- Essential Bookkeeping Habits For Audit Ready Books in Canada

- GST HST In Canada

- GST HST Filing Deadlines

GST HST Filing Deadlines

For Canadian Small Business

By L.Kenway BComm CPB Retired

This is the year you get all your ducks in a row! Start by starting.

Published January 1, 2024 | Edited May 20, 2024

WHAT'S IN THIS ARTICLE

Takeaway | Highlights of Post | Filing Deadlines | Annual Filers Tip | Good Habit | Filing Return Online | Paper Filing | 4 Ways to Pay | Improve Your Cash Flow | FAQ

NEXT IN SERIES >> How to File A GST HST Return

Get all your ducks in a row so you can file on time!

Get all your ducks in a row so you can file on time!Takeaway

- Your GST HST filing deadline depends on which of the four GST/HST reporting period you were assigned.

- You must file a nil return when you have no net tax to remit or no business transactions to report.

- Refunds due may be automatically applied to other outstanding government debts.

- Annual filers may be required to make quarterly GST HST installments.

Good Compliance Practices Don't Happen On Any One Particular Day. They Are Not An Event. They Are A HABIT.

Highlights Of This Post

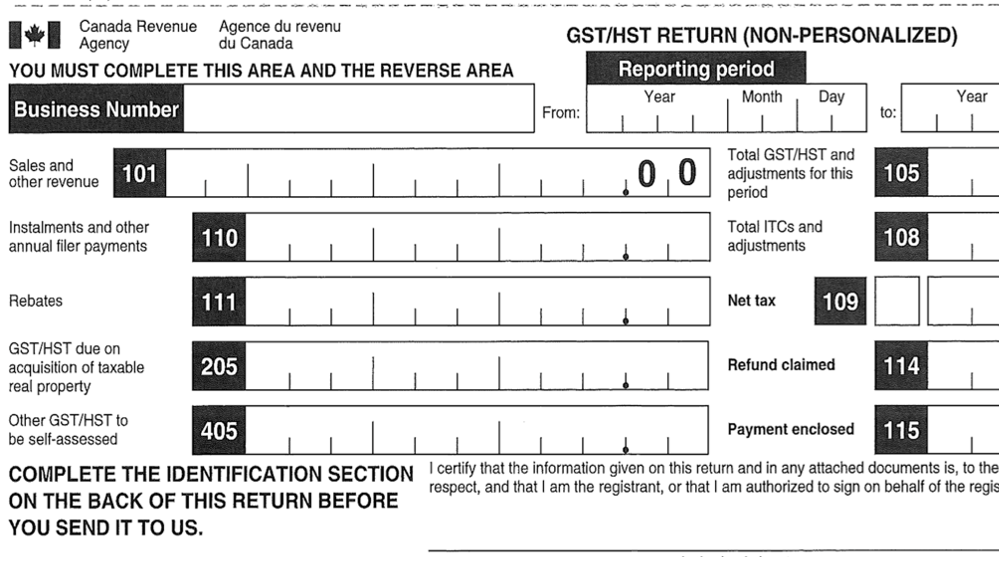

- GST HST Form GST34-2E

Your GST HST filing deadline/ due date is determined by your reporting period. Reporting periods are determined by your annual sales ... not whether you are a corporation or a sole proprietor.

If December 31 is your year-end reporting date ... and you are an annual filer, find out how to meet your April 30th payment deadline which is different from your June 15th filing deadline.

Annual filers can make their life easier and reduce their risk by filing quarterly.

Online filing is the preferred method to file. There are two ways to file online GST/HST NETFILE or My Business Account.

Paper Filing is still available if you are not required to file online.

Choose the payment method that best suits your needs after you've met your GST HST filing deadline.

The biggest MISTAKE new business owners make is to use funds collected in trust to finance their business or personal lifestyle. It's a really tough slog to get out of this rabbit hole once you fall down it. BREAK THE HABIT BY moving the money to a separate account; or remitting at regular intervals instead of just on the reporting due date.

GST HST Tax Filing Deadlines Form GST34-2E

Your tax filing deadline / due date for GST HST is determined by your reporting period. Reporting periods are determined by your annual sales ... not whether you are a corporation or a sole proprietor.

If the due date falls on a Saturday, Sunday or holiday, it moves to the next business day.

| Annual Sales | Assigned Reporting Period |

Optional Reporting Period |

GST Filing DEADLINE |

GST Payment DEADLINE |

GST Installments Due (See Tip) |

|---|---|---|---|---|---|

| L.T. 1.5 million | Annual NOT Dec 31 yrend | Monthly or Quarterly | 3 months after year-end | Same as filing deadline | One month after each of your fiscal QUARTERS |

| L.T. 1.5 million | Annual Dec 31 year-end | Monthly or Quarterly | June 15 | April 30 | April 30, July 31, Oct 31, Jan 31 |

| 1.5 to 6 million | Quarterly | Monthly | One month after end of reporting period |

Same as filing deadline | Not applicable |

| G.T. 6 million | Monthly | No options | One month after end of reporting period |

Same as filing deadline | Not applicable |

Annual GST HST Filing Deadline

If December 31 is your year-end date ... and you are an annual filer, consider this tip.

