- Essential Bookkeeping Habits For Audit Ready Books in Canada

- Payroll Manual

- Part 2 - Payroll Compliance and Reporting

Payroll Compliance and Reporting In Canada

For Small Businesses With Less Than 10 Employees

Applies To Contract Of Service Relationships | Employer - Employee Status

By L.Kenway BComm CPB Retired

WHAT'S IN THIS ARTICLE

Table of Contents | Introduction | We Are Here | Key Terms | Keeping CRA Happy | Year-End Task List | Working With Non-Employees | Your Legal Requirements | The Bottom Line

Learning the best practices to keeping the CRA happy makes your life easier.

Learning the best practices to keeping the CRA happy makes your life easier.Published February 25, 2025

PREVIOUS SECTION >> Part 1 - Setting Up And Processing Payroll In Canada

NEXT SECTION >> Payroll Tax Filing Deadlines - Form PD7A

Part 2 - Payroll Compliance and Reporting

Table of Contents

2.1. Keeping CRA Happy: Reports and Deadlines

A. Introductory Information (content directly on this page)

- Annual Filing Process Flowchart

- Year-End Task List

- Best Practices

- A Word About Minimum Wage

- CRA Hot Buttons To Avoid When Managing Payroll

- CRA Record Keeping Requirements

B. Specific Topics (links to separate supporting articles)

2.2 Working with Non-Employees

A. Introductory Information (content directly on this page)

- Hiring and Managing Independent Contractors

- Required Forms and Documentation (T4A, Contracts)

- GST/HST Implications

- A Special Category: The Incorporated Employee

B. Specific Topics (links to separate supporting articles)

- Why Worker Classification Matters

- Before You Hire A Subcontractor

- Do You Need A Written Agreement?

- Subcontractor Reporting Requirements

- T4A Information Slips

- T5018 or T4A? Which Slip Do You Use?

3. Reminders About Your Legal Obligations

Part 2 - Payroll Compliance and Payroll Processing For Less Than 10 Employees

Welcome to Part 2 - Payroll Compliance and Reporting

You're in the right place if you've made your first few payroll runs and are now ready to file your PD7A with the CRA. This will be monthly or quarterly, depending on what CRA assigned to you when you opened your payroll account.

While Part 1 focused on getting started with payroll, this section helps you maintain good standing with CRA and handle non-employee workers correctly.

I'll be focusing on keeping you compliant with CRA requirements and managing your relationship with non-employees (like contractors and incorporated employees). We'll walk through the key deadlines, forms, and best practices that small business owners need to know.

Think of this as your roadmap for:

- Staying on top of your CRA remittances and reports.

- Understanding which forms to file and when.

- Managing contractors and other non-employee workers properly.

- Meeting your basic legal obligations as an employer.

This practical guide builds on Part 1 of the Canadian Payroll Manual. If you haven't yet set up your payroll system or processed your first paycheque, you might want to start with Part 1.

Success is the sum of small efforts, repeated day in and day out.

Robert Collier

We Are Here (Let's Check In!)

