding the proper forms like T4A and T5018 and knowing your deadlines makes a world of difference.

It's all about classifying your workers correctly—knowing who's an employee and who's self-employed impacts taxes, benefits, and insurance and keeping on top of updates like the CRA reversing its position on reimbursements of subcontractor fees for non-Canadian residents. It's prudent to keep your subcontractor agreements clear and compliant. So get a fresh cup of your favourite tea, and let this friendly guide walk you through the essentials. It's got all the info to help you get your ducks in a row and keep your business on track!

#3 Self Employed Tax Deductions

Navigating taxes can feel like tackling a mountain, but the third most popular blog for 2024 discusses 'Canadian Self-Employed Tax Deductions'. It is your trusty guide to the summit and covers everything you need to know about essential deductions for your business. Think of tax deductions as your best friend—they're here to help you save money and keep your business running smoothly.

From office expenses and advertising to the all-important vehicle and travel deductions, this guide breaks down everything a sole proprietor can claim on their T1 Schedule T2125. It'll help you separate business from personal expenses like a pro. Refill your water bottle, turn off your phone for a few minutes, and learn how to make tax time a breeze. With these tips, you're sure to maximize your savings and avoid any nasty surprises during an audit. Happy filing, and may your deductions be hefty and compliant!

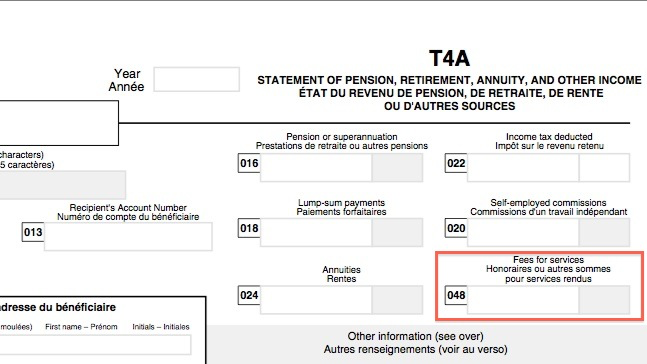

#4 T4A Information Slips

If you're baffled by T4A slips and independent contractor rules, this guide is here to help. Digging into 'T4A Information Slips', the fourth popular blog of 2024, helps you make your way through the labaryinth of subcontractor tax reporting requirements in Canada. It's necessary as a small business owner to know these ins and outs to correctly classify your team of subcontractors and avoid costly mistakes.

This guide breaks down everything you need for non-construction subcontractors, like bookkeepers and lawyers, with helpful tips on ensuring compliance with CRA standards. From filling out Box 048 to understanding what to do before you hire, this article clears up the confusion around T4A forms. Dive in to learn how to get it right from the start, and keep your hires and taxes on track!

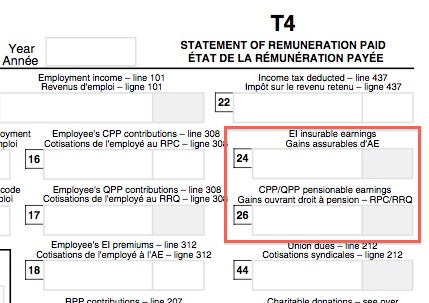

#5 T4 Slip Boxes 24 and 26

If you're navigating the world of T4 slips and wondering what boxes 24 and 26 are all about, you've come to the right place. The fifth most popular blog of 2024 was 'T4 Slip Boxes 24 and 26'. It breaks down everything you need to know about reporting deadlines and requirements, making sure you're on top of your game come tax season.

To keep things running smoothly during the T4 season (the deadline is the last day of February!), it's important to double-check employee addresses and manage those slip details carefully. Find out how to use CRA's online tools to file efficiently and avoid those pesky penalties. Plus, get answers to common questions about what happens if the business owner faces bankruptcy or passes away. Dive into the guide and tackle those T4 slips like a pro—it's all about making your payroll process as painless as possible!

#6 Cancel Your GST HST Account: The Financial Impact

Thinking about closing your GST/HST account? The sixth most popular blog of 2024, 'Cancel Your GST HST Account: The Financial Impact', gives you the scoop on what to expect. Whether you're selling your business, going on a new adventure, or just simplifying things, it's key to know the ropes before making the move.

Learn how to close your account online smoothly through CRA's My Business Account and prepare for the financial impact of goods and services tax. From paying back input tax credits on capital and non-capital property to self-assessing GST/HST at the time of closure, this guide has you covered with all the steps to ensure a smooth transition. Plus, find out why you might want to keep your GST/HST account by considering options like the Quick Method for reduced paperwork and tax savvy! Dive in and let us guide you through this process, ensuring you stay compliant and your business transitions smoothly!

Hey, I've even included some chair yoga stretches that can help you relax from the aches and pains you get from your desk work.

#7 Meals and Entertainment Expense Deduction

Unsure about how much you can write off for meals and entertainment in Canada? The seventh most popular blog of 2024, 'Meals and Entertainment Expense Deduction' helps you dodge the all confusion around what is and what is not deductible. Discover how to ensure your claims pass the CRA's audit-ready standards.

The rules are straightforward: Instead of the dream of writing off every lunch, meals and entertainment expenses generally fit into three categories—50% deductible, 100% deductible, or not deductible at all. Hosting a business lunch? That's 50% deductible. But grabbing lunch while running errands? Sorry, that's a no-go. And when expenses are 100% deductible, like staff parties or conferences, knowing the limits keeps your books in the clear. Dive in to learn the dos and don'ts of claiming these popular deductions—so you can stop holding your breath because now you know the rules!

#8 7 Keys to CRA Mileage Log Requirements

If you're using your personal vehicle for business, it's necessary to know about '7 Keys to CRA Mileage Log Requirements', the eighth most popular blog of 2024. Keeping a meticulous mileage log can save you from headaches with the Canada Revenue Agency (CRA) and preserve valuable deductions.

Key takeaways include maintaining a detailed or simplified logbook that tracks your business trips year-round, keeping essential records like business travel dates, destinations, and odometer readings, and organizing your supporting expense receipts like fuel and repairs. Whether you're self-employed or an employee, sticking to these inflexible rules ensures your tax deductions are have supporting documentation and will hold up during an audit. So start logging your miles and safeguard those valuable business deductions!

#9 Maintaining The Corporate Minute Book

If you haven't thought much about your corporate minute book, it might be time to start. The ninth most popular blog of 2024 explains that 'Maintaining The Corporate Minute Book' is an essential organizational tool for small incorporated businesses in Canada.

Why's it so important? Well, it keeps track of your company's critical decisions, from shareholder actions to board resolutions. It's required by law and plays a crucial role in audits, business sales, and financial compliance. While you can manage it yourself, having a lawyer do it can save you from legal headaches. So, have a chat with your lawyer about your minute book—it's your roadmap to keeping your corporation neat and legally sound!

9 Most Popular Blogs of 2024

There you have it. The nine most popular blogs of 2024 from this site.

As we revisited the 9 most popular blogs of 2024, it's clear to me that small business owners are seeking practical advice and insights on a broad range of topics related to running a successful business.

From mastering tax compliance and understanding subcontractor reporting, to maximizing deductions and meeting your legal requirements with regards your corporate minute book, these popular blog posts provide guidance tailored to the needs of Canada's small business owners like you.

Each chat reframes complex information into actionable steps, helping business owners like yourself plot a course of action through the complexities of onerous regulations. Many of the chats on this site aim to improve the management of your business's cash flow. By staying informed and proactive, you can tackle challenges with confidence, ensuring your business flourishes in Canada's ever-changing business world.

Back to top