To meet the tax filing deadlines requirement and avoid interest charges, pay your GST/HST owing by the Balance Due Date of April 30th, even if you are filing by the June 15th deadline ...

Don't know if you are going to owe a payment or get a refund?

Your bookkeeper should be able to provide a fairly accurate ESTIMATE if your books are up-to-date. (You are getting your books done at least quarterly aren't you? If not, why not?)

If you want to switch from annual filing to quarterly filing (so you can recover your ITCs throughout the year instead of just once a year), it must be done before the end February. Complete Form GST20 Election for GST/HST Reporting Period ... or it can be done over the phone with a CRA representative.

Read more about GST/HST tax compliance here.

Help getting all your ducks in a row

Get all your ducks in a row so you can file on time!

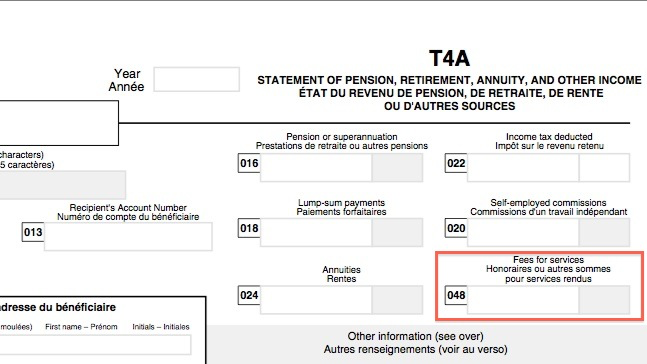

Get all your ducks in a row so you can file on time!What are you looking for? GST deadlines, payroll deadlines, business income tax, independent contractor deadlines ... WHAT! There are deadlines for independent contractors?

Funds Collected In Trust - Don't Fall Down This Rabbit Hole

The biggest mistake new business owners make is to use funds collected in trust to finance their business or personal lifestyle. It creates a vortex many small businesses never climb out of.

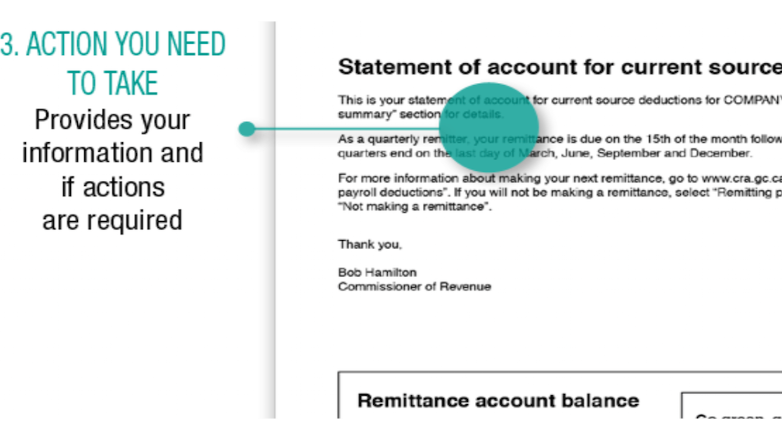

It's important to remember GST/HST funds (and payroll source deductions) are collected on behalf of the government. They are held informally in trust by your business until remitted.

Business owners get into financial trouble by failing to keep up with their compliance paperwork... which leads to them falling behind on their GST/HST remittances because ... they spent the GST/HST funds. There was no intentional duplicity on their part. It's just that they were positive they had enough input tax credits (ITCs) to offset the payment owing.

Money collected in trust is payable when due. Generally you cannot negotiate repayment terms with CRA for money held in trust like you can with income tax payable.

AUDIT READY

Taking this one action will ensure that you don't have huge tax amounts owing to the CRA which grow due to penalty and interest charges.

To reduce the temptation to spend trust funds for your own personal expenses ... or to cover your business expenses, open up a savings account. At regular intervals, transfer your GST/HST collected into this savings account. I suggest using the Quick Method Rate as the amount to set aside in this account.

When you file your GST/HST quarterly (or annual) reports, pay (or transfer) any amounts owing from this account.

CRA can and will collect unremitted trust funds by any means allowed under federal legislation such as seizure and sale of assets, garnishments, and assessment of directors.

If after setting up the savings account you still can't resist dipping into it to finance your business or personal lifestyle, my advice is to be kind to yourself and REMOVE THE TEMPTATION by making CRA installments instead of transfers to your savings account.

Remember, the money is NOT yours. The funds are held in trust. It's a really tough slog to get out of this rabbit hole once you fall down it. Please don't assume you have enough input tax credits (ITCs) to offset the GST HST payment owing.