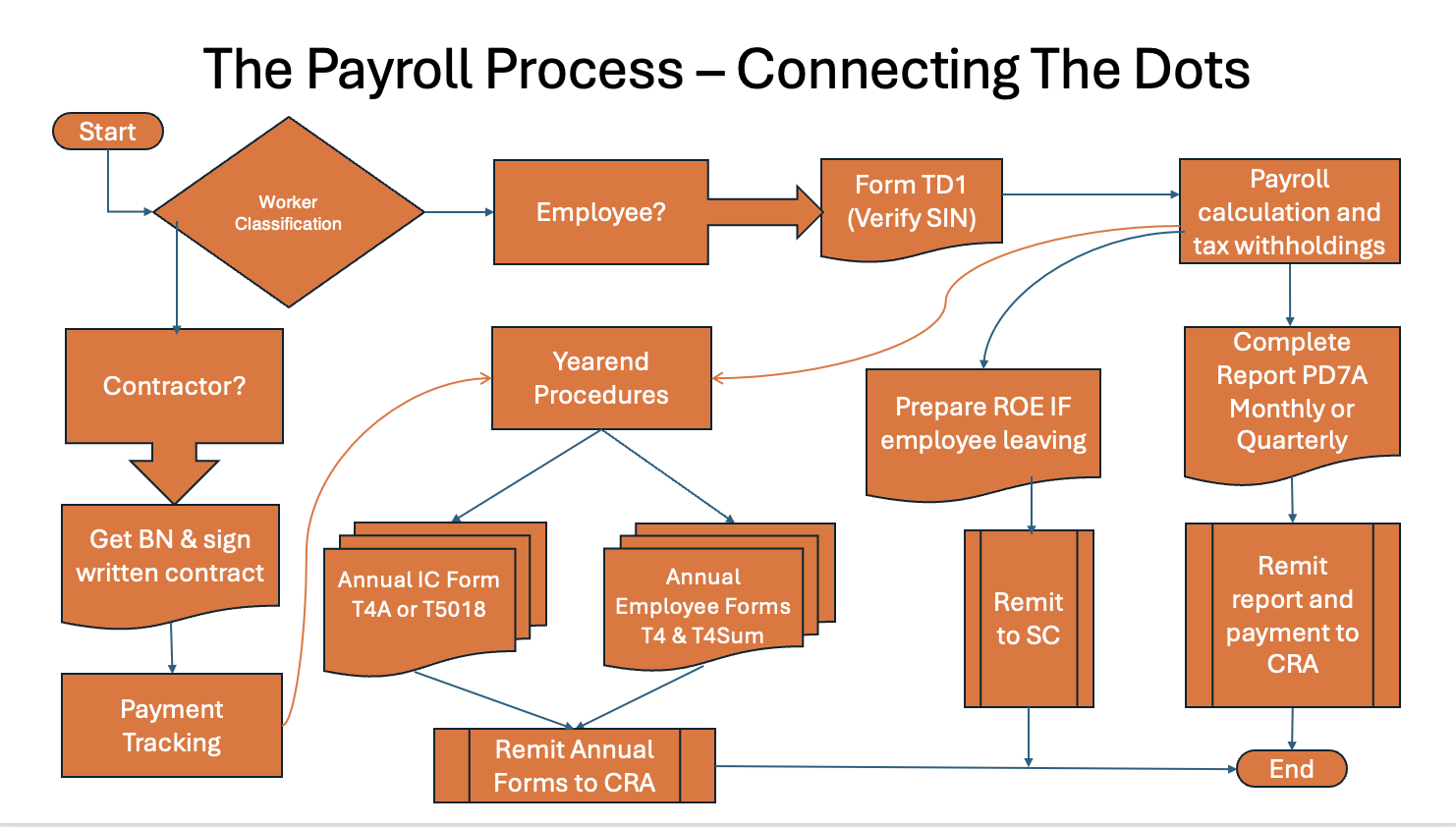

Before we jump in, let's see where we are in the overall payroll process. Remember our roadmap? You'll see this overview of the payroll process throughout the manual to help you stay oriented. Keeping referencing it if you are getting lost in the process.

In Part 1 of the Canadian Payroll Manual, we looked at worker classification all the way through to payroll calculation and tax withholdings.

In Part 2, we're going to be looking at the areas with arrows leading away from payroll calculation and tax withholdings (there are three of them) as well as the contractor workflow.

A simplified flowchart showing an overview of the payroll process.

A simplified flowchart showing an overview of the payroll process.See how the dots connect between the different forms and procedures.

Key Terms To Know

(Here are some important terms that are good to know)

- PD7A - Monthly remittance statement submitted to CRA showing what you owe for source deductions. It must accompany your remittances so CRA know what the monies are for.

- T4 Slip - Annual statement of earnings and deductions given to each employee due on or before February 28th.

- T4 Summary - Annual report to CRA summarizing all T4 slips issued due on or before February 28th.

- ROE - Record of Employment, required when an employee leaves or has an interruption of earnings.

- Remittance Due Date - Date by which you must pay source deductions to CRA (varies by employer type). CRA assigns this period when you open your payroll account. You must get their permission to change your remitting period.

- Pensionable Earnings - Income that requires mandatory CPP contributions be made (has a yearly maximum).

- Insurable Earnings - Income that requires mandatory EI premiums be paid (has a yearly maximum).

Let's take a look at what keeps CRA happy ...

CRA determines your remitter type by calculating your average monthly withholding amount. NEW EMPLOYERS usually start as monthly remitters.

CRA determines your remitter type by calculating your average monthly withholding amount. NEW EMPLOYERS usually start as monthly remitters.Canadian Payroll Manual

2.1 Keeping CRA Happy: Reports and Deadlines

Section TOC

- Annual Filing Process Flowchart

- Year-End Task List

- Best Practices (Start How You Want To Finish)

- A Word About Minimum Wage

- CRA Hot Buttons To Avoid When Managing Payroll

- CRA Record Keeping Requirements

Specific Topics (links to separate supporting articles)

This next section of the Canadian Payroll Manual addresses common payroll challenges faced by micro-businesses in meeting their reporting deadlines to keep the Canada Revenue Agency happy.

