- Essential Bookkeeping Habits For Audit Ready Books in Canada

- Canadian Controlled Private Corporations

- Incorporating your business

When Should You Incorporate As A CCPC In Canada?

Is Incorporating Right For YOUR Business?

By L.Kenway BComm CPB Retired

Revised November 16, 2024 | Originally Published on Bookkeeping-Essentials.co in 2009

WHAT'S IN THIS ARTICLE

Should You Incorporate As A CCPC? | Advantages of Incorporating | Disadvantages of Incorporating | When Not to Incorporate | Additional Considerations | My Takeaways | My Conclusion | Tax on Split Income (TOSI) Rules | CCPC Image Index

NEXT IN SERIES >> Creating and Maintaining The Corporate Minute Book

Should You Incorporate As A CCPC?

You operate a business as a sole proprietor or a partnership. Is it the right time to incorporate your business as a CCPC? Should you incorporate as a CCPC?

Keep reading to find the answer ...

There is little tax advantage for a sole proprietor to incorporate if the owner intends to withdraw all profits instead of leaving them in the company.

There is little tax advantage for a sole proprietor to incorporate if the owner intends to withdraw all profits instead of leaving them in the company.Deciding whether to incorporate your business as a sole proprietor involves several considerations. Let's look at some key factors that can help you evaluate whether you should incorporate as a CCPC so you can determine if incorporation is right for your business:

PLEASE TAKE NOTE

This chat gives you TALKING points to DISCUSS with your accountant ...

because incorporation isn't right for every business.

Should You Incorporate as a CCPC?

Advantages of Incorporating

- Limited Liability: As a corporation, your personal assets are typically protected from business liabilities and debts, unlike as a sole proprietor. However, directors can still be personally liable in certain situations and personal guarantees bypasses certain areas of protection.

- Tax Planning and Deferral: Corporations in Canada may benefit from potential tax advantages, such as income splitting with family members and deferring personal taxes by leaving profits in the business at a lower corporate tax rate.

- Income Splitting: You might be able to split income with family members through dividends, where permissible, potentially reducing your overall tax burden. However, you need to make sure you don't run amok of TOSI (tax on split income) rules.

- Access to Capital: Corporations might find it easier to raise capital. Investors often prefer to invest in incorporated entities.

- Continuity: A corporation has a perpetual existence, meaning it continues to exist even if you leave or sell your business.

Should You Incorporate as a CCPC?

Disadvantages of Incorporating

- Incorporation and Annual Reporting Costs: Incorporating a business involves upfront costs for legal and accounting services. These costs can vary significantly depending on the complexity of the business and the jurisdiction. In addition to the initial costs, there are ongoing annual expenses for filing corporate tax returns, maintaining records, and possibly holding annual general meetings. Can your business handle these additional costs?

- Complexity and Compliance Reporting: Once incorporated, a business must adhere to various compliance regulations, which include filing annual reports, maintaining corporate records, and managing payroll taxes as you now become an employee. There are also specific administrative requirements around issuing shares, appointing directors, and keeping minutes of meetings. This can increase the complexity and administrative burden of running the business. Are you good at keeping up with your business's paperwork? Do you enjoy paperwork enough to take on more?

- Trapped Losses: Unlike in a sole proprietorship, losses incurred by a corporation cannot be used to offset the personal income of the shareholders. This limits personal tax planning strategies. These losses remain in the corporation and can only be used to offset future corporate income. This can be seen as a disadvantage, especially for new businesses that may not generate profit in the initial years.

- Double Taxation: Corporations face the issue of double taxation, where the company pays corporate taxes on its earnings, and shareholders pay taxes on dividends. The effectiveness and implementation of mechanisms such as dividend tax credits, lower tax rates on qualified dividends, or integration can vary, and often they don’t completely align the tax burdens of corporations and individuals. These mechanisms don't entirely eliminate the layer of taxation on distributed dividends.

Should You Incorporate as a CCPC?

When Not to Incorporate

- Small Profit Margin: If your business has a small profit margin or inconsistent revenue stream, the benefits of the lower corporate tax rate may not outweigh the costs and complexity of incorporation.

- Simplicity Preference: If you prefer minimal administrative tasks and direct control without procedural complexities, staying as a sole proprietor might be preferable.

- Personal Circumstances: If you rely heavily on using business losses to offset personal income taxes, remaining a sole proprietor initially may be better.

- Retained Earnings and Profit Withdrawal: If you as a business owner intend to withdraw all or most of the profits regularly, the advantages of retaining income within a corporation can be negated. When profits are not retained by the business, the tax advantages of income splitting, and lower tax rates are diminished. With no plan to reinvest profits, the benefits for growth or tax deferrals are minimized. And finally, the additional administrative complexities and costs are likely not justified as there will be no significant tax benefits when profits are not retained in the company.

Should You Incorporate as a CCPC?