Reference Source: CRA> Newsroom> Alert> 2010> Archived Tax alert - Abuse of source deductions and GST/HST amounts held in trust

GST HST Filing Deadlines

GST HST Return Filing Options

Option 1: Online Filing

Online filing is the preferred method to file ... making meeting your tax filing deadlines easier than ever. You should step outside of your comfort zone and try it if you are still filing a paper return. It's quick and easy to use. There are three ways to file online:

- GST/HST NETFILE - Your eight character access code can be found on your prior year Notice of Assessment.

- My Business Account - Accessing GST/HST NETFILE through the "File a return" link in My Business Account does not require an access code.

- Represent A Client Portal - Your bookkeeper or accountant can file the return for you if you have given them online access.

Each filing option includes the option to pay any amount owing by setting up a preauthorized payment with CRA. It requires a minimum of 7 days (or 5 business days) for the payment request to take effect.

CRA will no longer send you a paper filing package once you have made two consecutive electronic payments.

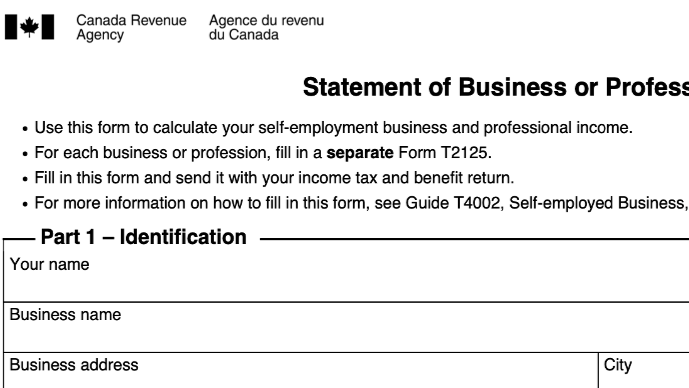

Option 2: Paper Filing Form GST34-2 or Form GST34-3

Paper Filing is still available if you are not required to file online. Your GST/HST return is paper filed on form GST34-2 E Personalized Return. The bottom portion of the form includes a line for remitting your payment.

Do NOT use form RC158 GST/HST NETFILE/TELEFILE Remittance Voucher ... or RC177 GST/HST Balance Due Remittance Voucher ... to remit your normal reporting payment. For normal reporting, use RC159 Amount Owing Remittance Voucher or use MY PAYMENT to pay online.

Four Ways to Pay Your GST HST Owing

When filing online (through GST/HST NETFILE or My Business Account) and a balance is owing, you have four ways to pay it:

- Pay it using CRA's new online service My Payment. There is a $50,000 threshold.

- Pay it online through your financial institution. You have to pay a one time admin fee to begin using the Bank's service ... and then transactional service fees.

- Setting up a pre-authorized debit agreement through My Business Account.

- Pay by cheque but this payment method is not encouraged any more.

- When paying by cheque, use form RC158 E, GST/HST Netfile/Telefile Remittance Voucher to remit your payment. This form is included on page 9/10 in your mail out from CRA.

- Page 7/8 of your reporting package has form RC177 E for balance due remittances required for use by annual filers.

Annual Filers: Improve Your Cashflow

Each assigned reporting period has an optional reporting period that you may opt for. If you are an annual filer, you should consider opting to file quarterly so you can claim your offsetting ITCs faster. Why?

When your net sales tax in a year is $3,000 or more, an annual filer must make equal quarterly installments (reporting them on line 110 of your GST return) in the next year ... without claiming the offsetting ITCs.

Small business owners often intermingle the GST funds collected with their own (instead of holding them in a separate account). Then they end up using the GST funds collected in trust to meet their cash flow requirements ... and get themselves in hot water when the GST funds collected are not available to remit to CRA come filing time.

AUDIT READY

By opting for a more frequent reporting period, you are less likely to think of the money as your own ... and less tempted to spend the funds held in reserve for the government ... with the added bonus of claiming your ITCs four times a year instead of once a year. That's why my preference is to reduce your risk by filing quarterly.

MORE >> Self Employed Cash Management System

FAQ about GST HST Filing Deadlines

FAQ about GST HST Filing DeadlinesFAQ on GST HST

How is my tax filing deadline determined?

How is my tax filing deadline determined?

Your GST HST tax filing due date is determined by your filing period. Filing periods are determined by your annual sales.

I file my GST return annually. I heard I should be make quarterly installments. Is that true?

I file my GST return annually. I heard I should be make quarterly installments. Is that true?

Possibly. When your net sales tax in a year is $3,000 or more, an annual filer must make equal quarterly installments (reporting them on line 110 of your GST return) in the next year ... without claiming the offsetting ITCs.

This is why you might want to consider filing quarterly as discussed earlier in this article.

Can I use GST collected on my own business until I have to file and remit?

Can I use GST collected on my own business until I have to file and remit?

No. These funds are collected in trust for the government. It is not your money to borrow or spend. If you are behind on your paperwork, please don't assume that your input tax credits will offset your GSTHST collected. You know what they say people who assume things. Yes I know you do!

If you are continually short of cash, seriously consider implementing this simple cash management system. Not only will it help you get control of your cash flow, it will help your year-end and tax preparation flow more smoothly too.

Back to top