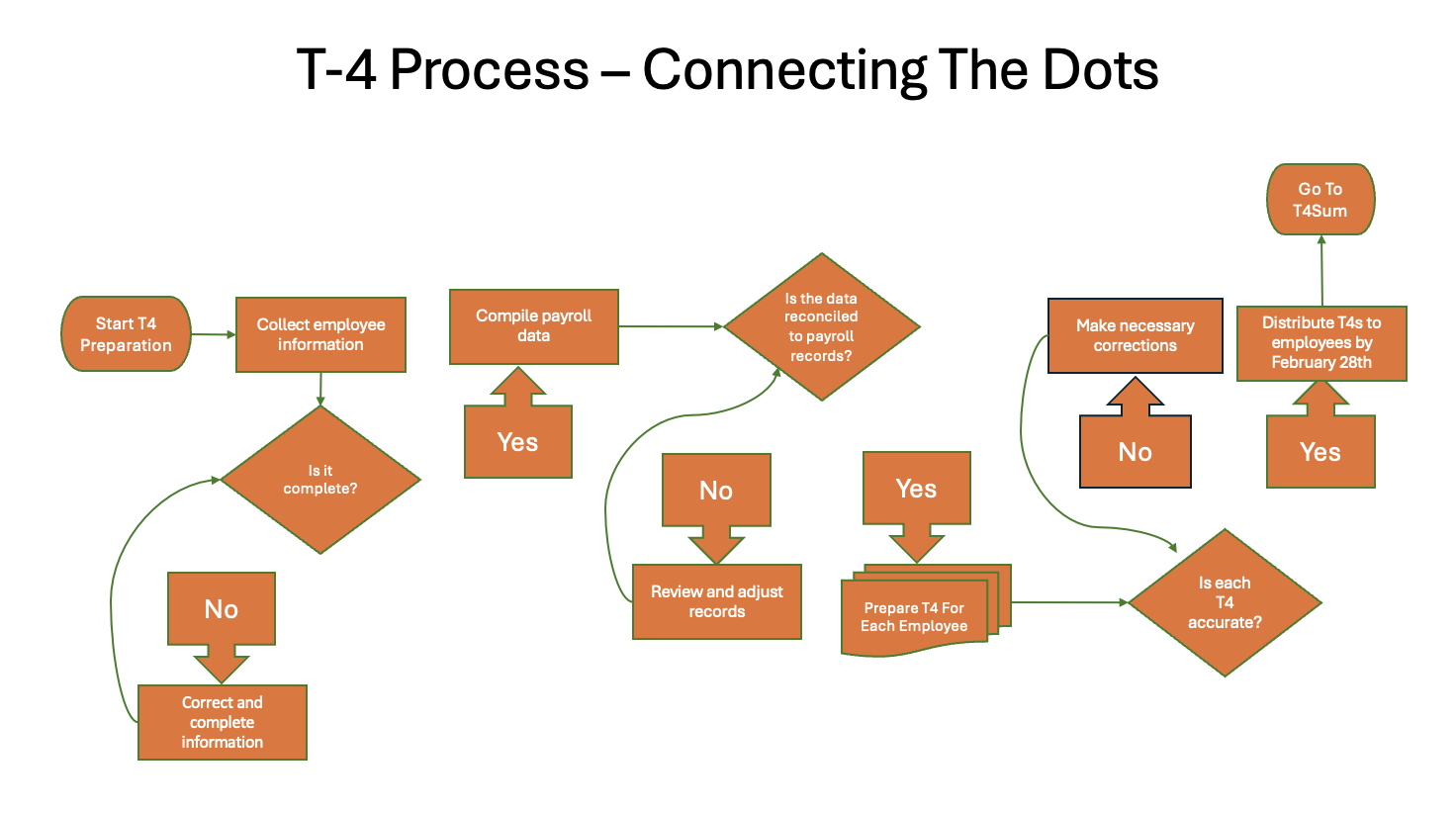

Annual Filing Process Flowchart

A picture is worth a thousand words!

A flowchart showing the T4 Statement of Remuneration Paid preparation process. Look how the dots between the different forms and procedures connect and flow.