Additional Considerations

- Consult a Professional: It's essential to chat with a business advisor who understands your industry, tax situation, and long-term goals. For this business decision, don't penny pinch. Consult with a CPA. I can't stress this enough because if you screw up this decision, it can be very costly in the short term and long term.

- Evaluate Long-term Goals: Consider your business growth plans, potential for bringing in partners, or planning for succession when deciding whether to incorporate.

- Provincial Regulations: Be aware of the provincial regulations and costs associated with incorporation, as these may vary across Canada.

- Credibility and Branding: Sometimes, being a corporation can enhance your business's credibility and appeal to customers or clients who prefer dealing with established entities.

By carefully weighing all these factors and obtaining professional advice tailored to your unique business situation, you can make an informed decision about whether incorporating is right for your business. It's important to understand that incorporating is not right for every business, no matter what your buddies tell you.

Should You Incorporate as a CCPC?

My Takeaways

You should only consider incorporation if:

- Profitability and Sustainability: The business is profitable ... and the profits are sustainable for the foreseeable future. Incorporation tends to be more beneficial if the business is profitable and those profits are expected to be sustainable. This allows the business owner to retain earnings within the corporation and benefit from the lower corporate tax rates.

- Retaining Profits: The owner can leave profits in the business to take advantage of the lower corporate tax rate ... versus being taxed at a higher personal tax rate if not incorporated. The ability to leave profits in the business to benefit from lower corporate tax rates is a significant advantage of incorporation. This is especially effective if the owner doesn't need to draw all of the income immediately and can afford to defer personal taxation.

- Lifetime Capital Gain Exemption: The owner wants to sell the business and take advantage of the lifetime capital gains exemption (LCGE). LCGE can be a major incentive for incorporation if you plan to sell the business. However, it applies only to qualifying small business corporation shares, not the sale of assets. Proper planning is essential to qualify for this exemption.

- Liability Protection: For protection for significant product liability that cannot be covered through insurance and/or to manage risk ... BUT directors are still personally liable and any personal guarantees required for financing bypass incorporated liability protection. Incorporation can offer liability protection, but as noted, directors can still be personally liable in certain situations, such as unpaid employee wages or taxes. Adequate insurance and risk management strategies are still essential.

- Income Splitting: The owner wants to income split with family members by paying dividends which are paid at a lower tax rate than employment income. TOSI (Tax on Split Income) rules become an issue. While income splitting through dividends is possible, 2018 tax changes in Canada (especially the TOSI rules) have tightened the ability to do this with family members who are not actively involved in the business. 'Kiddie tax' applies to minors receiving certain types of income to prevent income splitting with children. TOSI rules also make income splitting with adults more difficult. See TOSI rules below.

Should You Incorporate as a CCPC?

My Conclusion

An important consideration for business owners deciding on a business structure is around profits. If the owner is withdrawing all profits instead of leaving them in the company, there seems to me to be little tax advantage for a sole proprietor to incorporate. In that instance, incorporating might not offer the best tax advantage due to the double taxation mentioned above.

However, whether or not to incorporate involves several additional factors beyond profits and taxation. Here are some key considerations to discuss with your accountant on whether they are relevant to your business:

- liability protection

- credibility and perception

- raising capital

- retained earnings

- flexibility in compensation

- long-term planning

Remember every business situation is unique.

Innovation, Science and Economic Development Canada (ISED) has a Guide to Federal Incorporation: Helping small businesses incorporate federally if you want to research this topic further. Chapter 1 tackles 'Why Should I Incorporate?'.

Should You Incorporate as a CCPC?