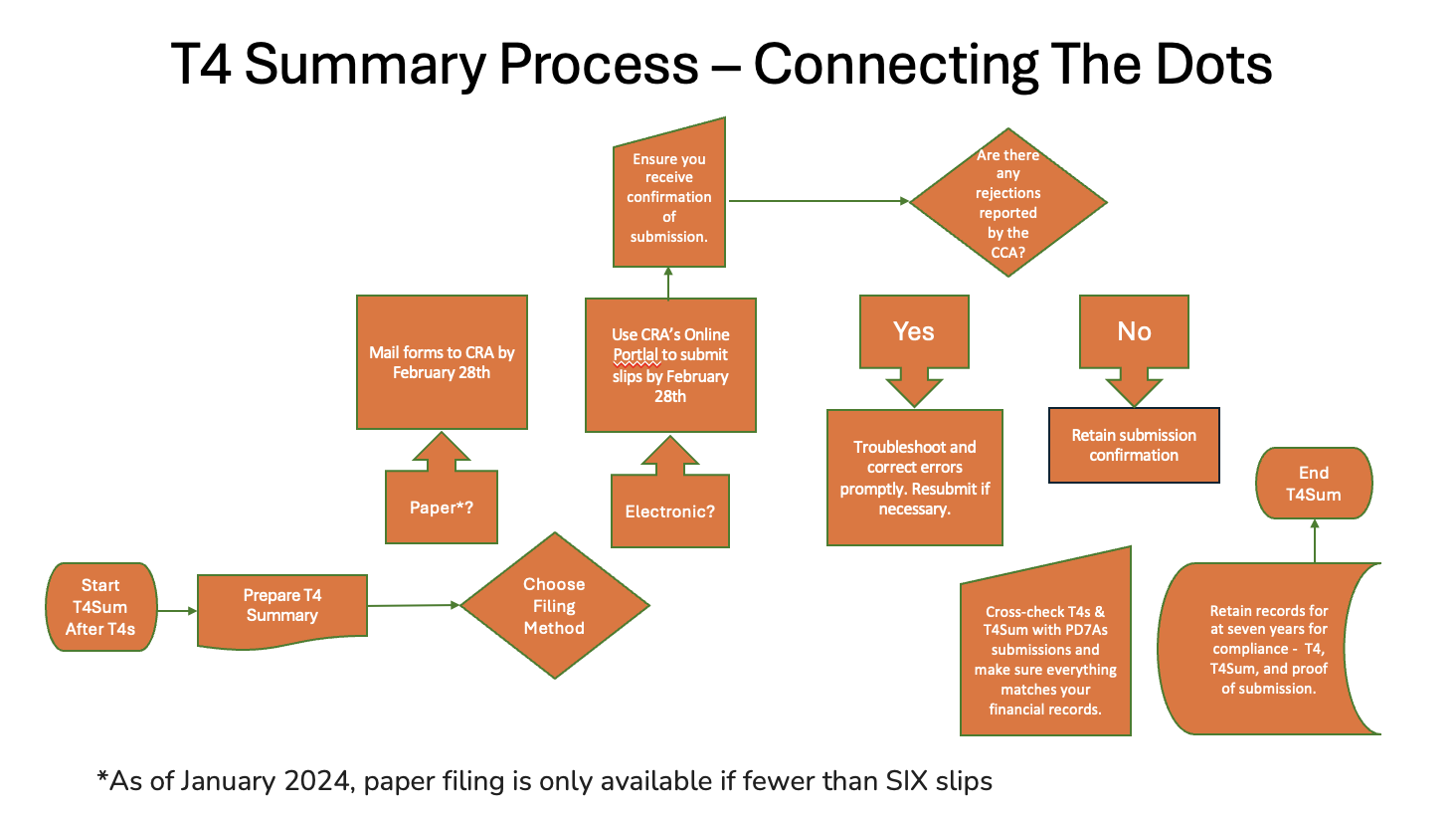

A flowchart showing the T4 Statement of Remuneration Paid preparation process. Look how the dots between the different forms and procedures connect and flow. A flowchart showing the T4 Summary of Remuneration Paid process. Look how the dots between the different forms and procedures connect and flow.

A flowchart showing the T4 Summary of Remuneration Paid process. Look how the dots between the different forms and procedures connect and flow.

Simplified Yearend Payroll Procedures Task List

As the year winds down, it's time to get your payroll all quacked up—I mean, wrapped up. 😉 If you've been tracking everything throughout the year, this won't be a massive task. Let's break it down shall we?

- Review Employee Information

Before you can close out the year, give your employee details a once-over. Start by confirming your employee details. Verify against the newest TD1 Form that the addresses, Social Insurance Numbers (SINs), and contact information are correct. Revise as necessary. Make sure you update any changes in pay, deductions, or benefits, make sure they are recorded accurately.

🦆 Duck Tip: Have your employees complete a new TD1 form every December so you know you have the most up-to-date for your T4 slips. It's a when employees get on social media complaining they haven't received their T4. Later they find out - oops! I forgot to give my employer my latest address and email.

🦆 Another Duck Tip: Need help with employee verification procedures? The article 'Hiring Your First Employee' walks you through the process step by step. - Reconcile Payroll Records

Now it's time to match up those numbers. Cross-check payroll totals by comparing your year-to-date payroll summary with actual payouts throughout the year. Validate deductions by double-checking that all deductions, like income taxes withheld, Canada Pension Plan (CPP) contributions and Employment Insurance (EI) premiums, are correct. - Calculate Bonuses

If you're rewarding your employees with a year-end bonuses, here's your reminder to include them in the final figures. How? Make sure bonuses are calculated and included in the final pay for the year. Heads up that your withholding on bonus payments might differ from regular pay. - Prepare T4 Slips (Statement of Remuneration Paid)

This may sound like a quack-load of paperwork, but it’s unavoidable. You have to create a T4 slip for each employee. A T4 slip summarizes an employee's annual earnings and deductions. You need to plan to distribute all the slips by February 28th deadline. You can hand them out or electronically deliver them (see sidebar) to your employees but it must happen before or on by the last day of February. - EFILE the T4 Summary to CRA

Important Update: Starting January 1, 2024, if you issue more than five (5) information slips, you must file electronically. Paper filing is only allowed if you have five or fewer slips to submit.

Get everything squared away with the government by compiling and submitting your T4 Summary. The T4Sum is a total summary of all the T4s you issued which you must send to the CRA by February 28th. Make sure the total matches the sum of all your individual T4s.

🦆 Duck Tip: Most payroll software includes electronic filing capabilities, making this process much easier. If you're still doing manual payroll and need to file more than five slips, consider using CRA's Web Forms application - it's free!

🦆 Duck, Duck, Do! Ensure you retain copies of T4s and related documents for at least seven years to be in compliance with CRA's business record-keeping requirements. - Set Up Vacation Pay Accruals (if applicable)

Don’t let vacation pay throw you off balance. Review the labour laws around vacation pay. You need to calculate any accrued but unused, vacation pay so it’s ready for next year. If you use payroll software like QBO Canada Payroll Core, I believe an employee's vacation time balance will automatically carry over into a new calendar year saving you the hassle of yearend calculations around unused vacation pay. Right there, this makes using payroll software mandatory ... for me.

My time (and yours) is valuable too but it is worth your time to check that the program rolled the correct amounts forward into the new year. - Back Up All Records

Imagine a digital 🦆 duck-pond archive! Secure your data by implementing automatic, regular backups of payroll records. If you’re using payroll software, most will offer automated backup options. I also like to download PDF copies of all my payroll reports after each payroll run.

🦆Duck Wisdom: When setting up your routine for data backup, remember the 3-2-3 backup rule. The rule says to setup a system that enables disaster recovery in two different ways (offline and online) is:

(i) to keep at least three (3) copies of your data,

(ii) store your information on two (2) different storage media,

(iii) with at least one (1) of them located physically offsite plus (2) stored in the cloud in different geographical areas.

🦆 Duck Tip: Regularly test the restore process to ensure that your backup files work effectively when you need them. You don't want to learn you can't restore data during a crisis. - Planning For Next Year

Before you close your books for the year, let's get your ducks in a row for the new payroll year coming up.

8a. Payroll Calendar Setup

Staying ahead is key to reducing stress. Plan your payroll dates in advance. Map out your payroll schedule for the new year, making sure to factor in compliance with any statutory holidays.

Pull out your calendar (digital or paper - whatever works for you) and mark your regular pay dates for the year, statutory holidays that might affect banking/processing times, remittance due dates (monthly or quarterly), and T4 deadline (February 28th).

🦆 Duck Tip: If your first pay date of the new year falls close to January 1st, plan ahead. Banks are closed on New Year's Day so you'll need extra processing time.

8b. System Updates

Make sure your payroll system is ready to roll in the new year.

If you use payroll software: Watch for the automatic tax table updates (usually available late December). Verify the update installed correctly by running a test calculation. Check that vacation pay balances carried forward accurately.

If you calculate manually: Download the new Payroll Deductions Tables from CRA's website. Update your spreadsheet formulas with the new rates. Double-check your remittance schedule - it might change based on your previous year's payroll volume.

🦆 Duck Tip: This is why I love payroll software - it handles these updates automatically. Worth every penny for the time saved and peace of mind!

8c. Employee Updates

Start the year fresh with updated employee information. Review pay rates and scheduled increases. Update TD1 forms if needed. Confirm benefit deductions are correct. Verify vacation pay calculations and balances.

Remember to document any changes in your payroll records - your future self will thank you! - Tax Updates

Using payroll software? They'll update the tax tables automatically (usually late December). Calculating manually? Download the new Payroll Deductions Tables from CRA. Double-check if your remittance schedule changes based on your previous payroll volume.

🦆 Duck Tip: This is yet another reason I recommend using payroll software - they handle tax table updates automatically. One less thing for you to worry about! - Evaluate and Seek Improvement

Use this opportunity to streamline. This simplified task list is just your starting point. Refine your processes by reflecting on this year's process and pinpoint any areas for improvement. Then revise this task list (on a regular basis) to make it customized to your business.

🦆 Want More Detail? Check out Wagepoint's comprehensive year-end checklist [wagepoint.com/blog/payroll-year-end-checklist-canada/]. They're a leading Canadian online payroll provider, and their list covers everything from A to Z. While some items might not apply to your small business, it's a great resource if you want to dive deeper. ADP Canada usually has a good list as well.

And there you have it! Follow this simplified checklist and you’ll strut into the new year with your payroll duck feathers perfectly aligned. Remember, consistent habits build the path to a stress-free payroll system. You’ve got this!

Additional Tips for Year-End Payroll

- Review Employee Benefits: Ensure all taxable benefits have been accurately reported and included in payroll calculations.

- Check for Compliance Updates: Keep an eye on any new federal or provincial payroll regulations that might come into effect in the new year. I like to check 'What's New For Payroll' on the CRA website. I also sign up for their newsletters.

- Bookkeeper or Accountant Review: I'm going to say this ...If possible, have a second pair of eyes, such as a bookkeeper or accountant, review your year-end reports for any discrepancies ... but honestly if you have a bookkeeper, you shouldn't be doing the payroll runs or the year-end procedures. Delegate this responsibility to your bookkeeper. Free up some time to spend with your family or friends. It will give you work-life balance which is hared to establish in your start-up years.

Best Practices All Year Long

(Start How You Want To Finish)

Let's talk about making your payroll life easier. The Canadian Payroll Manual emphasizes starting with good habits. Here are practices that will help you stay organized and compliant.

- Set a Consistent Payroll Schedule: It will reduce your stress. Decide whether you'll run payroll bi-weekly or semi-monthly, and stick to it. Process payroll the same way each time. Keep a payroll calendar marking all due dates. Use a checklist for your payroll process. Consistency is your friend here.

- Digital is your friend too: Scan paper documents (but keep originals of signed forms). Use cloud storage with backup. Create a simple folder system by year and employee.

- Use Simple Payroll Software: Payroll software simplifies your life and minimizes errors. It's takes a lot of the burden of tracking 'what's new'. Just make sure to choose a user-friendly payroll software that automates tax calculations and direct deposits. At this stage in your business, you should be able to get by with their most basic payroll service. It's unlikely you will need all the bells and whistles of the more advanced modules.

- Keep Employee Records Up-to-Date: It will make your life easier once you start preparing your T4s if employee records are up-to-date. Develop the habit of updating employee information as soon as there are changes. Encourage employees to notify you of changes promptly. Get organized by creating a separate folder for each employee, keeping current year records easily accessible, moving older records to 'archive' storage, and labeling everything clearly with dates.

🦆Duck Tip: Set a reminder in your calendar for January each year to archive the previous year's records and start fresh folders for the new year. - Meet Tax Compliance Deadlines: Avoid penalties and have smooth operations by filing and remitting on time. Familiarize yourself with your basic Canadian payroll tax deadlines. Remember you are running your business. It should not be running you!

- Simplified Policies: It's simple. Clear rules lead to fewer misunderstandings. Write simple, clear policies about pay schedules, vacation time, and any other pertinent payroll information. Share this with your employee(s) upfront. Just be sure to keep it up-to-date. Remember, start how you want to finish. So even if you only have one employee now, get all yours in a row to set yourself up for seamless growth.