Tax on Split Income (TOSI) Rules

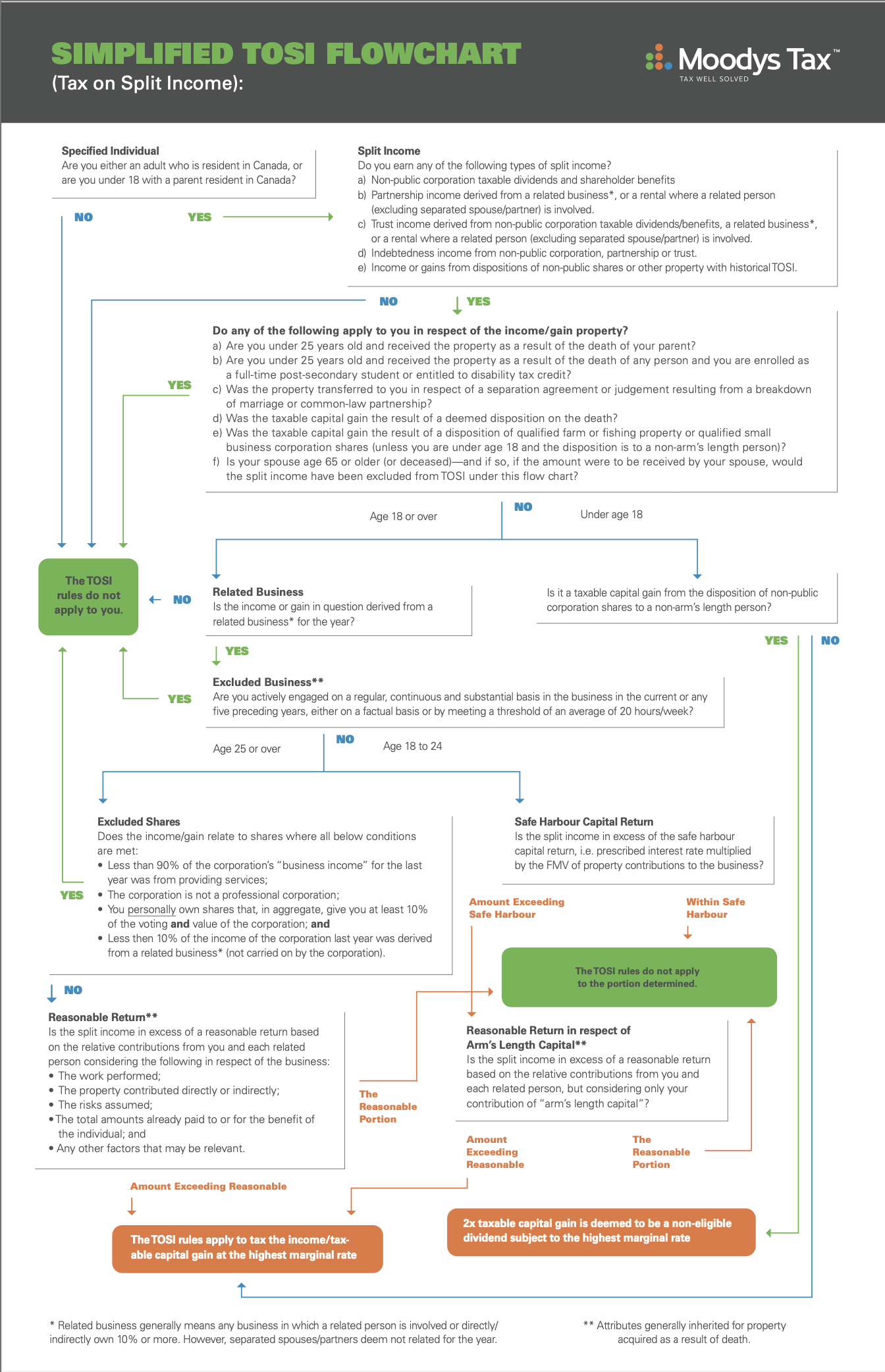

TOSI, or the Tax on Split Income, is a set of rules in Canada designed to prevent income splitting among family members (both minors and adults) to take advantage of lower tax rates.

TOSI, or the Tax on Split Income, is a set of rules in Canada designed to prevent income splitting among family members (both minors and adults) to take advantage of lower tax rates.TOSI, or the Tax on Split Income, is a set of rules in Canada designed to prevent income splitting among family members (both minors and adults) to take advantage of lower tax rates. These rules aim to ensure that income is taxed at a higher rate if it is deemed to be split income unless certain exclusions apply.

Here's a breakdown of key points about TOSI:

- Target Income: TOSI generally applies to dividends, interest, and capital gains from private corporations distributed to family members who are not meaningfully involved in the business.

- Reasonableness Test: Income is exempt from TOSI if paid to a family member who is actively engaged in the business on a regular and continuous basis. This involvement usually means working an average of at least 20 hours per week during the business's operating season or contributing significantly to the business.

- Age Consideration: TOSI generally targets individuals aged 18 and over. For those under 18, the 'kiddie tax' applies to income from dividends, interest, or certain capital gains, effectively taxing it at a higher rate.

- Excluded Amounts: TOSI does not apply to certain income received by individuals who are 18 years or older from non-service businesses, where the individual meets certain criteria, such as being a business owner or earning 'safe harbor' income like salaries.

- Spousal Exemption: In some cases, dividends received by a spouse may be exempt from TOSI if the main business operator is 65 or older, recognizing the retirement phase.

- Capital Gains: TOSI includes capital gains derived from the sale of shares of private corporations, but exclusions can apply, like those related to the sale of qualified farm or fishing properties.

- Compliance and Planning: Businesses and families need to ensure compliance with TOSI rules, which may require restructuring income distribution and confirming active involvement of family members in the business to avoid punitive tax rates.

These rules have significant implications for tax planning for families in business together, and understanding them is crucial for making informed financial and operational decisions. As with all business decisions that can have an impact on taxes paid, chatting with a tax professional is wise to ensure compliance and to optimize your tax strategies.

Source: Moody's Tax Tax on Split Income Flowchart December 20, 2017 by Kenneth Leung CPA CA

Source: Moody's Tax Tax on Split Income Flowchart December 20, 2017 by Kenneth Leung CPA CAIncorporated Tax Compliance

Learning The Rules

Owner-Manager Compensation ... Coming Soon

Owner-Manager Compensation ... Coming Soon