🦆Duck Tip: If writing isn't your thing, do a video instead. - Have a Contingency Plan: You want to be prepared for those "just in case" moments like system failures, personnel absences, supplier issues. Identify someone trustworthy who can step in if you're unavailable. Keep a cheat sheet of the essential payroll steps for them. Automatically backup your data.

🦆Duck Tale: Here is a real life 'Oh S**t!' story that happened in 2024. Bench Accounting unexpectedly closed on December 27, 2024, after 13 years of helping businesses. They had a solid reputation. With no notice, clients were left without access as the platform went offline. Fortunately, client access to their data was restored when Employer.com stepped in and acquired the company by December 30, 2024. This is never ideal, but stuff happens. The timing just before the end of the year could have been disastrous. In all fairness to Bench, they were making arrangements with clients to access their data so they could transition to another platform of their choosing. Still it could have left business owners a couple of weeks behind once they got setup on a new platform. - Open Communication: Engaged employees are more likely to report issues early, allowing you to address them promptly. Let employees know they can come to you with questions.

- Secure Handling of Payroll Data: Protect both you and your employees by taking data security seriously. Safeguard your payroll information with secure passwords and manage access to sensitive data carefully.

A Word About Minimum Wage

Remember that employment labour standards affect your payroll calculations. You'll need to ensure your payroll system accounts for:

- Current minimum wage rates

- Overtime calculations

- Vacation pay accrual

- Statutory holiday pay

For detailed information about these requirements, see my Canadian Employment and Labour Standards page.

CRA Hot Buttons To Avoid When Managing Payroll

This section of the Canadian Payroll Manual highlights common mistakes that small business owners should watch out for.

Record Keeping Gaps

- Hot Button: Not maintaining required payroll records for 7 years.

- 🦆 Getting Your Ducks Aligned: Create a simple filing system (digital or paper) that includes pay statements, T4s and T4 summaries, TD1 forms, ROEs, time sheets, payroll registers, and documentation supporting taxable benefits. Digital records must be accessible and readable.

Misclassifying Workers

- Hot Button: Incorrectly treating employees as independent contractors.

- 🦆 Getting Your Ducks Aligned: Understand the key differences between employees and contractors. When in doubt, use CRA's online assessment tools, their RC 4110 checklist, or seek professional guidance. The consequences of misclassification can be severe (back taxes, penalties, interest).

--- Sidebar ---

I feel I need to chat a bit more about CRA's online tools. Using CRA's online tools (like the payroll deductions calculator or the RC4110 employee vs. contractor tool) provides a reasonable basis for your payroll calculations and worker classifications. If you use these tools correctly and input accurate information, the CRA will generally accept the results. This means they likely won't penalize you if they later find a minor discrepancy.

However, it's not absolutely binding in all cases. There might be unique circumstances or complex situations where the CRA could challenge the outcome of their own tools. For example: incorrect information is used, your unique circumstances have nuances not captured by their tools, a court interprets the law differently than the CRA's tools.

--- End Sidebar ---

Miscalculating Deductions

- Hot Button: Incorrectly calculating or misapplying payroll deductions for income tax, CPP, and EI.

- 🦆 Getting Your Ducks Aligned: Use reliable payroll software or services that keep tax calculations up-to-date. You risk penalties and interest if you have incorrect calculations.

Regularly review official guidelines or consult with your payroll advisor whoever that may be.

Missing Filing Deadlines

- Hot Button: Forgetting to file forms and remit payroll taxes by deadline.

- 🦆 Getting Your Ducks Aligned: Mark important dates on your calendar and set automated reminders.

T4 Reporting Errors

- Hot Button: Incorrect reporting of taxable benefits or missing T4 boxes.

- 🦆 Getting Your Ducks Aligned: Review T4 requirements carefully, especially for common items like vehicle allowances or health benefits.

--- Sidebar ---

I feel I need to chat a bit more about this hot button. Let me give you an example. A frequent T4 reporting error involves incorrectly handling automobile allowances. Employers may mistakenly report a reasonable allowance as a taxable benefit or fail to properly separate the taxable portion of an unreasonable allowance for accurate income and CPP/EI reporting.

Note: It is my understanding that the CRA employs a results-oriented approach to auditing taxable benefits, meaning they don't preemptively target specific benefit types. Instead, if they identify a trend - for example, issues with automobile benefits - they will incorporate checks for that specific benefit into all their compliance audits. It is often industry specific.

--- End Sidebar ---

🦆 Duck Tip: It's important to maintain clear documentation of how taxable benefits are calculated, especially for automobile allowances. This is low hanging fruit during an audit.

Neglecting Backup of Payroll Data

- Hot Button: Failing to back up payroll data can lead to data loss due to system failures.

- 🦆 Getting Your Ducks Aligned: Regularly back up your payroll data and maintain an additional copy in a secure cloud or off-site location as your affordable tech option. Don't forget creating a PDF payroll reporting package as part of your backup plan. This is what I call a low tech option.

Overlooking Provincial Employment Standards

- Hot Button: Ignoring provincial-specific employment standards that might affect payroll.

- 🦆 Getting Your Ducks Aligned: Familiarize yourself with the labor standards in your province and ensure your payroll process complies with these regional requirements.

Inconsistent Payroll Schedules

- This is more of a pitfall that can lead to a hot button: Irregular payroll processing leading to confusion and errors. While inconsistency itself isn't a direct violation, it can lead to errors that become CRA issues.

- 🦆 Getting Your Ducks Aligned: Establish a consistent payroll rhythm—like clockwork, pay your ducks consistently to keep them in line. Stick to your set schedule to maintain order.

By keeping these hot buttons and pitfalls in mind while incorporating preventative measures into your habits, you'll keep your payroll process smooth and stress-free—just like ducks gliding across calm water! The key is habit formation, which will help keep your ducks in a row.

CRA Recordkeeping Requirements

Let me explain what CRA expects from you as an employer when it comes to keeping payroll records. I know it can seem overwhelming, but for a small business with less than 10 employees, the Canadian Payroll Manual shows you how it's manageable if you stay organized.

What Records Do You Need to Keep?

The basics you must keep for each employee:

- Their SIN and current address

- The dates they worked for you

- Their salary or wage rate

- All their earnings and deductions (broken down by type)

- Vacation pay calculations

- T4 information

- TD1 forms (both federal and provincial)

How Long Do You Keep These Records?

Here's the simple rule, keep everything for 7 years. For example, if you're looking at 2025 payroll records, keep them until December 31, 2032.

Canadian Payroll Manual

2.2 Working With Non-Employees

When you're thinking about bringing an independent contractor on board, I know it feels just like hiring an employee—but there are important differences to keep in mind.

When you're thinking about bringing an independent contractor on board, I know it feels just like hiring an employee—but there are important differences to keep in mind.Section TOC

- Hiring and Managing Independent Contractors

- Required Forms and Documentation (T4A, Contracts)

- GST/HST Implications

- A Special Category: The Incorporated Employee

Specific Topics (links to separate supporting articles)

- Why Worker Classification Matters

- Before You Hire A Subcontractor

- Do You Need A Written Agreement?

- Subcontractor Reporting Requirements

- T4A Information Slips

- T5018 or T4A? Which Slip Do You Use?

This next section of the Canadian Payroll Manual addresses common payroll challenges faced by micro-businesses when working with independent contractors rather than employees.

So, you've gotten your ducks in a row with your employees—great work! Now, let's chat about another important aspect of your business: working with independent contractors. Understanding how to hire, manage, and report for independent contractors can help maintain a smooth operation Your life will be better if you can save yourself from headaches with the CRA!

Hiring and Managing Independent Contractors

When you're thinking about bringing an independent contractor on board, I know it feels just like hiring an employee—but there are important differences to keep in mind. Determining whether someone is truly an independent contractor rather than an employee is not a trivial matter. Worker classification affects everything from tax obligations to legal responsibilities.

You don't provide contractors the same benefits and withholdings as you would for employees. They generally work independently, supply their own tools, and have the opportunity for profit or risk of loss. Make sure this distinction is in writing—draft a clear contract that outlines the terms of engagement, deliverables, payment terms, and intellectual property rights.

Required Forms and Documentation

To keep everything in line, there are a few critical pieces of documentation you will need:

- Independent Contractor Agreement: This isn’t just a good idea—it's a must have. Your agreement should clarify roles, responsibilities, project details, payment schedule, and termination conditions.

- T4A Slip: You'll need to issue this slip when you pay someone $500 or more for business services outside of regular employment. Think of it as your way of reporting to CRA who you paid for what services. CRA may do a matching audit or field audit to make sure your IC reports the income on his/her tax return.

Think of this slip as your "services rendered" slip. You need this when you pay someone who isn't your employee for services. Common examples are:

- Freelance writers

- Independent consultants

- Professional speakers

- Board members receiving fees

You're spot on if you noticed that the T4A is for services, not products. If you buy products from vendors, you don't need to issue a T4A. Just keep those receipts for your business expenses. Visit my article on T4A slips for more in-depth information about T4A requirements and tips. - T5018: This is specifically for construction subcontractors. If you're paying subcontractors for construction services (like renovations, plumbing work, electrical work), you need to issue a T5018 when you pay them more than $500 in a calendar year.

So here's a quick way to get these ducks in line:

- Buying products? → Keep the receipt, no slip needed

- Paying for services (non-construction)? → T4A

- Paying for construction services? → T5018

Don't forget to keep well-organized records of all payments, as you'll need these for tax purposes. Maintaining detailed records will also save you time and potential stress when the CRA comes knocking.

GST/HST Implications

GST/HST can be a tricky aspect of working with contractors, especially if you're new to business. I've got some suggestions for you to consider:

- Registration: Contractors and businesses must typically register for GST/HST if their taxable revenues exceed $30,000 in a year. Make sure your contractor is doing their part if this applies.

- Invoicing and Input Tax Credits: When you receive an invoice from a contractor, it may include GST/HST. You can generally claim this as an Input Tax Credit on your returns, assuming your business is registered and you’re entitled to do so. When you are registered for GST/HST, the effect on your business is neutral.

Again, keep those documents tidy and organized—it's all part of making sure your ducks are neatly in a row.

Personal Services Business - A Special Category

The Incorporated Employee Is Not a Contractor or Self-Employed

The Canadian Payroll Manual addresses this special category because many small businesses encounter PSB situations. I'm going to address PSBs from two perspectives: (1) the business owner considering hiring an incorporated employee, and (2) the incorporated employee considering this arrangement.

As a small business owner, you might come across someone who wants to work with you through their corporation instead of being hired as an employee. This arrangement is sometimes called an 'incorporated employee' and their corporation might be considered a Personal Services Business (PSB) by CRA. Let's break this down in plain language.

What Is A PSB, Really?

Howard Levitt, a Canadian employment lawyer, describes personal services businesses as an intermediary category of workers that own their own business but are largely dependent on one client.

Why Did PSB Rules Come Into Existence?

Although a personal services business (PSB) is a Canadian Controlled Private Corporation (CCPC), it operates under different rules. PSB rules came into existence to prevent family owned corporations and/or incorporated employees from gaining access to the small business deduction.

An Example:

Remember Laura, the certified professional bookkeeper (CPB)? Let's revisit her work relationship with your business.

Laura is a bookkeeper (CPB) who incorporated herself as 'Laura's Bookkeeping Solutions Inc.'. She works mostly or only for your business, using your office and following your schedule. CRA might view Laura's corporation as a PSB.

For Business Owners Considering Hiring an Incorporated Employee:

Why Would A Business Want To Enter Into This Type of Relationship?

Usually business owners, like yourself, want an incorporated employee relationship to avoid costly payroll taxes and clearly define the intent of their working relationship as not that of employer-employee. This arrangement shifts the administrative burden and ongoing costs to the incorporated employee.

Business Owner Alert

If you hire an incorporated employee, you are not responsible for withholdings as you are entering into a contract for services. You do need to be aware incorporated employees can sue for wrongful dismissal and Mr. Levitt says you still have secondary liability if the worker doesn't pay their self-employment taxes.

What a PSB Worker Relationship Means for You as a Business Owner

- You don't deduct CPP, EI, or income tax.

- Laura will bill you through Laura's Bookkeeping Solutions Inc., her corporation.

- You still need a clear written contract

- Watch out! You could be liable if (1) Laura doesn't pay her self-employment taxes, or (2) you terminate the contract (Laura can sue for wrongful dismissal).

For Workers Considering Incorporating to Provide Services:

Dependent Contractor / Non-Employee Alert

There is a tax issue when you are a sole shareholder and employee of a corporation in Canada. Incorporated employees need to be aware of this tax issue and how it affects them.

Today's PSB rules, which have changed significantly in recent years, may have marked negative tax consequences for the incorporated employee. Be aware that you will take on additional administrative burden and ongoing costs, including corporate tax filings, GST/HST registration and reporting, and corporate record keeping.

Important PSB Considerations for Both Parties

Red Flags to Watch For

Remember Laura? She might be considered a PSB by CRA, if she works mainly or only for you, uses your equipment, follows your schedule, and takes direction from you like an employee would.

CRA Audit Alert

The Canada Revenue Agency launched a PSB audit project in 2022. Their initial findings show significant non-compliance, particularly in transportation, professional services, and construction industries. If you're considering a PSB arrangement, be aware that CRA is actively reviewing these relationships and enforcing compliance.

For detailed information about CRA's three-phase audit project and its implications for both parties, click here.

🦆 Duck Tip: If you're unsure, it's worth getting professional advice. The cost of getting it wrong can be expensive!

Canadian Payroll Manual

3. Reminders About Your Legal Requirements

Remember to consider your various legal obligations when hiring employees

Remember to consider your various legal obligations when hiring employeesThis next section of the Canadian Payroll Manual addresses the legal obligations faced by micro-businesses when hiring employees.

- Tax Filings and Remittances: Employers must remit employee payroll deductions (including employees' income tax withholdings, EI premiums, and CPP contributions) to the CRA on or before the due dates.

Consequences: Late filing and remittances can result in penalties and interest charges. A good practice is setting reminders well before deadlines to avoid overlooking these obligations. - Accurate Record Keeping: It's extremely important to maintain accurate payroll records for each employee, as mandated by the CRA and provincial employment standards.

Consequences: Incorrect record-keeping can lead to audits and fines as well as employee complaints. Ensure your records are up-to-date and properly organized. - Compliance with Employment Standards: Be aware of federal and provincial employment standards rules regarding overtime, vacation pay, and statutory holidays as well as terminating an employee. (Things can sometimes go sideways pretty quickly in a small business.)

Consequences: Non-compliance can lead to employee grievances and legal challenges. Regularly review standards and ensure your payroll practices align with them.

🦆 Duck Tale: This first came on my radar when an employee went to Employment Standards about a pay issue instead of coming to me first. I pushed back on the Employment Standards officer that they should not have agreed to address the issue [non-issue] before she had discussed it with me. The employee did not give me a chance to address the issue which was an easy fix. The officer agreed. But I took the opportunity to learn what should have happened, etc.. - Privacy and Confidentiality: Protect employees' personal and payroll information under privacy laws.

Consequences: Breaches of confidentiality can lead to legal issues and damage your business's reputation. Invest in secure systems and train your staff in privacy best practices.

The Bottom Line

I know running payroll isn't the most exciting part of being a business owner - I get it. As this Canadian Payroll Manual has shown, managing payroll for a small business doesn't have to be overwhelming. But getting it right is really important for your business, your employees, and your peace of mind. The good news? Once you've got your systems in place and understand the basics we've covered in this manual, it becomes much more manageable.

Remember, you don't have to be perfect, but you do need to be diligent. Keep good records, stay on top of deadlines, and when in doubt, reach out to the CRA or a payroll professional for guidance. Your employees are counting on you to process their pay accurately and on time - and with the foundation you now have, you can deliver on that responsibility.

Still feeling overwhelmed? That's normal. Just take it one pay period at a time, and you'll find your groove.

RETURN TO >> Table of Contents